This chapter contains the following topics:

| • | Ensure that the Accounts Payable software is installed on your computer. Refer to the Release or SQL install documentation for installing A/P and other modules before proceeding. The installation files and documentation are available for download. |

| • | Familiarize yourself with the main features of this module by reading the Understanding Accounts Payable chapter in this documentation. |

| • | Consult with your accountant before using Passport Business Solutions. Inform your accountant which accounting software you use. He or she can advise you on converting from your existing Accounts Payable system. |

Use the data files and SQL tables to enter information describing your A/P system and how you want your transactions handled. The following is a brief explanation of these:

This contains all of your general ledger accounts used in A/P. Any time you use a G/L account number, A/P will verify that it is in this data. If you are running other Passport modules, this set of data may already exist. You may have to enter additional accounts for accounts payable.

This file/table contains all of your accounts payable accounts. These accounts must also exist in the Valid G/L Accounts.

This contains all of your cash accounts, including those used by Passport Accounts Receivable, Accounts Payable, Check Reconciliation, Order Entry, Point of Sale and Payroll. If you are using these other modules, this data may already exist. These accounts must also exist in Valid G/L Accounts.

This file/table is used to record information about your company, such as your company name, address, etc. If you are running any other Passport module, this data may already exist.

This defines how you use accounts payable and controls some of the features of Passport A/P.

For example, one part determines how you age your vendor accounts. This information can affect other Passport modules.

This maintains a record for each of your vendors, with information such as the vendor’s name, address, usual terms, year-to-date, and last-year statistics.

An open item is any bill that has not been paid in full, or any unused credit or debit memo on file for a vendor. The Open Items is all open items (called payables) for all vendors.

Perform these steps to use PBS Accounts Payable:

| • | Familiarize yourself with the System User documentation, especially this chapter,Using Accounts Payable and Guide to Daily and Monthly Operations. |

| • | Start A/P according to the instructions in the Using Accounts Payable chapter. |

| • | The Company information is set up for you as part of the installation procedure. Use Company information menu selection to modify the Company information as appropriate for your company (refer to the Company Information chapter in the PBS Administration documentation. |

| • | The Valid G/L Accounts file/table is used by A/P to ensure that G/L accounts entered into the system are valid accounts. |

| • | If you are already using another PBS module (other than General Ledger), this data already exists. |

| • | If you are already using General Ledger but no other PBS module, use Setup valid G/L accounts within G/L to create the Valid G/L Accounts file/table automatically. |

| • | Otherwise, enter the accounts manually using the Valid G/L accounts selection of the System User documentation. |

| • | Enter your cash accounts using Cash accounts. PBS allows you to use an unlimited number of cash accounts in A/P. If you are running any other PBS module, this file/table may already exist. You may cut checks in A/P against any of these accounts. The accounts entered here must have been entered previously in the Valid G/L Accounts file/table (refer to the Cash Accounts chapter in the System User documentation). |

| • | Enter your A/P accounts, using A/P accounts. PBS allows you to use an unlimited number of A/P accounts. The accounts entered here must have been entered previously in Valid G/L Accounts (refer to the A/P Accounts chapter). |

| • | Enter A/P controls using Control information. This controls how A/P is used by your company (refer to the Control Information chapter). |

| • | Enter your vendors, using Vendors (refer to the Vendors chapter). |

| • | Enter a pay-to address for each vendor that requires this. |

| • | If you are using Positive Pay or Direct Deposit, read the Implement Positive Pay and Direct Deposit appendix. |

| • | Before using A/P on a regular basis, you must ensure that all outstanding payables are entered into A/P and that the total of these payables corresponds to the balance of your A/P account in your General Ledger. |

| • | How you do this depends on whether or not you are interfaced to PBS General Ledger. Each use is discussed in a separate section below. |

| • | Begin using the PBS A/P module on a regular basis, making all entries through this module (unless you are using PBS Purchase Order). Refer to the Guide to Daily and Monthly Operations chapter. |

Collect the documents which correspond to the outstanding account balance in your General Ledger as of the day you plan to start using PBS A/P on a regular basis.

Enter and post regular payable transactions for all of these outstanding payables.

You may enter each individual payable for each vendor, or one summary payable for each vendor. Your choice here depends upon your business situation and should be done with the advice of your accountant.

Note that if you enter one summary payable for each vendor, you can not track early payment discounts for the individual vouchers summarized, nor can you age individual vouchers using the Aged open items report. See View Open Items

If you are not using PBS General Ledger

Print the Payables Distribution to G/L Report, specifying that the distributions be purged. Print this report “Earliest/Latest” for all G/L accounts.

This step is done to purge all distributions created by posting the outstanding payables. Since these distributions have already been entered into your General Ledger, the outstanding balance for your A/P accounts, as shown on the Aged Open Items Report (when run by invoice date), should tie out to the A/P accounts in your General Ledger.

At this point, the open items in A/P correspond to your A/P account balance in General Ledger and there are no outstanding unpurged distributions in A/P. You are ready to start using A/P on a regular basis.

Payables posted from this point forward create G/L distributions. These distributions can be printed and purged. The Payables Distribution to G/L report is used to transfer the debits and credits from A/P to your manual General Ledger. See Distributions to G/L

Print the Payables Distribution to G/L Report, specifying that the distributions be purged. Print this report “Earliest/Latest” for all G/L accounts. Specify that all distributions are purged, not just distributions already interfaced to G/L. You want all distributions purged in this case because your A/P account balance already includes all of these distributions, and you do not want any of these distributions transferred to General Ledger.

The outstanding balance for your A/P account, as shown on the Aged Open Items Report (when run by invoice date), should tie out to the A/P account in your General Ledger.

At this point, the open items in A/P correspond to your A/P account balance in General Ledger and there are no outstanding unpurged distributions in A/P. You are ready to start using A/P on a regular basis.

Payables posted from this point forward create G/L distributions. These distributions are transferred to General Ledger by using Get Distributions in G/L. Refer to the Distributions chapter in the G/L user documentation for more information.

When you finish building your data files, you are ready to use A/P. The remaining chapters in this documentation show you how to:

| • | Enter payables |

| • | Enter recurring payables |

| • | Print the Aged Open Items Report |

| • | View a vendor’s invoices |

| • | Modify A/P open items |

| • | Print the Cash Disbursements Projection Report |

| • | Print the Cash Requirements Report |

| • | Prepare payments and print checks |

| • | Void checks |

| • | Print the various vendor history reports |

| • | Purge fully paid open items |

| • | Purge temporary vendors |

| • | Print the Payables Distributions to G/L Report |

| • | Print the Purchases/Discounts Report |

| • | Perform year-end functions (Refer to the period-ending and accounting year-ending checklists in the Guide to Daily and Monthly Operations chapter.) |

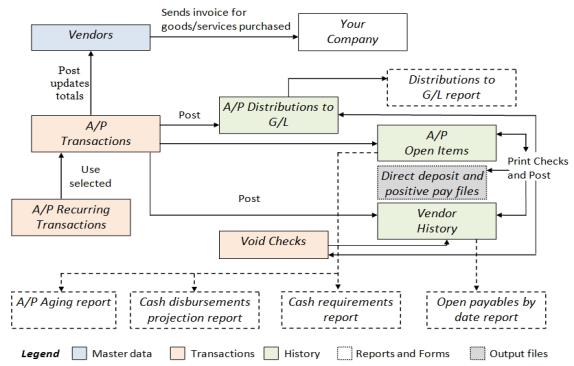

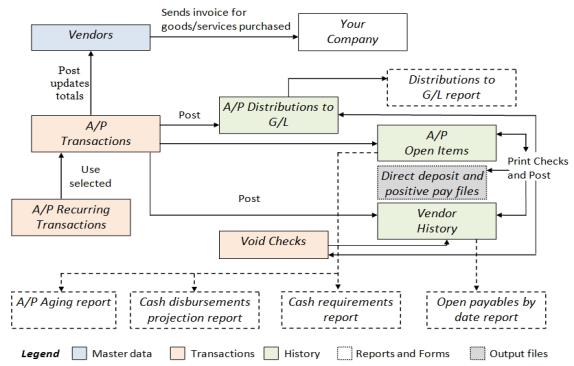

This chart illustrates the flow of data within the Accounts Payable module.

Some of the data can come from other sources. For example, when entering a payable the purchase order and receiver fields are tied to the Purchase Order module. When entering payable distributions, the job data is tied to the Job Cost module.

A/P Distributions to G/L data flows into the G/L module when Get distributions is run.

If you have problems with this software module, contact your dealer or authorized consultant.

For the name and location of a PBS dealer or an authorized consultant near you, contact Passport Software at 1-800-969-7900.

If you wish to receive support directly from Passport, please call our End User Support Department at 1-800-969-7900

You can contact your own dealer for training; however, if your dealer does not offer training, call Passport at 1-800-969-7900.

PBS Accounts Payable is a powerful application designed to meet the needs of business. If you have specific business requirements that you would like addressed, Passport Software, Inc. provides custom modification services for Accounts Payable and all other Passport Business Solutions modules to meet your requirements. Please contact our Sales Department for further information at 1-800-969-7900.