This chapter contains the following topics:

The Close a year updates the Vendors at the end of your fiscal year. It does this by moving the current year-to-date purchases, discount amounts, payment totals and memo purchase amounts to the last year matching fields, and then clears the current year-to-date amounts. It also clears year-to-date amounts in Recurring payables.

The Close a year for 1099s selection handles 1099 processing at the end of the calendar year, if you have elected to print 1099 forms in Control information. See the Close Year for 1099s section. You can print 1099-MISC forms on preprinted continuous forms, or produce them on magnetic media.

|

Note |

This function should not be run until all of this fiscal year’s business transactions have been posted and completed and the Purchases/Discounts report is printed, along with any other fiscal year-ending reports. It should also not be run until you have closed the last month of the year. |

Select

Close a year from the Year-end menu.

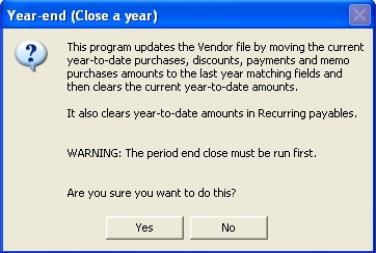

Graphical Mode

The following screen appears:

Character Mode

The following screen appears:

Enter the following information:

Are you sure you want to do this?

Refer to the Introduction to Year End section of this chapter for an explanation of what this function does.

Select Yes (or enter Y) to continue or No (N) to cancel this function.

If you select Yes (Y), there will be a period of processing as data is updated. You will be notified when this has completed; press <Esc> to return to the menu.

No report is produced by this selection.

|

Format |

Graphical mode: Yes/No buttons Character mode: One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> for the default |

1099’s are a means of reporting to IRS and taxpayers dividends, interest and other forms of income.

PBS year-end processing for 1099’s includes reviewing and entering vendor’s 1099 data, printing 1099 reports, printing 1099 forms and creating 1099 magnetic media. It also includes the closing of a year for 1099’s. The following sections in this chapter documents these functions.

1099-MISC reports must be filed by Feb. 28 with the IRS. However, you should report your 1099-MISC forms to payees by January 31 and magnetic media by March 31. Be sure to check with the IRS for any changes to these deadlines.

The Passport Business Solutions Accounts Payable module automates the majority of your reporting needs as an business by accumulating miscellaneous 1099 amounts for each vendor as you pay them their checks throughout the year.

Much of the information you report is accumulated for you, however the full requirements of 1099 reporting go beyond the scope of the day-to-day operations of the accounts payable system.

To enable you to effectively use the accounts payable system for 1099 reporting, this function allows you to edit and record additional vendor information so that it is available to the 1099 reporting functions.

The screen contains calculated information and entry fields. The IRS instructions refer to these fields by referencing the 1099 box number on the 1099 MISC form. Each field on the screen is followed by the corresponding 1099 box number. For detailed information on each box number, refer to the IRS instructions for filling out 1099 forms.

1099 data is accumulated in the 1099 Miscellaneous Information file/table during A/P postings. When this occurs both the calculated and override fields are updated. This automated calculation may be all you need to print your 1099s.

You may use this screen to change accumulated amounts or enter data that was not accumulated by the system. When you print 1099s or generate 1099 magnetic media, the program uses the amounts in the override fields. Therefore the calculated fields provide amounts for what was accumulated throughout the year, but the override data is used when printing 1099s or magnetic media.

1099 Field Applicable to your Site

Many of the fields may not be applicable to your vendors. When this is the case press <Enter> for the field to set it to zero.

Select

1099-Misc reporting info from the Year-end menu.

The following screen appears:

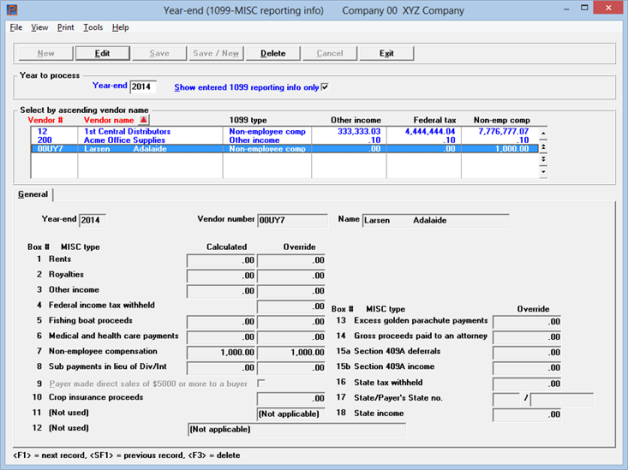

Graphical Mode

When data exists for at least one vendor for the 1099 year-end, it will display in the list box.

1099 MISC Reporting Info List Box

The list box displays up to 1099 vendors at a time. If the Show entered 1099 reporting info only field is not checked, then it will display non 1099 vendors as well. Then you may enter new records for non 1099 vendors.

You may sort the 1099 vendors by vendor number or vendor name, both in ascending or descending order. Only column names in red may be sorted. Click on the column name or the arrow to the right of the column name to change the sort or use the View options.

To locate a 1099 vendor, start typing a number or name, depending on which sort field is selected. You may also use the up/down arrows, Page up, Page down, Home and End keys to locate an item. The <F1> and <SF1> keys are the same as the up/down arrow keys.

1099 vendors that display in the list box are available for changes or deletion. The fields for the selected 1099 vendor display in the lower part of the screen.

When a 1099 vendor is found, you may select the <Enter> key or Edit button to start editing the amounts.

1099 MISC Reporting Info Buttons

You may select a button or keyboard equivalent for editing, deleting or adding a new vendor:

| Button | Keyboard | Description |

|

New |

Alt+n |

To enter a new 1099 vendor record |

|

Delete |

Alt+d |

To delete the 1099 vendor record selected in the list box. You may also select <F3> to delete a 1099 record |

|

Edit |

Alt+e |

To edit the 1099 vendor record selected in the list box |

|

Save |

Alt+s |

To save a new 1099 vendor record or changes to an edited 1099 vendor record |

|

Save/New |

Alt+w |

This button is never active on this screen |

|

Cancel |

Alt+c |

To cancel adding or editing a 1099 vendor record |

|

Exit |

Alt+x |

To exit the screen. You may also use the <Esc> key |

Show entered 1099 reporting info only

The list box default is to only show those vendors that have a 1099 record. If you want to see all the vendors that do not have 1099 records, including non-1099 vendors, then uncheck this box.

Menu Selections

At the top left of the screen menu selections are available. Most of these are the same from screen to screen. The selections that are unique to this screens are explained here:

Under the Print menu you may select 1099-MISC reporting list, Brief 1099 report and Full 1099 report. See Printing a 1099-MISC Report List, Printing a brief 1099 report and Printing a full 1099 report.

Enter the year for which you are reporting 1099 information. The default year is the 1099 year ending date field from A/P Control information.

|

Format |

4 digits |

|

Example |

Select <Enter> key |

|

Note |

When closing a 1099 year, never change the date in A/P Control information. Use the Close a year for 1099’s menu selection. Doing this will keep the 1099 fields in Vendors in sync with the data in 1099 miscellaneous information which is used for printing 1099’s or creating 1099 magnetic media. |

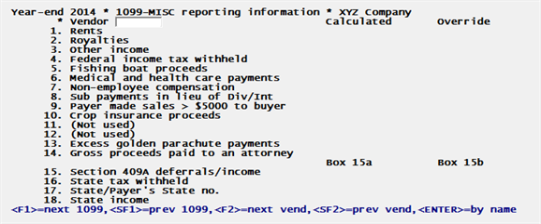

Character Mode

On the first screen enter the Year-end field. The following screen displays after entering the first screen:

Options

Enter the vendor number or use one of the options:

|

<F1> |

For the next 1099 record |

|

<SF1> |

For the previous 1099 record |

|

<F2> |

For the next vendor in vendor number sequence |

|

<SF2> |

For the previous vendor |

|

Enter |

To look up the vendor by name |

|

Format |

6 characters |

|

Example |

Press <F1> |

Looking up the vendor by name

Options

When blank is entered for vendor number, the cursor moves to the vendor name field.

Enter the vendor name, or just the leading characters. Upper / lower case is significant. Entries made under a personal rather than corporate name are searched for by surname. You may also use one of the options:

|

<F2> |

For the next vendor in vendor name sequence |

|

<SF2> |

For the previous vendor |

|

blank |

To return to vendor lookup by number |

|

Format |

25 characters |

|

Example |

(Does not occur in this example) |

The fields on this screen relate directly to the 1099 form box numbers.

For fields 1 through 14 there are two columns of numbers and values. The first column is the system calculated data and the second column is the editable over-ride amount. The calculated data gets accumulated throughout the year as you process 1099 payables. When it is time to print 1099s or generate a 1099 magnetic media file, you may change the values by entering an over-ride amount.

For field 15 there are two boxes. Field 16 through 18 relate to state information.

When entering information you should refer to Instructions for Form 1099-MISC, available as a download from the IRS website.

Enter amounts of $600 or more for all types of rents.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter the gross royalty payments of $10 or more.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter the backup withholding.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter the federal income tax withheld.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter the fishing boat proceeds.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

6 Medical and health care payments

Enter payments of $600 or more made in the course of your trade or business to each physician, or other supplier or provider of medical or health care services.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter non-employee compensation of $600 or more.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

8 Sub payments made in lieu of Div/Int

Enter payments or at least $10 received by a broker for a customer.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

9 Payments made direct sales of $5000 or more to a buyer

Enter 1 for sales by you of $5000 or more of consumer products to a person on a buy-sell, or other commission basis for resale (by the buyer or any other person) anywhere other than in a permanent retail establishment. Otherwise, leave the field blank.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

1 digit, either 1 or blank |

|

Example |

Press <Enter> |

Enter insurance crop proceeds of $600 or more.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

This field is not used.

|

Format |

999999999.99 |

|

Example |

Press <Enter> |

This field is not used.

|

Format |

40 characters |

|

Example |

Press <Enter> |

13 Excess golden parachute payments

Enter any excess golden parachute amounts.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

14 Gross proceeds paid to an attorney

Enter the amount of gross proceeds paid to an attorney.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter the total amount of current year and past years deferred of at least $600.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Enter the amount to be deferred this year.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

This field will only print on the 1099 form. It is not written to the 1099 magnetic media electronic file.

This box may or may not be appropriate for your state. Enter the dollar amount.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

This field will only print on the 1099 form. It is not written to the 1099 magnetic media electronic file.

This box may or may not be appropriate for your state. Enter the state or accept the default from Vendors.

|

Format |

2 characters |

|

Example |

Press <Enter> |

This field will only print on the 1099 form. It is not written to the 1099 magnetic media electronic file.

This box may or may not be appropriate for your state. Enter the state tax ID number or accept the default from Vendors.

|

Format |

10 characters |

|

Example |

Press <Enter> |

This field will only print on the 1099 form. It is not written to the 1099 magnetic media electronic file.

This box may or may not be appropriate for your state. Enter the dollar amount.

This field is not accumulated through postings. It may only be entered before you do your year-end processing.

|

Format |

9999999.99 |

|

Example |

Press <Enter> |

Make any needed changes, then select the Save button to keep your changes.

If you unchecked (no) to the field Print 1099 forms in Control information, this selection is not available.

For each vendor who gets a 1099, this report shows the individual 1099 Miscellaneous types and amounts reported by vendor number.

Select

1099-MISC reporting list from the Year-end menu.

Graphical mode access

A screen like the following will appear:

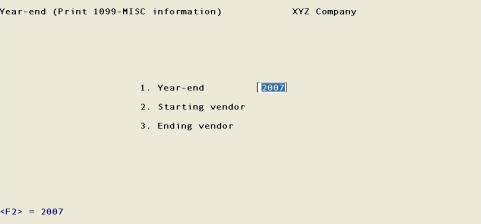

Character Mode

A screen like the following will appear:

Enter the year for which you are reporting 1099 information. The default year is taken from the 1099 year ending date field in A/P Control information.

|

Format |

4 digits |

|

Example |

Select <Enter> key |

Starting Vendor #

Ending Vendor #

Options

Enter the range of vendors, by number, to include on the report. You may also use the option:

|

<F2> |

For the “First” starting vendor or “Last” ending vendor |

|

Format |

6 characters each |

|

Example |

Press <F2> for each field |

In Character mode:

Make any needed changes, then press <Enter> to print the report.

If you unchecked (no) the Print 1099 forms field in Control information, this selection is not available.

For each vendor who gets a 1099, this report shows only the vendor number, name, vendor’s TIN (Taxpayer Identification Number), calculated 1099 amount total, override 1099 amount total, the first line of the vendor’s address, and the first of the vendor’s two phone numbers for the year selected.

It does not include amounts or information for boxes 4, 15, 16, 17 and 18.

This report will shows the total 1099 amounts for each 1099 vendor and does not break down the different 1099 types. If you want a report by 1099-MISC type, see the Printing a 1099-MISC Report List section.

Select

Brief 1099 Report from the Year-end menu.

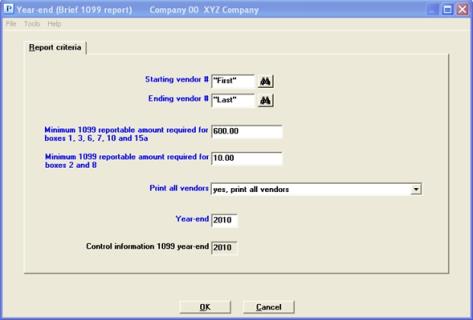

Graphical Mode

A screen similar to the following appears:

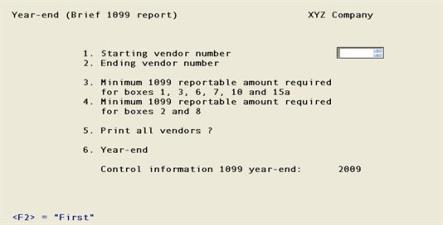

Character Mode

The following screen appears:

Ending vendor #

For both starting and ending vendor, to select the correct vendor you may locate the number by using the vendor lookup, or enter manually. In graphical mode the default is "First" and "Last" respectively.

Options

You may also use the option:

|

<F2> |

For the “First” starting vendor or “Last” ending vendor |

|

Format |

6 characters each |

|

Example |

Press <F2> for each field |

Minimum 1099 reportable amount required

for boxes 1, 3, 6, 7, 10 and 15a

Enter the minimum cut-off or select the Enter key to use the default. If any 1099 amounts are above the reportable amount, a 1099-MISC forms will be printed for the vendor whose YTD amounts for boxes 1, 3, 6, 7, 10 and 15a are equal to or more than this amount.

|

Format |

9,999,999,999.99 |

|

Example |

Select <Enter> |

The default amount is $600.

Minimum 1099 reportable amount required

for boxes 2 and 8

Enter the minimum cut-off or use the Enter key to select the default. 1099-MISC forms will be printed for vendors whose YTD amount for boxes 2 and 8 are equal to or more than this amount.

|

Format |

9,999,999,999.99 |

|

Example |

Select <Enter> |

The default amount is $10.

This determines if you print vendors with amounts that do not meet the minimum amounts for the boxes mentioned in the previous two boxes and other boxes that require more than zero.

In graphical mode select either yes, print all vendors to print all or only print the vendors that meet the minimum amounts.

|

Format |

Character mode: 1 character, Y or N |

|

Example |

Type N |

|

Note |

When you print all vendors, three possible errors could print on the report:

|

Enter the year for which you are reporting 1099 information. The default year is the 1099 year ending date field from A/P Control information.

|

Format |

4 digits |

|

Example |

Select <Enter> key |

Control information 1099 year-end:

This is for informational purposes only to let you know the 1099 year ending date in A/P Control information. This date has no effect on what is being reported. It is the Year-end field that determines which year's data is printed.

In Character mode:

Answer Y to re-enter the screen, or N to continue. The brief report will be printed.

If you unchecked (no) the Print 1099 forms field in Control information, this selection is not available.

This report is the same as the brief report but also shows the full vendor address. See Printing a brief 1099 report. If you want a break down by type, see the Printing a 1099-MISC Report List section.

Select

Full 1099 Report from the Year-end menu.

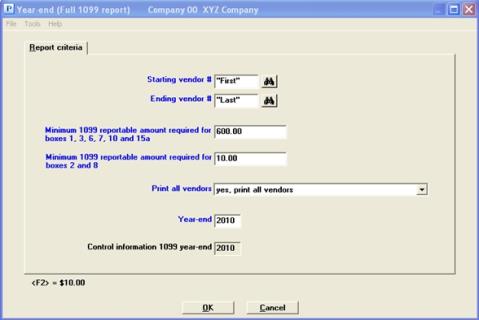

Graphical Mode

A screen similar to the following appears:

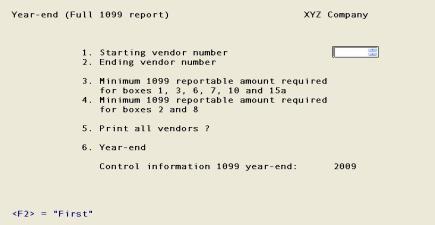

Character Mode

The following screen appears:

Starting Vendor number

Ending Vendor number

Options

Enter the range of vendors, by number, to include on the report. You may also use the option:

|

<F2> |

For the “First” starting vendor or “Last” ending vendor |

|

Format |

6 characters each |

|

Example |

Press <F2> for each field |

Minimum 1099 reportable amount required

for boxes 1, 3, 6, 7, 10 and 15a

Enter the minimum cut-off or select the <Enter> key to use the default. If any 1099 amounts are above the reportable amount, a 1099-MISC forms will be printed for the vendor whose YTD amounts for boxes 1, 3, 6, 7, 10 and 15a are equal to or more than this amount.

|

Format |

9,999,999,999.99 |

|

Example |

Select <Enter> |

The default amount is $600.

Minimum 1099 reportable amount required

for boxes 2 and 8

Enter the minimum cut-off or use the <Enter> key to select the default. 1099-MISC forms will be printed for vendors whose YTD amount for boxes 2 and 8 are equal to or more than this amount.

|

Format |

9,999,999,999.99 |

|

Example |

Select <Enter> |

The default amount is $10.

This determines if you print vendors with amounts that do not meet the minimum amounts for the boxes mentioned in fields 3 and 4 and other boxes that require more than zero.

Enter Y to print all or N to only print the vendors that meet the minimum amounts.

|

Format |

1 character, Y or N |

|

Example |

Type N |

|

Note |

When you select Y to print all vendors, three possible errors could print on the report:

|

Enter the year for which you are reporting 1099 information. The default year is the 1099 year ending date field from A/P Control information.

|

Format |

4 digits |

|

Example |

Select <Enter> key |

Control information 1099 year-end

This is for informational purposes only to let you know the 1099 year ending date in A/P Control information. This date has no effect on what is being reported. It is the Year-endYear-end field that determines which year's data is printed.

Select OK to print the report. The full report will be printed. Select Cancel to return to the menu.

If you unchecked (no) the Print 1099 forms field in Control information, this selection is not available.

This selection prints a 1099-MISC form for each vendor who is to get a 1099-MISC as specified in Vendors and whose 1099 amount YTD is equal to or greater than the minimum reportable amount entered.

Select

Print 1099 forms from the Year-end menu.

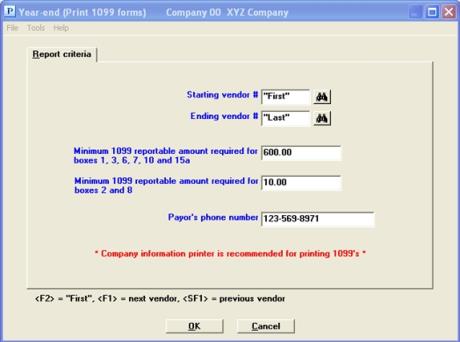

Graphical Mode

A screen similar to the following appears:

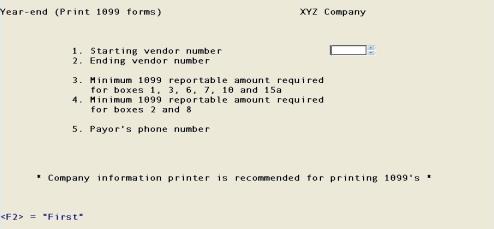

Character mode

The following screen appears:

Starting Vendor #

Ending Vendor #

Options

Enter the range of vendors, by number, to include on the report. You may also use the option:

|

<F2> |

For the “First” starting vendor or “Last” ending vendor |

|

Format |

6 characters each |

|

Example |

Press <F2> for each field |

Minimum 1099 reportable amount required

for boxes 1, 3, 6, 7, 10 and 15a

Enter the minimum cut-off or select the <Enter> key to use the default. If any 1099 amounts are above the reportable amount, a 1099-MISC forms will be printed for the vendor whose YTD amounts for boxes 1, 3, 6, 7, 10 and 15a are equal to or more than this amount.

|

Format |

9,999,999,999.99 |

|

Example |

Select <Enter> |

The default amount is $600.

Minimum 1099 reportable amount required

for boxes 2 and 8

Enter the minimum cut-off or use the <Enter> to key to select the default. 1099-MISC forms will be printed for vendors whose YTD amount for boxes 2 and 8 are equal to or more than this amount.

|

Format |

9,999,999,999.99 |

|

Example |

Select <Enter> |

The default amount is $10.

|

Note |

Boxes 4, 10, 13, 14, 15b, 16 and 18 do not have a minimum amount. |

Enter a phone number where the IRS can reach you.

|

Format |

15 characters. The default is your corporate phone number from Company information. |

|

Example |

Press <Enter> |

Make any changes or select OK to continue. You may select Cancel to return to the menu.

In character mode select a field number to make changes or select <Enter> to continue.

Please mount 1099 forms on printer

Mount the 1099-MISC forms on the printer.

In graphical mode select OK when ready or select Cancel to return to the Report criteria screen. In character mode type DONE when ready.

If you are using a dot matrix printer align the perforation at the top of the forms with the print head.

It is important to start the actual forms from the top of the page, and to do the printing with a carbon-based black ink ribbon. With dot matrix printers, the matrix size must be 7 X 9 per character. The IRS requires this for their forms scanner.

|

Format |

Character mode: 4 characters Graphical mode: Check box where checked is yes and unchecked is no. The default is unchecked |

|

Example |

Character mode: Type DONE Graphical mode: Check the box and select OK |

If using a dot matrix pin feed printer, adjust the printing pressure according to the thickness of the forms.

Select Printer

When using a laser printer, it is recommended that you use a Company information PCL laser printer when you print 1099’s rather than Windows printer. In order to do the alignment, make sure your printer is PCL compliant.

For a laser printer, specify horizontal or vertical alignment.

Print alignment?

Print a test alignment form by answering Yes (Y) to the print alignment question. Adjust the positioning of the 1099 forms in the printer as necessary and print another alignment form. Repeat this procedure until the alignment of the form is correct. If the 1099 forms are not positioned so that the first actual form to print is the first form on a page, print one or two more alignment forms until the next form to print is at the top of the page.

|

Format |

Graphical mode: Yes/No buttons Character mode: One letter, either Y or N |

|

Example |

Now answer No to the print alignment question. |

Number of copies

For a laser printer, specify the number of copies.

The program prints 1099 forms for each vendor to whom you paid at least the minimum reportable amount.

Please mount regular paper on printer

This message appears when all forms have printed.

|

Format |

Character mode: 4 characters Graphical mode: Check box where checked is yes and unchecked is no |

|

Example |

Type DONE Check the box and select OK |

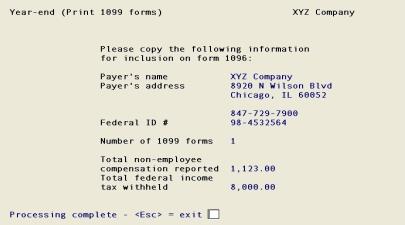

When the 1099 forms printing is completed, the following screen appears:

The Total non-employee compensation reported field is actually the total amount for all 1099 boxes 1, 2, 3, 5, 6, 7, 8, 10, 13, 14, 15a and 15b.

To print this screen select <Ctrl-P> in Windows. Select <Ctrl-F10> for UNIX or Linux to print to the first printer set up in Company information.

Press <Esc> to return to the A/P menu.

If you unchecked (no) to the field Print 1099 forms in Control information, this selection is not available.

1099-MISC reports are written to a disk file named IRSTAX. This file gets generated in the top-level PBS directory.

If you need to produce magnetic 1099-MISC reports for more than one company, then complete the reporting for one company at a time since the IRSTAX file on the hard disk for the first company will be overwritten by the same file for the second and subsequent companies.

Do not report 1099-MISC forms on magnetic media using both Payroll and Accounts Payable unless separate and distinct taxpayer identification numbers are used, one for Payroll and a different one for Accounts Payable.

You may want to make up to three copies of this file; one to send to the IRS; another as an archive; and the third for a working copy for reference should the IRS have questions about your 1099-MISC reports.

Select

Magnetic 1099 forms from the Year-end menu.

Select printer

You are asked for the printer on which the exception report is to print. See the bullet points under While Processing is Occurring:.

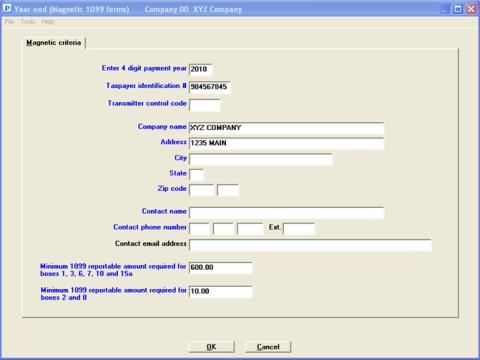

Graphical Mode

A screen like the following appears:

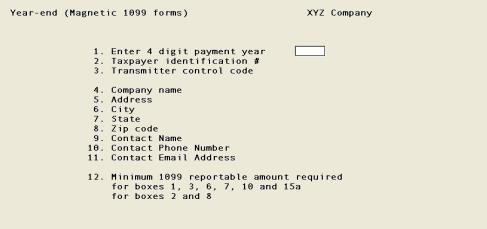

Character Mode

The following screen appears:

Enter information as follows:

Enter 4 digits of payment year

Enter the 4 digits of the year for which 1099-MISC forms are being produced.

|

Format |

9999 |

|

Example |

Type 2007 |

Options

Enter your taxpayer identification number, or use the option:

|

<F2> |

For the ID specified in Control information |

|

Format |

999999999 |

|

Example |

Press <F2> |

Enter your company’s control code. This is supplied to you by the IRS.

|

Format |

5 characters |

|

Example |

Type ABCDE |

Options

Enter the company’s name or use the option:

|

<F2> |

For the ID specified in Control information |

|

Format |

40 characters |

|

Example |

Press <F2> |

Options

Enter the company’s address, or use the option:

|

<F2> |

For the ID specified in Control information |

|

Format |

40 characters |

|

Example |

Press <F2> |

Enter the company’s city.

|

Format |

25 characters |

|

Example |

Type Anytown |

Enter the postal abbreviation for the company’s state.

|

Format |

Two letters. Lower-case is converted to upper-case. Only valid postal abbreviations for United States states or territories are accepted. |

|

Example |

Type TX |

Enter your corporate zip code.

|

Format |

99999 for the first segment (required) 9999 for the second segment (optional) |

|

Example |

Type 12345 for the first segment. Press <Enter> to leave the second segment blank. |

Enter the contact name for your company.

|

Format |

40 characters |

|

Example |

Type Joe Blow |

Enter the contact phone number.

The phone number is four separate fields. They include area code, exchange, number and extension.

|

Format |

Area code - three digits Exchange - three digits Number - four digits Extension - five optional digits |

Enter the email address. This field is optional but recommended when you have one.

|

Format |

Up to 50 characters |

Minimum 1099 reportable amount require

for boxes 1, 3, 6, 7, 10 and 15a

Enter the minimum amount required to report to the IRS for boxes 1, 3, 6, 7, 10 and 15a. The default is $600.

|

Format |

9,999,999,999.99 |

|

Example |

Select Enter for the default |

Enter the minimum amount required to report to the IRS for boxes 2 and 8. The default is $10.

|

Format |

9,999,999,999.99 |

|

Example |

Select Enter for the default |

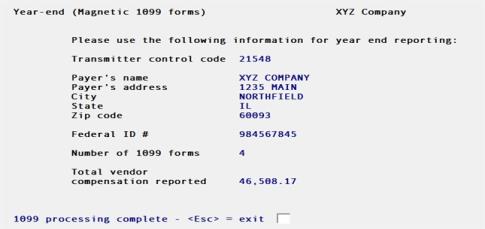

Select Cancel to return to the menu or make any needed changes and then select OK. Processing will occur as follows:

While Processing is Occurring:

| • | As 1099 records are written to disk, the program checks the taxpayer identification number (TIN), state code, zip code and minimum amount for each vendor getting a 1099. If the program finds an error, the information for that vendor is reported on the Magnetic 1099 Exception Report. This enables you to get the TIN, state code, or zip code for each vendor quickly identified so it can be corrected. |

| • | A Magnetic 1099 Exception Report is always generated. If there are no errors, then it is indicated in the report that NO ERRORS FOUND. It also prints the same information as on the screen below. The IRSTAX file is produced. |

A screen similar to the following appears:

This information is provided to you as a guide in completing year end IRS reporting. Copy it manually or print with <Ctrl+P>. In UNIX or Linux select <Ctrl+F10> to print the screen to the first printer set up in Company information. The same information is also printed on the Magnetic 1099 Exception Report.

The total vendor compensation report and on screen amount includes boxes 1, 2, 3, 5, 6, 7, 8, 10, 13, and 14. It does not include an accumulation of boxes 4, 15, 16, 17 and 18.

Press <Esc> to return to the A/P menu.

Closing a 1099 year has no effect on the reporting of 1099 amounts via 1099 forms and magnetic media. However if wish to refer to the amount in the vendor 1099 field as a check for accuracy, then you may wait to close the 1099 year until your reporting is completed.

Closing a 1099 year only effects the amounts being reported in the vendor fields 1099 amount year to date1099 amount next year and 1099 amount year to date1099 amount next year. These fields are for your information only. The actual amounts that will be reported can be accessed in 1099-MISC reporting info menu selection. See Review and Enter 1099 Information.

In the normal day-to-day running of a business, the preparation and reporting of 1099-MISC information takes some time. 1099-MISC reports must be filed by Feb. 28 with the IRS. However, you should report your 1099-MISC forms to payees by January 31. Please see the IRS documentation for 1099s for any changes to these dates.

Normal Accounts Payable activity continues during these two months including the entering and subsequent payment of vouchers for vendors who will get 1099-MISC reports for this new year as opposed to the current reporting year.

The normal Close a year function allows the vendor’s historical Accounts Payable information to be adjusted for new year A/P activity, but does not change the vendor’s accumulated 1099-MISC information. Payments for the new year to vendors who get 1099-MISC forms are accumulated into the 1099 amount next year field in Vendors.

You must prepare Vendors for accumulating the current year’s 1099-MISC information. Do this by selecting the Close a year for 1099’s function.

During the close each vendor will have their 1099 amount YTD set to the 1099 amount next year. The 1099 amount next year is then set to zero. When this has been done for all applicable vendors, the 1099 year ending date in Control information is incremented by one.

|

Note |

The 1099 year ending date in Control information is used by various functions to update the right 1099 amount field in Vendors and the correct year in the 1099 MISC record. If this date is set incorrectly, incorrect 1099 amounts are accumulated. |

Select

Close year for 1099’s from the Year-end menu.

Graphical Mode

The following screen appears:

Click on Yes to continue or No to cancel this function.

If you click on Yes, there will be a period of processing as A/P data is updated. You will be notified when this has completed; press <Esc> to return to the menu.

No report is produced by this selection.

|

Format |

Push button, Yes or No |

|

Example |

Press <Enter> for the default of No |

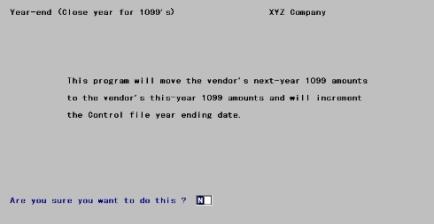

Character Mode

The following screen appears:

Are you sure you want to do this?

Answer Y to continue or N to cancel this function.

If you answer Y, there will be a period of processing as files are updated. You will be notified when this has completed; press <Esc> to return to the menu.

No report is produced by this selection.

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> for the default |