This chapter contains the following topics:

The Invoices selection lets you enter, list, print, and post invoices and credit memos.

The normal sequence is to enter an invoice, print it, and then post it.

| • | You may not post an invoice until it has been printed. |

| • | You may print an invoice more than once before posting it. |

| • | Until an invoice has been posted, you may change or delete it as required even if it has been printed. |

An alternate approach is to print the invoice as you enter it. This feature, adapted to point-of-sale transactions, is called immediate printing. The feature is optional; to use it, you must have authorized it beforehand in Control information, and you must have dedicated an invoicing station to this operator at the start of this invoicing session. Immediate invoices, like regular invoices, must be posted after they have been printed. See the Print immediately field in Control information.

An edit list of invoices entered but not yet posted may be printed at any time, whether or not the invoices have been printed. Edit lists are optional, and are not a prerequisite for either printing or posting.

You may also use Invoices (Reprint) to reprint an invoice that has already been posted, provided that you have chosen to keep invoice history and that the invoice has not been purged.

Invoices can be configured to interface to Inventory Control. It cannot be configured to interface to Inventory Management.

The Invoices selection produces physical documents (invoices and credit memos) to be delivered to your customer, either separately or packed with the merchandise. Of course, it also handles the accounting transactions, checks the customer’s credit (if desired), maintains the inventory (if interfaced to I/C), and does numerous other things. Printed invoices are posted to A/R open items and A/R invoice history.

If your business does not require such documents (for instance, if your customers are all walk-ins), you are not required to produce them. The Miscellaneous charges selection lets you enter an invoice without printing a physical document; it does not however break out individual line items, nor does it interface to I/C. See the Miscellaneous Charges chapter. Miscellaneous charges entries are posted to A/R open items only, but they do not post to A/R invoice history.

You do not have to choose one method or the other exclusively but can use both as appropriate.

Statements are physical documents sent to a customer at regular intervals, summarizing his account balance and listing his invoices, payments, and other transactions. You can produce both invoices and statements, or use either without the other. You may print statements with invoices as well.

Credit checking is done as invoices are entered, provided that you have checked the box to the Do credit checking field in Control information. The customer’s account balance (including pending unposted transactions) is compared to his credit limit as each line item is entered.

As soon as the credit limit is reached, you are so notified and given the choice of canceling the invoice, canceling this line item only (if that is what you are currently entering), or continuing anyway. If you choose the latter, credit checking is suspended for the remainder of the invoice.

Credit checking does not occur on credit memos, only on invoices.

The credit hold feature is separate from the credit limit feature. If a customer is on credit hold you cannot enter an invoice for him at all. See the Credit hold field in Customers.

For cash transactions to one-time customer, you may want to define a generic customer number. This allows all cash transactions to be saved in the Invoice History file. You could use a miscellaneous customer number (such as CASH) for this purpose, but this would still require you to enter a name and address for each invoice. Reserving a regular customer number (such as CASH) avoids this problem. As an alternative, the Point of Sale module is designed to handle cash and carry customers.

Invoices may be under batch control, which involves screens not discussed in this chapter. Refer to the Using Batch Controls chapter of the System User documentation.

If you are interfaced to the PBS Order Entry module, be aware that each module handles its own invoices. This selection does not give you access to O/E invoices. However, if you keep invoice history the same file is used to accumulate history from both modules.

Billings for a job (or sub-job) are transferred directly to the Job Cost module and need not be re-entered in that module.

The cost of each line item associated with a job is transferred to the corresponding cost item of that job indirectly, through the Inventory Control module. If you are not interfaced to I/C, such costs must be entered separately in J/C. This also means that the cost of Service line items is not transferred to J/C (since services do not form part of your inventory).

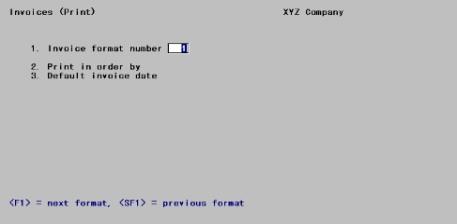

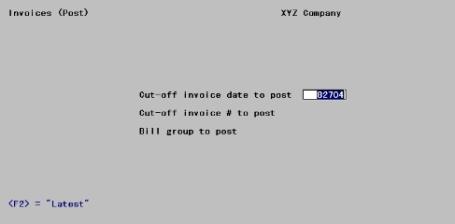

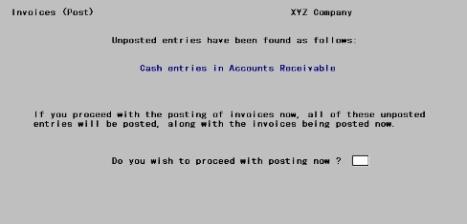

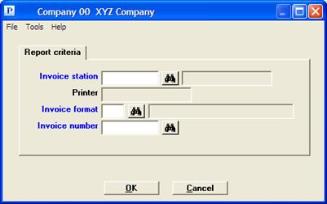

Select

Enter from the Invoices menu.

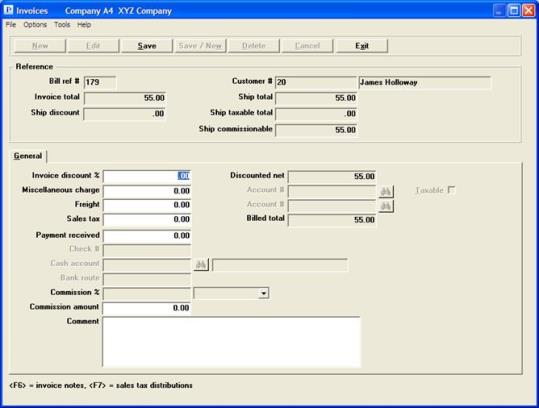

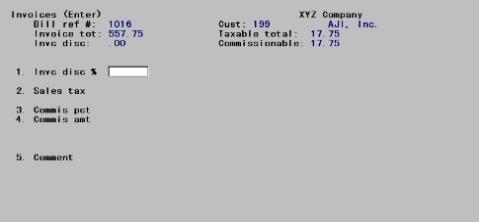

A single invoice involves data entry on three different screens: a Header Screen for the invoice as a whole, a Line Item Screen for each item, and a Totals Screen for totals, sales tax, commissions, and various charges.

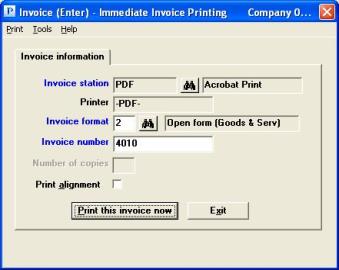

Each will be described in turn, but first we must discuss a screen that appears only at the beginning of the session and is not repeated for each invoice. This is the immediate invoicing screen, and it only appears if you have selected the check box (yes) to Print immediately in Control information. If not, skip to the next Header Screen section.

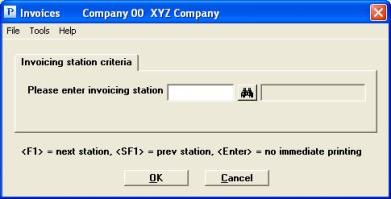

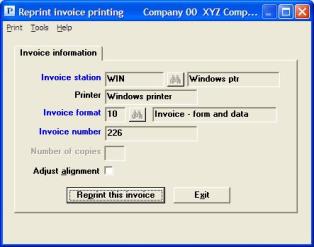

Graphical Mode

The following screen appears:

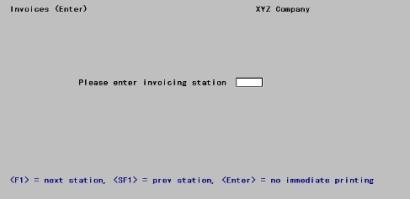

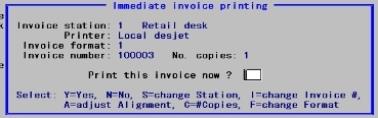

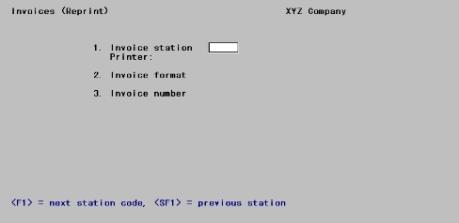

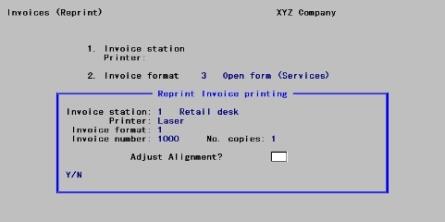

Character Mode

The following screen appears:

Enter the following information:

Please enter invoicing station

Options

Enter the code of a valid invoice printer control station, or use one of the options:

|

<F1> |

For the next invoice printer control station code on file |

|

<SF1> |

For the previous station |

|

Blank |

To disable immediate printing for the remainder of this invoicing session |

Selecting a station does not imply that every invoice in this session will be an immediate invoice, it merely permits you to print any invoice immediately. It is recommended (but not required) that only one operator at a time be assigned to any invoice station.

|

Format |

3 characters |

|

Example |

Type 1 |

If you select an invoicing station that has a printer designated to print PDF documents (a -PDF- printer), then a PDF file will be created for the invoice and will display on screen. The PDF file will be generated and may be available to email to the customer. See the PDF Invoices section later in this chapter. See a definition of PDF.

Select Cancel to go back to the menu or OK to begin entering invoices.

From this screen you can work with both new and existing invoice entries (sometimes called bills). Since an actual invoice number is not assigned until the invoice is printed, bills are temporarily assigned a bill reference number. Upon entry or selection of an existing bill reference number, that bill will appear and be available for changes or deletion. Upon entry or automatic assignment of a new bill reference number, you can enter complete information for a new invoice.

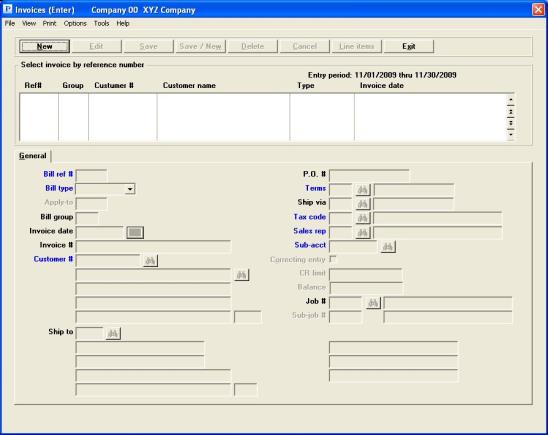

Graphical Mode

The header screen is the first screen of each invoice:

From this screen you can work with both new and existing invoices.

The list box displays up to 6 existing invoices, and credit memos, at a time. You may sort the invoices by bill reference number, group, customer number and customer name in ascending or descending order. Only column names in red may be sorted. To select or change the sort order, click on the column name or the arrow to the right of the column name or use the View options.

To locate an invoice, start typing a bill reference number or a number or name that matches the selected sort order. You may also use the up/down arrows, Page up, Page down, Home and End keys to locate an invoice. The <F1> and <SF1> keys function the same as the up/down arrow keys.

Invoices that display in the list box are available for changes or deletion. The fields for the selected invoice display in the lower part of the screen.

When an invoice is found, you may select the <Enter> key or Edit button to start editing.

Buttons

You have the following options with the buttons and keyboard equivalents:

| Button | Keyboard | Description |

|---|---|---|

|

Alt+n |

For entering a new invoice header |

|

|

Alt+e |

For editing an existing invoice header |

|

|

Alt+s |

For saving the addition of the new invoice header or for saving the changes to an existing invoice header |

|

|

Alt+w |

This is a combination of the Save and New buttons |

|

|

Alt+d |

To delete an invoice |

|

|

Alt+c |

To cancel adding or editing an invoice. Your entries will not be saved |

|

|

Alt+l |

To access the line items of an existing invoice for entering, editing or deleting them |

|

|

Alt+x |

To exit the invoice header window |

Menu Selections

For general users, the options menu selections can and may be restricted by the assigned menu. The Options menu selections include:

| Menu selection | Link to documentation |

|---|---|

|

View invoices |

|

|

Purge customer history |

|

|

View customers open items |

|

|

View recurring bills |

|

|

View customer history by date |

|

|

View customer history by doc # |

|

|

Invoice notes <F6> |

For general users, the print menu selections can be restricted based on the assigned menu. Under the print menu selections you may access the following:

| Menu selection | Link to documentation |

|---|---|

| Edit list | Listing Invoices |

| Invoices | Invoice Print |

| Reprint | Reprinting Invoices |

The header screen has one General tab.

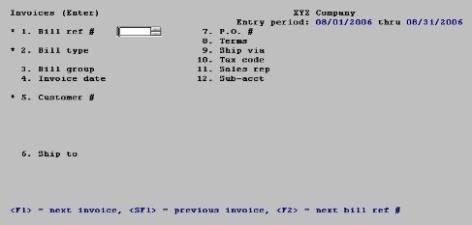

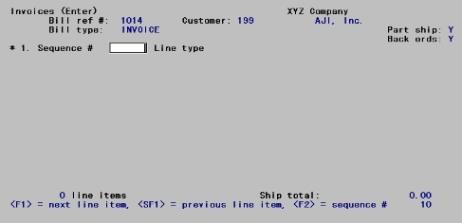

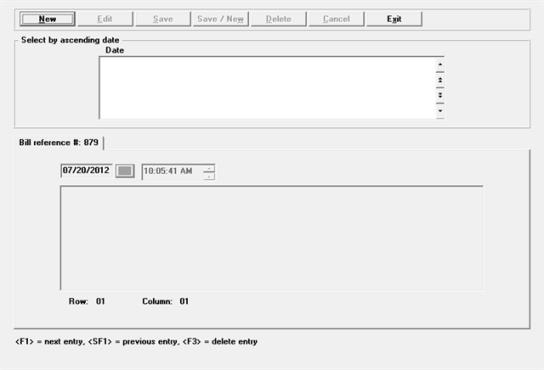

Character Mode

This is the first screen of each invoice:

If you are using date controls, the date range (from Control information) will display in the upper right. This date range applies to the invoice date field.

Enter the following information:

Options

Enter a reference number for this invoice,

In character mode only, you may use one of these options:

|

<F1> |

For the next existing invoice entry on file |

|

<SF1> |

For the previous entry |

|

<F2> |

To enter a new invoice and assign it the next available reference number |

If this is an existing entry and the invoice has already been printed, * Already printed * appears on the screen.

|

Format |

6 characters |

|

Example |

Press <F2> |

Enter what type of bill this is: Invoice or Credit memo.

|

Format |

Drop down list, either Invoice or Credit memo. The default for the first entry of a session is Invoice; thereafter each entry’s default is whatever the previous entry was. |

|

Example |

Press <Enter> |

This field may only be entered for credit memos. If this is a credit for a specific invoice, enter the number of that invoice. This field is optional. If you leave it blank, Open displays. If you enter an invoice number, it is not checked against invoice history.

If using PBS Multi-payment processing, you must enter an apply-to number. You cannot apply a credit memo to open. You may read more about PBS Multi-payment processing and the configuration in the PBS Multi-payment Setup appendix in the A/R User documentation.

|

Format |

999999 |

|

Example |

This field does not appear for an invoice. |

Bill groups are an optional way of classifying invoices. When you come to print the invoices, you can select invoices by their group code.

If you are using batch controls, the bill group is automatically set to the number of the current batch and cannot be changed.

Options

Otherwise, enter any desired code, or leave the field blank if you do not use this feature. If you selected a station for immediate invoicing, you may also use the option:

|

<F2> |

To use the station code for this invoicing station as the bill group |

|

Format |

3 characters |

|

Example |

Press <Enter> to skip this field. |

Options

Enter the date to assign to this invoice, or use one of the options:

|

<F1> |

For the same date as the previous invoice or credit memo entered; or, in the case of the first entry of the session, for the system date. |

|

<F2> |

To postpone assigning a date until the invoice is printed. |

Leaving the date blank is the same as pressing <F2>.

|

Format |

MMDDYY |

|

Example |

Type 30505 |

You may be warned or stopped against entering a date that is outside the allowed date range. For more information, read about Date Control in the Control information chapter.

Options

Enter the number of the customer for this invoice, or use one of the options:

|

<F1> |

For the next customer on file |

|

<SF1> |

For the previous customer |

|

<F2> |

For the same customer as the invoice or credit memo previously entered (unless this is the first entry of the session) |

|

Blank |

To look up the customer by name |

|

Format |

12 characters |

|

Example |

Type AJI (a customer number which is not used yet, since we are going to enter a new customer). |

Options

If you have left the customer number blank, the cursor will move to the name field to permit selection by customer name.

Enter the customer name, or the leading characters of the name; or use one of the options:

|

<F1> |

For the next customer on file, in customer name sequence |

|

<SF1> |

For the previous customer |

|

Blank |

To revert to selecting the customer by his number |

|

Format |

25 characters |

|

Example |

(Does not occur in this example because you have already selected the customer by number.) |

Miscellaneous Customer

Existing miscellaneous customers may be entered, or selected with the option keys. These customers have numbers beginning with an asterisk (*) and have been described in the Miscellaneous customers section of the Customers chapter.

By definition a miscellaneous customer number represents a category of customers and not an individual customer, so you can enter a different name and address each time that number is used.

Miscellaneous Customer Name

Options

Enter the name of this customer. This may be left blank. You may also use the option:

|

<F2> |

To toggle between entering a personal name or a corporate name. Initially this is set to corporate name. |

|

Format |

25 characters |

|

Example |

(Does not appear in this example) |

Entering a Person’s Name

If you have pressed <F2> at the preceding field when entering a miscellaneous customer, the Name field splits into two subfields allowing entry of a personal name and a surname.

Options

Enter the individual’s first name (and middle initial if you wish); or use the following option:

|

<F2> |

To revert to entering a corporate name |

|

Format |

10 characters |

|

Example |

(Does not occur in this example because you have entered a corporate name) |

Enter the customer’s surname.

|

Format |

14 characters |

|

Example |

(Does not occur in this example) |

Miscellaneous Customer Address

Each line is optional and may be left blank.

|

Format |

25 characters for the name |

|

|

25 characters for address line 1 |

|

|

30 characters for address line 2 |

|

|

3 characters for country |

|

|

30 characters for address line 3 |

|

Example |

(Does not appear in this example) |

As soon as a customer is identified (other than a miscellaneous customer or a customer added on-the-fly), the customer credit is checked.

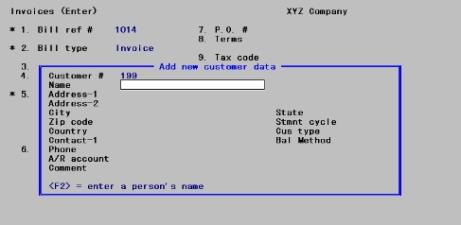

This customer is not on file — would you like to add it ?

This question appears when you enter a customer number (regular or miscellaneous) that is not already on file. Select No to correct an erroneous entry, or Yes to add the new customer on-the-fly.

|

Format |

Yes/No button window |

|

Example |

Select Yes |

|

Note |

If the customer is already on file, proceed to the Ship to field. |

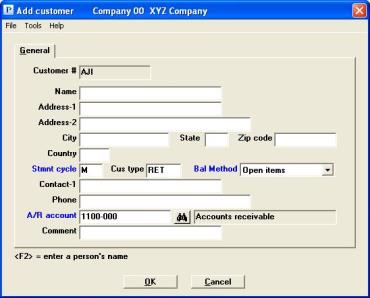

Graphical Mode

The following window appears:

Character Mode

The following window appears on the screen:

From this screen you can work with new entries only. The effect is as though you had gone into the Customers (Enter) selection and entered a new customer there. This is the case even though your password may not authorize you to use that selection.

Be aware that not every field on the Customers screen appears on this screen:

| • | Some fields, such as Contact-2, are omitted altogether. |

| • | Other fields will be supplied automatically from your entries in the remainder of this invoice. These include: terms code, ship-via code, tax code, sales representative, and cost center. |

| • | The credit limit is automatically set to zero, but this invoice does not set off the credit limit check. The next invoice for this customer will. |

If necessary, you can use Customers (Enter) to change this new customer after adding him here.

Enter the following information:

Enter the customer’s name. Name is optional, but omitting customer names is not recommended. You may use the <F2> option to enter a personal name as opposed to a corporate name, as described above for miscellaneous customers.

|

Format |

25 characters |

|

Example |

Type AJI, Inc. |

Enter two lines of customer address. All address fields are optional.

|

Format |

30 characters at each field |

|

Example |

Type 15 West Eire Ave. Type Suite 101 |

Enter the remainder of the customer address.

|

Format |

15 characters for city |

|

2 characters for state |

10 characters for zip |

|

Example |

Type Chicago |

|

Type IL |

Type 60600 |

Enter a country code for the customer.

|

Format |

3 characters |

|

Example |

Press <Enter> |

Enter the statement cycle code which specifies how often statements are to be printed for this customer, such as W (weekly), M (monthly), or Q (quarterly). This field is required.

|

Format |

One character. The default is whatever has been defined in the Customer on the fly defaults box of Control information. |

|

Example |

Press <Enter> |

If you plan to use the PBS Sales Analysis (S/A) module, entering a customer type will enable you to evaluate sales information for different customer types, to determine their relative profitability. If you do not intend to use S/A, you might still want to categorize customers by type for your own information. Some price codes in the PBS Inventory Control module can use customer type as a basis for assigning prices.

Enter a customer type. This field is optional.

|

Format |

5 characters. The default is whatever has been defined in the Customer on the fly defaults box of Control information. |

|

Example |

Press <Enter> |

Enter the code for the method used in handling this customer’s account, either Open item or Balance forward.

For open-item customers, all payments received must be applied to a specific receivable. For balance-forward customers, payments are applied to the oldest unpaid receivables.

One-time customers should be assigned a balance method of Open item so that specific items can be selected for payment.

|

Format |

One letter. The default is whatever has been defined in the Customer on the fly defaults box of Control information |

|

Example |

Press <Enter> |

Enter the name of the person to contact at the customer’s location.

Contact name cannot be printed on invoices or quotations for a miscellaneous customer.

|

Format |

25 characters |

|

Example |

Type T.A. Wagner |

Enter the phone number of the contact entered above.

|

Format |

25 characters |

|

Example |

Type 123-456-7890 |

Options

Enter the number of the A/R account to which documents for this customer are to be posted. This must be a valid entry in A/R Accounts. You may use one of the options:

|

<F1> |

For the next A/R account on file. This option and the next are not available if only one A/R account is on file. |

|

<SF1> |

For the previous A/R account |

|

<F2> |

For the default A/R account from Control information |

|

Format |

Your standard account number format, as defined in CTL Company information |

|

Example |

Press <F2> |

Enter any comment pertaining to this customer. This field is optional.

|

Format |

25 characters |

|

Example |

Type Franchise retailer |

Select Cancel to return to the invoice entry window without saving the information about the customer, or OK to accept this new customer and to proceed to the next field on the main screen. Note that customers added on-the-fly are not actually added to Customers until you complete this invoice; if you cancel the invoice the new customer is also canceled.

Options

Enter the code for the ship-to address at which services are performed or to which goods are delivered. This must already be on file in Ship-to addresses for this customer. You may use one of the options:

|

Blank |

To make the ship-to address the same as the customer’s billing address |

|

<F1> |

For the next ship-to address on file for this customer |

|

<SF1> |

For the previous ship-to address on file for this customer |

|

<F2> |

To enter a new ship-to address |

|

Format |

99999 There is no default. |

|

Example |

Press <Enter> |

If you have pressed <F2>, enter an address for this invoice. All fields are optional.

|

Format |

25 characters for the name |

|

25 characters for address line 1 |

30 characters for address line 2 |

|

30 characters for address line 3 |

3 characters for country |

|

Example |

(Does not appear in this example) |

Do you want to save this ship-to?

If you have pressed <F2>, this question appears unless you have left the ship-to address blank or this is a customer added on-the-fly.

If you select Yes, the address just entered will be added to the Ship-to Addresses file. The next available ship-to number for this customer will be assigned automatically and will appear on the screen.

If you select no, this new ship-to address will be only for this one invoice and will not be saved.

Enter the customer purchase order number if any. This field is optional.

|

Format |

15 characters |

|

Example |

Press <Enter> |

The terms code is required and must be already be present in the Terms codes selection. See the Terms chapter.

For a balance forward customer, the customer’s usual terms code displays and cannot be changed.

Options

For an existing non-miscellaneous open-item customer, enter a terms code or use the option:

|

<F2> |

For the customer’s usual terms code |

Options

For a miscellaneous customer or a customer added on-the-fly, enter a terms code or use one of the options:

|

<F1> |

For the next terms code on file |

|

<SF1> |

For the previous terms code |

|

Format |

3 characters. There is no default. |

|

Example |

Press <F1>, then press <Enter> |

This field appears only if the Use ship-vias field in Control information is checked.

The ship-via code identifies what carrier you will use to ship the goods. This field is optional and may be left blank, but if entered it must be a valid entry in Ship-via codes.

Options

For an existing non-miscellaneous customer, enter a ship-via code or use the option:

|

<F2> |

For the customer’s usual ship-via code. If none has been specified in Customers, this option is not available. |

Options

For a miscellaneous customer or a customer added on-the-fly, enter a ship-via code or use one of the options

|

<F1> |

For the next ship-via code on file |

|

<SF1> |

For the previous ship-via code |

|

Format |

3 characters |

|

Example |

Press <F2>, then press <Enter> |

This field is required and must be an existing entry in Tax codes. See the Tax Codes chapter. Enter a tax code, or use one of the options:

Options

For an existing non-miscellaneous customer, enter a tax code or use the option:

|

<F2> |

For the default tax code: If the ship-to address is the same as the bill-to address, the customer’s tax code is the default. If this is being shipped to an existing ship-to address, that address’s tax code is the default. If the ship-to address is neither the bill-to address nor any existing ship-to address, the customer’s tax code is the default. |

Options

For a miscellaneous customer or a customer added on-the-fly, enter a tax code or use one of the options:

|

<F1> |

For the next tax code on file |

|

<SF1> |

For the previous tax code |

|

Format |

3 characters |

|

Example |

Press <F2>, then press <Enter> |

This field appears only if the A/R Control information Use sales reps field specifies that sales representatives are used. If so, the field is required and must be a valid entry from the Sales reps selection. See the Sales Reps chapter.

Options

For an existing non-miscellaneous customer, enter a sales representative code or use the option:

|

<F2> |

For this customer’s default sales representative |

Options

For a miscellaneous customer or a customer added on-the-fly, enter a sales representative code or use one of the options:

|

<F1> |

For the next sales representative on file |

|

<SF1> |

For the previous sales representative |

|

Format |

3 characters |

|

Example |

Press <F2>, then press <Enter> |

Cost ctr appears only if Control information specifies that multiple cost centers are used. If so a cost center is required and each segment of it must be on file in the Cost centers selection of the System application - Ctl on the menu. Note that zero or blank may be a valid entry if so defined in Cost centers. If cost centers are not used, but sub-accounts are used, sub-acct displays.

Options

Enter the cost center or sub-accts to which this invoice is assigned, or use the option:

|

<F2> |

For the default cost center or sub-account from Control information or the default cost center from Customers (depending on what your answer has been to the question Assign cost ctrs (or sub-accts) by in Control information) |

|

Format |

Your standard cost center or sub-account format, as defined in Company information |

|

Example |

Press <F2> |

If this is a new entry and you are interfaced to G/L and you have answered Y to the question Allow correcting transactions ? in G/L Control information, you may select the <Space bar> to check this box to make it a correcting entry. Otherwise, leave it unchecked.

|

Format |

Check box, checked is yes and unchecked is no |

|

Example |

Leave it unchecked |

If Job Cost is not interfaced, this field cannot be entered.

If this is a miscellaneous customer or a balance-forward customer, this field may not be entered. Only open-item customers can be billed for jobs (since the payment when received must be applied to that job).

If billing for a job, enter the job number of an active or closed job already on file in the Job Cost module. This may not be a job in the Inactive Files.

If this invoice is not for a job, leave this field blank. This field and the next will display as Not applicable.

Options

You may use the one of the options:

|

<F1> |

For the next job on file in the Job Cost module |

|

<SF1> |

For the previous job |

|

<F2> |

To indicate the invoice is for multiple jobs (you will be asked for a job number for each line item, and you will not be able to enter Standard Bill line items) |

You may bill a customer for a job even though that job is a for a different customer than this invoice.

|

Format |

7 characters. There is no default. |

|

Example |

Press <Enter> |

If Job Cost is not interfaced, this field cannot be entered.

If you have entered a job number in the previous field, and that job is broken down into sub-jobs, and those sub-jobs are billed separately, enter the number of the sub-job you are billing.

Options

You may use one of the options:

|

<F1> |

For this job’s next sub-job |

|

<SF1> |

For this job’s previous sub-job |

|

Format |

3 characters. There is no default. |

|

Example |

(In this example the cursor does not move to this field) |

The next screen is the Line Item Screen.

1st user-defined field

2nd user-defined field

3rd user-defined field

These fields appear only if it is defined in Control information. If present, the caption that displays, and the number of characters expected, is whatever you have defined in the A/R Optional fields section of Control information.

Note that the user-defined fields are alphanumeric, not date or numeric fields. Whatever you enter will appear exactly that way on the invoice.

Enter the information appropriate to the field.

|

Format |

Number of characters specified in Control information |

|

Example |

Type 3/15/05 as the Ship date. |

This completes the first screen. Make any needed changes. Note that you cannot change the bill reference number or customer number fields, even for a new entry.

Options

If this is an existing entry, you may use one of the options:

|

<F1> |

For the next existing invoice entry on file. |

|

<SF1> |

For the previous entry |

|

<F3> |

To delete this entry |

Correcting Entries for Character Mode

Options

If this is a new entry and you are interfaced to G/L and you have answered Y to the question Allow correcting transactions ? in G/L Control information, you may use the option:

|

<F5> |

To toggle between making this a correcting entry and not doing so. Correcting entries are identified as such in the upper right of the screen. The default is that credit memos are correcting entries and invoices are not. |

What happens when you press <Enter> depends on whether this is an existing entry or a new entry:

| • | For a new invoice, the line-item screen appears automatically |

| • | For an existing invoice: |

If you have changed the tax code, the existing line-item screens appear in succession so you can correct the taxability of each one.

If you have not done so, you are asked, Do you wish to change the line items ?.

Answer N to terminate processing this invoice and proceed to another entry.

Answer Y to view the line items or the totals screen.

Each line item of the invoice is entered on a separate screen.

| • | An invoice may have up to 9,999 line items. Typically it has at least one, but it may have none at all (for instance, to correct an erroneous freight charge on a previous invoice). |

| • | The term line item should not be taken literally to mean a single line on the invoice as printed; each line item may occupy several lines. |

| • | To terminate processing line items and proceed to the totals screen, in character mode press <Esc> from the Sequence # field of any line-item screen and in graphical mode select the Exit button. |

| • | Some of the fields illustrated for Goods and Services line items may not be accessible on your screen, depending on your choices in Control information and Company information. When this happens in character mode the remaining fields on the screen are renumbered. In graphical mode fields that are inaccessible display, but cannot be entered. |

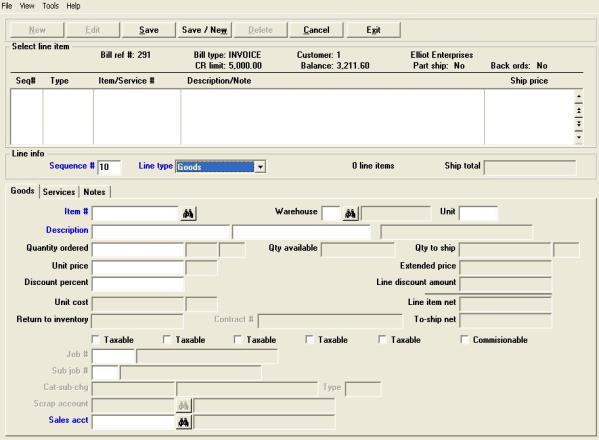

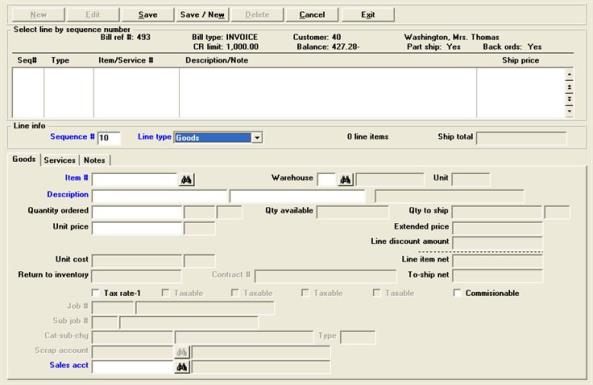

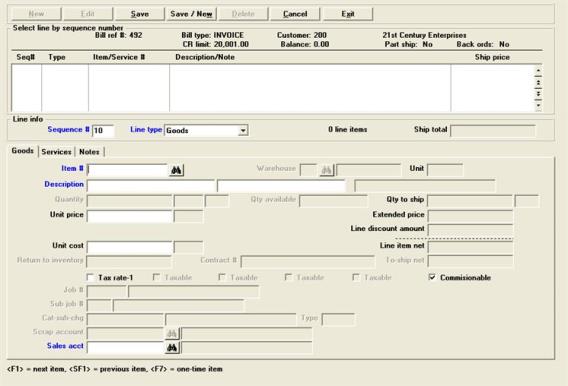

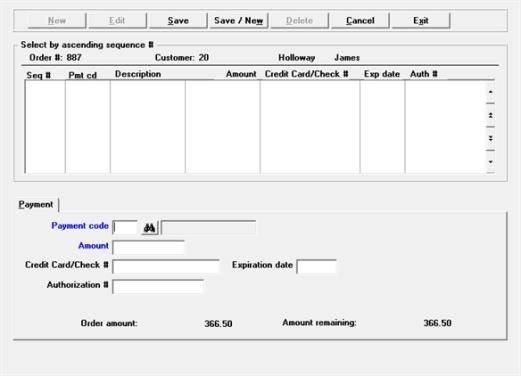

Graphical Mode

The following screen appears:

From this screen you can work with both new and existing invoice lines.

Up to 6 existing invoice lines display in the list box. You may sort the lines by sequence number or type both in ascending or descending order. Click the arrow to the right of the column name to change the sort or use the View menu options. Only Red fields may be sorted.

To locate a line, start typing the sequence number or type depending on which column is selected.

You may also use the up/down arrows, Page up, Page down, Home and End keys to locate a line. When adding a line or scanning through the invoice lines, the corresponding tab will display based on the Line type.

You have the following button and keyboard equivalent options:

| Button | Keyboard | Description |

|---|---|---|

|

New |

Alt+n |

For entering a new invoice line |

|

Edit |

Alt+e |

For editing an existing invoice line |

|

Save |

Alt+s |

For saving the addition of the new invoice line or for saving the changes to an existing invoice line |

|

Save/New |

Alt+w |

This is a combination of the Save and New buttons |

|

Delete |

Alt+d |

To delete an invoice line |

|

Cancel |

Alt+c |

To cancel adding or editing an invoice line. Your entries will not be saved |

|

Exit |

Alt+e |

To exit the invoice line window. The totals tab will display next |

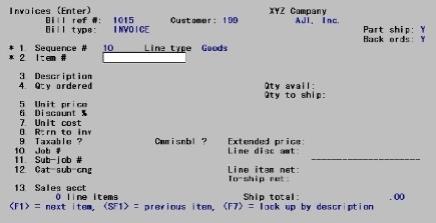

Character Mode

The following screen appears:

From this screen you can work with both new and existing line items.

Enter the information as follows:

Line items within an invoice are in sequence by an arbitrary number, which by default is assigned in increments of ten. This lets you insert new lines between existing lines. For example, to insert a line item between #10 and #20, give it any sequence number from 11 to 19 (preferably 15, to allow room for still later insertions on either side).

If you change the first line number to 1, then by default that invoice will increment with single digits. For example, you enter the first line as 1, then second new line will be 2. If you want to increment by 1 for another invoice, then you will have to change the sequence number from 10 to 1.

When going back to edit an existing order, if the first line sequence number is 1, then the sequence # for lines added will be incremented by 1. Note that if a user adds a line to an invoice with no line sequence 1, and changes the default sequence# to 1, then next time the user edits this invoice, as long as line sequence # 1 is present, new lines will be offered a sequence # incremented by 1. Reversely, if the first line sequence# is 10, the next time the user edits this invoice, new lines will be offered a sequence # incremented by 10. In any case the user can manually change the sequence # when adding a line.

Options

Enter a sequence number, or use one of the options:

|

<F1> |

For the next existing line item, if any |

|

<SF1> |

For the previous existing line item |

|

<F2> |

For a new line item, to be added at the end of the invoice and to be given a sequence number ending in zero |

Normal practice when entering a new invoice is to use <F2> for each line item.

If you select an existing line item (either by direct entry of a sequence number or by using the option keys), that item is displayed in the appropriate format.

|

Format |

9999 |

|

Example |

Press <F2> to assign sequence number 10. |

Enter the type of line item:

|

Goods |

Goods are merchandise such as parts, books, appliances, etc. Entering this line item when interfaced to the PBS Inventory Control module is considerably different than when not, so each case is discussed separately. See either Goods Line Items (With I/C) orGoods Line Items (Without I/C) |

|

Services |

Services are usually billed by unit of time. See Services Line Items |

|

Notes |

Notes are a comment that prints at this point on the invoice. See Notes Line Items |

|

Standard Bill |

A Standard bill is a predefined group of line items that you can paste into the invoice. See Standard Bill Line Items |

There is no separate line type for jobs. If you are interfaced to the PBS Job Cost module and are billing for a job, you can use either a Goods line or a Services line.

After you enter a line that is a service or an item, the next new line defaults to the same line type you just entered.

As soon as you enter a line type the remainder of the screen fills out in the format appropriate for that line item. Each will be discussed in a separate section, beginning with Goods.

|

Format |

Drop down list. |

|

Example |

Select Goods |

If you are not interfaced to the PBS Inventory Control module, do not use this section.

Graphical Mode

When the line entry screen displays, the sequence number is filled in and the Line type defaults to Goods.

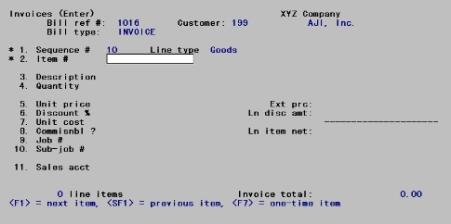

Character Mode

After pressing <F2> for the Sequence # and typing G for the Line type, the screen appears thus: Enter the following information:

Options

Enter the inventory item number. This item (even a miscellaneous item) must be on file in I/C Items. However, it must not be a serialized or lot item; these can only be sold through O/E. You may use one of the options:

|

<F1> |

For the next item on file, in item number sequence |

|

<SF1> |

For the previous item |

|

<F7> |

To look up the item by description |

The unit or conversion factor in effect when an invoice is entered remains on that invoice, even if you subsequently change them using I/C Items.

Item Lookup By Description

Options

If you pressed <F7>, the cursor moves to the Description field. Enter the item’s description (or any portion of it beginning with the first letter). Your options are:

|

<F1> |

For the next item on file, in item name sequence |

|

<SF1> |

For the previous item |

|

<Enter> |

To return to lookup by number |

Only the first line of the description is used for lookup, but the full description and item number display when an item is selected by either name or number.

Miscellaneous Items

Miscellaneous items are generic low-volume items for which you do not want to maintain a separate inventory. Another use of these items is to represent intangibles such as service charges or the overhead costs associated with assembling kits. They are identified by an asterisk (*) as the first character of the item number.

If I/C does not use multi-warehousing, skip this section. Otherwise:

| • | If A/R Control information specifies that multiple warehouses are not used, you cannot enter a warehouse because the default warehouse is assumed. If the item is not stocked there you are warned of the fact but allowed to continue (you will be able to select an alternate when you come to the Quantity ordered field). |

| • | If A/R Control information specifies that multiple warehouses are used, enter the warehouse you wish to ship from. The warehouse must have been defined in I/C Warehouses (blank for Central is a valid entry), and the item must be stocked at that warehouse. |

Options

You may use the option:

|

<F2> |

For the default warehouse from Control information |

|

Format |

Two characters. |

|

Example |

Press <F2> |

This field is skipped except for miscellaneous items.

Options

Enter the unit or measurement, or use the option:

|

<F2> |

For EACH |

|

Format |

4 characters |

|

Example |

(Does not occur in this example) |

For an item that is already on file and not a miscellaneous item, the description displays automatically. You can change this or press <Enter> twice to accept it as is.

If you are entering a miscellaneous item, enter the description of the item.

|

Format |

2 fields of 25 characters each |

|

Example |

Press <Enter> twice |

Enter the quantity ordered. If you leave this field blank, a quantity of 1 is assumed.

For an invoice (but not a credit memo), you can specify a negative quantity. This indicates returned goods, and requires you to specify, in a later field of this screen, how much has been scrapped and how much returned to inventory. The value of the quantity scrapped is assigned to the default scrap account specified in Control information. See the Inventory scrap acct field.

The quantity available at the current warehouse is displayed on the screen for your reference when entering the quantity ordered.

Options

You have several options:

|

<F1> |

To toggle between flagging this as a drop shipment or not. A drop shipment is delivered to the customer directly by your vendor and thus never forms part of your inventory. |

|

<F2> |

To view alternate items. |

|

<F5> |

To obtain more information about this item at this warehouse. This option is not available for miscellaneous items. |

|

<SF5> |

To see what other warehouses stock this item. This option is only available if multiple warehouses have been specified in Control information. |

|

<F7> |

If you are interfaced with I/C and the item has one or two alternate units of measure, change to the alternate prompted at the bottom of the screen. |

|

Format |

99,999,999.99999- |

|

Example |

Type 5 |

This message appears if the quantity ordered is not available at this warehouse. Use the <Space bar> to select one of the following radio buttons:

|

Radio Choices |

Description |

|

Ship in stock |

Ship the quantity available only. The Qty ordered field will change accordingly. No back-ordering will occur. |

|

Cancel |

Cancel the entire line item and clear the screen for entry of another line item. |

|

Alternate item |

To view alternate items. |

|

Override |

Ship the full quantity anyway (in anticipation of a receiving) |

OK or Cancel

Select OK to accept your choice or Cancel to go back to the quantity field.

Pressing <F2> from the Qty ordered field displays an alternate item screen. All alternates for this item stocked at this warehouse are shown. Select any listed item and then click on the Select button. This will replace your original entry in the Item number field. Press <Esc> or click on the Cancel button to return to the screen without changing the item.

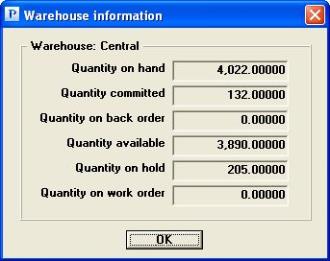

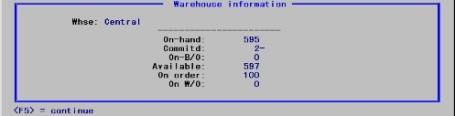

Pressing <F5> from the Qty ordered field displays a window.

Graphical

A window like the following displays:

Click on the OK button or select <Enter> to return to the quantity field.

Character

The following window displays:

This shows the quantities of this item available at this warehouse. Press <F5> to return to the screen.

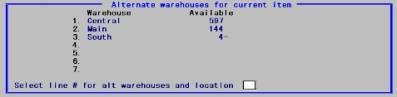

Pressing <SF5> from the Qty ordered field displays the window.

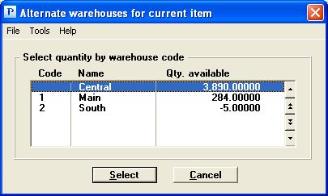

Graphical

All warehouses where this item is currently stocked are shown. Use your mouse or keyboard to select the warehouse. Click on the Select button to use the warehouse or click on Cancel to return to the quantity field.

Character

All warehouses where this item is currently stocked are shown. Select any listed warehouse by entering its line number. This will replace your original entry in the Warehouse field. Press <Esc> to return to the screen without changing warehouses.

You may alternate <F5>and <SF5> to discover alternate items at different warehouses.

Enter the unit price. The quantity is automatically multiplied by this price and the extended price appears.

You may enter a price of zero, but will be required to confirm that you really wish to do this.

Options

Enter the unit price, or use the option:

|

<F2> |

For the default price |

In the absence of sales or contract pricing, the default price is the regular price. This is the price calculated from the item’s price code, if it has one. If it does not, the item’s Price-1 becomes the default. If pricing by warehouse is in effect, the default price is that applying at the selected warehouse.

Sales or contract pricing (or both) may apply for this item, customer, warehouse, and date. If so, the default is the lowest of the regular, sales or contract price. However, the contract price overrides the sales price if so specified in the I/C Contract prices entry.

|

Format |

999,999,999,999.99999 |

|

Example |

Press <F2> |

If the fields in the Discounts calculated on section from Control information specifies that you do not use discounts, this field is skipped. Otherwise:

| • | If you use line item discounts, this field appears as Discount %. Enter the discount percent for this line item only. |

|

Format |

999.99999 |

|

Example |

Press <Enter> |

| • | If you do not use line item discounts but do use an overall invoice discount, this field appears as Discountable. Check the box if the line item is discountable; it will be included in the total entitled to the overall invoice discount. |

|

Format |

Check box, checked is yes and unchecked is no. There is no default. |

|

Example |

(Does not occur in this example) |

| • | If you use both types of discount, you enter the line item discount percentage, not the discountability. All line items are considered discountable for the overall invoice discount. |

Customer Credit Check

As soon as the discounted amount of the line item is known, the customer credit is checked.

Replacement cost or

Average cost

Standard cost

Normally, you do not enter the unit cost field. An approximate value for the unit cost is displayed automatically, under a name which depends on the I/C inventory valuation method:

|

Valuation method |

Displays as |

|

LIFO |

Replacement cost |

|

FIFO |

Average cost |

|

Average cost |

Average cost |

|

Standard cost |

Standard cost |

This approximation is replaced by a calculated cost when the invoice is posted. For standard costing, the actual cost used is the standard cost.

The following cases are exceptions and require you to enter the cost directly. No other source is available and the information is needed to keep the cost of sales accurate and to pay commissions based on margin.

| • | Miscellaneous items |

| • | Negative line items on an invoice |

| • | All line items on a credit memo |

| • | Drop ship items |

Options

In these cases, enter the unit cost or use the option:

|

<F2> |

For the unit cost from Items. This option is not available for miscellaneous items. |

|

Format |

99,999,999.99999 |

When selling goods and services the costs and profit margin are not printed on the sales journal. It is not transferred to A/R Miscellaneous charges and it is not included as cost of sales on the sales journal.

This field is used only for returned merchandise that is, if this is a credit memo or an invoice line item with a negative quantity. Otherwise, Not applicable appears.

Enter the quantity of the items credited which are to be returned to inventory. The rest is considered scrapped.

The quantity cannot be larger than the quantity ordered in Field #4 above. For example, if the quantity ordered is -5, the quantity returned to inventory must be positive and not larger than 5.

|

Format |

99,999,999.99999 |

If the tax code in the header screen has zeros for all tax percents, this field displays as Not applicable and may not be entered.

Otherwise, the cursor does not move to this field but a default value appears. The format of this varies depending on your answer to Taxable by tax rate in Control information:

| • | If you left it unchecked, a single Y/N flag controls whether or not this line item is subject to all the tax rates in this invoice’s tax code. |

| • | If you checked the box, there are one to five flags separated by slashes — one for each of the tax rates in that tax code. |

Each flag is either Y or N, corresponding to the taxability code on file for this inventory item in I/C Items. Even miscellaneous items have default taxability codes.

Whether or not you can change this default depends upon your answer to the question Taxable by line item in Control information:

| • | If you left the Taxable by line item field unchecked, you may not change this field. The overall tax for the invoice may still be changed from the totals screen once you get to it. |

| • | If you checked that field, you may change the taxability but only from Field number to change ?. |

If you left the Taxable by tax rate field unchecked, specify whether or not the item is taxable.

|

Format |

Check box, checked is yes and unchecked is no |

|

Example |

(Appears automatically) |

If you checked the Taxable by tax rate field, a window appears and the cursor moves in succession through each tax rate in this tax code. Press Y or N to change, or <Enter> to ratify, each existing default. When all have been entered, answer Y at Any change ? to re-enter the information, or N to return to the main screen.

|

Format |

Check box, checked is yes and unchecked is no |

|

Example |

(Appears automatically) |

This field is skipped if the Use commissions field from Control information specifies that you do not use commissions.

Otherwise, the cursor does not move to this field but a default value appears.

| • | If a commission code has been defined for this item in I/C Items, the default is Y and the commission for this line item is calculated from that commission code. |

| • | Otherwise the default is N and no commission is calculated. |

You may change the default from Field number to change ?.

If you change N to Y, the commission calculated for this line item is based upon the commission percentage and method specified for either this customer or this sales representative (whichever has been specified in Control information).

|

Format |

Check box, checked is yes and unchecked is no |

|

Example |

(Appears automatically in this example) |

If you are not interfaced to the PBS Job Cost module, this field does not appear on the screen.

If the header screen indicates that this invoice is not for a job at all, this field is skipped and N/A displays automatically.

If the header screen indicates that this invoice is for a single job, the job number entered on the header screen displays here and this field is skipped.

Options

If the header screen indicates that this invoice is for multiple jobs, enter the job number for this line item. This must be an active or closed job. You may also use one of the options:

|

<F1> |

For the next job on file |

|

<SF1> |

For the previous job |

|

Blank |

If this line item is not for a job |

|

Format |

7 characters |

|

Example |

[This field cannot be entered, since J/C is not interfaced.] |

Job & Sub-job Descriptions

During entry of this field and the next two, a box displays the names of the job, sub-job, and cost item.

If this invoice or this line item of the invoice is not for a job, or is for a single job which either does not have sub-jobs or does not bill for them, this field is skipped and N/A displays automatically.

If this invoice is for a single job which uses and bills for sub-jobs, the sub-job number you entered on the header screen displays automatically.

If this invoice is for multiple jobs and this line item is for a job which uses sub-jobs and which bills for them, a sub-job number must be entered.

Options

Enter the sub-job number for this line item, or use one of the option

|

<F1> |

For the next sub-job of this job |

|

<SF1> |

For the previous sub-job |

|

Format |

999 |

|

Example |

[This field cannot be entered, since J/C is not interfaced.] |

This field is the cost item, and displays on the screen only if you are using both J/C and I/C. If you have specified (in J/C Control information) that you do not use change orders, the field appears as Cat-sub instead of Cat-sub-chg.

Enter the cost item of the job to which you want the cost of this inventory item to go. When this invoice is posted, the inventory cost for this line item will automatically be transferred to I/C. When I/C Inventory is posted the cost will then be transferred to J/C.

If this line item or this invoice is not for a job, this field will be skipped and N/A will appear instead.

You may leave this field blank to postpone transferring the cost. If you are interfaced to the PBS Accounts Payable module, you can transfer the cost to the job when you pay for the item in A/P Payables.

If this is a drop shipment or a miscellaneous item, this field is also skipped (because the item is not in I/C at all), and the cost can only be transferred in A/P.

Options

Enter a cost item, or use one of the following options:

|

<F1> |

For the next cost item for this job |

|

Format |

Three segments, as follows: |

|

|

999999 Cost category number |

|

|

999 Sub-job number. If there is none, this displays as zero. If there is a sub-job number in the preceding field, that number appears here automatically and cannot be changed. |

|

|

999 Change order number. If you do not use change orders, this segment does not appear. |

This field appears on the screen only if quantity returned to inventory is present and is less than the quantity credited. This can happen on any line of a credit memo, but on an invoice it happens only when the Qty ordered field is negative.

Options

Enter the account number to which the value of the scrapped goods is to be assigned, or use the option:

|

<F2> |

For the default scrap account from Control information |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

(Does not occur in this example) |

This field appears on the screen only if Control information specifies that sales are distributed manually. If not, the sale amount is automatically distributed to the default.

If present, this field appears as sales account if this is an invoice, or as credit account if this is a credit memo.

Returned merchandise should be credited to the same account it was originally sold from, whether on an invoice or a credit memo.

On initial entry the cursor does not move to this field and the default displays automatically. You may still change the account from Field number to change ?. You must change the account if the default is not a valid entry in Valid G/L accounts.

What constitutes the default depends on your answer to the question Multiple cost centers ? in Control information and on whether or not this line item is for a job. There are three cases:

| • | You are not using multiple cost centers and this line item is not for a job.The default is the sales account specified for this inventory item within I/C Items. Only the main account (and sub-account, if defined) are entered; the default cost center from Control information is automatically prefixed. |

Options

You may use one of the options:

|

<F1> |

For the next sales account from Control information |

|

<SF1> |

For the previous sales account |

These options are not available if no sales accounts are defined in Control information.

| • | You are using multiple cost centers and this line item is not for a job.The default is the sales account for this item Items, prefixed by the cost center from either the invoice header or the item (depending on your answer to Assign cost ctrs (or sub-accts) by in Control information). |

Options

You may use the option:

|

<F2> |

For the default account |

| • | This line item is for a job. The default is this job’s billing account from J/C Job descriptions (Jobs). |

Options

You may use the option:

|

<F2> |

For the default account |

|

Format |

Either full account number format or main/sub format, as described above. |

|

Example |

(Does not occur in this example) |

Options

Change any field as desired, then press <Enter> to process another line item. For an existing line item, you may also use one of the options:

|

<F3> |

To delete this line item |

|

<F5> |

To obtain more information about this item at this warehouse. This option is not available for miscellaneous items. |

|

<SF5> |

To show the job description (if this line item is for a job). Press <SF5> again to close the window. |

If you are interfaced to the PBS Inventory Control module, do not use this section.

Graphical Mode

The sequence number fills in automatically. The default is Goods for the Line type.

Character Mode

After pressing <F2>for the Sequence # and typing G for the Line type, the screen appears thus:

Enter the following information:

Options

Enter the item number as entered in Goods and services, or use one of the options:

|

<F1> |

For the next goods entry in the Goods/Services selection |

|

<SF1> |

For the previous entry |

|

<F7> |

For a one-time item |

A one-time item has a blank item number and is identified only by its description. It is used only on this invoice and is not added to the

Goods/Services file.

You can enter a service or good item number that is not already on file, in which case you are so informed and asked whether you want to enter it anyway.

| • | If this is merely a keying error, select No to re-enter the item number. |

| • | Select Yes to use this item number anyway. You are asked whether it should be added to the goods and services file. This gives you a chance to enter new services or goods items as you go. When you enter the fields, Item/Service number, Description 1, Description 2, Unit, Price and Cost; these entries are also written to the like fields in the Goods and Services file. |

Select No to use the item on this invoice only.

Select Yes to add the item to the file. This has the same effect as using the Goods and services (Enter) selection.

|

Format |

15 characters |

|

Example |

Type 2 |

For an item already on file, the description displays automatically. You can change this or press <Enter> twice to accept it as is.

If you are entering a new item, enter the description of the item.

|

Format |

2 fields of 25 characters each |

|

Example |

Press <Enter> twice |

Enter the quantity ordered. If you leave this field blank, a quantity of 1 is assumed.

Negative Quantity

| • | This is used to specify returned goods on an invoice. |

| • | For a credit memo, always enter a positive number as a credit for a particular item. (A negative number is not allowed.) |

|

Format |

99,999,999.99999- |

|

Example |

Type 5 |

Enter the unit price. The quantity is automatically multiplied by this price and the extended price appears.

You may enter a price of zero, but will be required to confirm that you really wish to do this.

Options

You may use the option:

|

<F2> |

For the item’s price from the Goods/Services file, if there is one. |

|

Format |

9,999,999,999.99999 |

|

Example |

Press <F2> |

This field, is entered identically whether interfaced to I/C or not.

Customer Credit Check

As soon as the discounted amount of the line item is known, the customer credit is checked.

Options

Enter the unit cost or use the option:

|

<F2> |

For the unit cost from Goods and services |

Although not seen by the customer, the unit cost is important because it is used to calculate the profit margin on this line item. This is required if you pay commissions based on margin. It is also transferred into the A/R Miscellaneous Charges file and is included in the cost of the sale on the Sales Journal.

|

Format |

999,999,999.99999 |

|

Example |

Press <F2> |

If you unchecked (no) to Taxable by line item in Control information, this field cannot be entered.

If the tax code in the header screen has zeros for all tax percents, this field displays as Not applicable and may not be entered.

Otherwise, the format of this varies depending on your answer to Taxable by tax rate in Control information:

| • | If you unchecked this field (no), a single check box controls whether or not this line item is subject to all the tax rates in this invoice’s tax code. Specify whether or not the item is taxable: |

|

Format |

Check box , checked is yes and unchecked is no |

|

Example |

(Appears automatically) |

| • | If you checked the box, there are one to five flags separated by slashes — one for each of the tax rates in that tax code. A window appears as shown. |

The cursor moves in succession through each tax rate in this tax code. Specify for each tax rate whether or not this item is taxable under that rate.

|

Format |

Check box, checked is yes and unchecked is no |

|

Example |

(Appears automatically) |

This field is skipped if Control information specifies that you do not use commissions.

Otherwise, accept the default of checked if a sales representative is entitled to a commission on this sale, or uncheck it if not.

|

Format |

Check box, checked is yes and unchecked is no. The default is checked. |

|

Example |

Select <Enter> to accept the default |

These fields may only be entered if interfaced to J/C and if <F2> was selected for the Invoices header field to indicate multiple jobs. These fields are entered identically whether or not I/C is interfaced. See the I/C interfaced Invoices, Invoices and Cat-sub-chg or Cat-sub fields descriptions.

This field appears on the screen only if Control information specifies that sales are distributed manually. If not, the sale amount is automatically distributed to the default account.

If present, this field appears as sales account if this is an invoice, or as credit account if this is a credit memo.

Returned merchandise should be credited to the same account it was originally sold from, whether on an invoice or a credit memo.

What constitutes the default depends on your answer to the question Multiple cost centers ? in Control information and on whether or not this line item is for a job. There are three cases:

| • | You are not using multiple cost centers and this line item is not for a job. The first sales account from Control information is displayed. The cursor does not move to this field on initial entry, but you can change the account from Field number to change ?. The default cost center from Control information does not display, but when prefixed to the main and sub-account on display the result must be a valid G/L account number. |

Options

You may use one of the options:

|

<F1> |

For the next sales account from Control information |

|

<SF1> |

For the previous sales account |

These options are not available if no sales accounts are defined in Control information.

| • | You are using multiple cost centers and this line item is not for a job.The cursor moves to this field on initial entry. No default displays. You must enter all segments of the account number, including the cost center if any, and this must constitute a valid G/L account. |

Options

You may use one of the options:

|

<F1> |

For the next sales account from Control information, prefixed by the cost center from the invoice header |

|

<SF1> |

For the previous sales account |

These options are not available if no sales accounts are defined in

Control information.

| • | This line item is for a job. The default is this job’s billing account from J/C Job descriptions (Jobs). This contains all segments of the account number; the header cost center and the default cost center from Control information are not used. The cursor does not move to this field on initial entry. The default is selected automatically, but you can change it from Field number to change ?. |

Options

You may use the option:

|

<F2> |

For the job’s default billing account |

|

Format |

Either full account number format or main/sub format, as described above. |

|

Example |

(Does not occur in this example) |

Options

Change any field as desired, then press <Enter> to process another line item. For an existing line item, you may also use the option

|

<F3> |

To delete this line item |

Graphical Mode

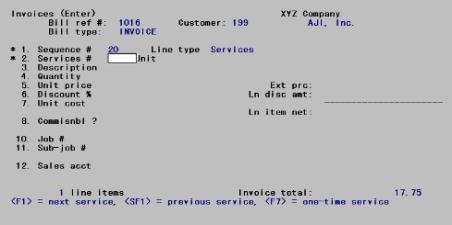

The sequence number fills in automatically. After selecting Services in the Line type field, the Services tab displays and looks appears similar to this:

Character Mode

After pressing <F2> for the Sequence # and typing S for the Line type, the screen appears thus:

Enter the following information:

Options

Enter the service number, or use one of the options:

|

<F1> |

For the next service on file in the Goods and services selection |

|

<SF1> |

For the previous service |

|

<F7> |

For a one-time service (one that is not in the file |

A one-time service has a blank service number and is identified only by its description. It is used only on this invoice and is not added to the Goods/Services file.

You can enter a service number that is not already on file, in which case you are so informed and asked whether you want to enter it anyway.

| • | If this is merely a keying error, answer N to re-enter the service number. |

| • | Answer Y to use this service number anyway. You are asked whether it should be added to the file. This gives you a chance to enter new services as you go. |

Answer N to use the service on this invoice only.

Answer Y to add the service to the file. This has the same effect as using the Goods and services (Enter) selection.

|

Format |

999 |

|

Example |

Press <F1> |

If this service is in the file, the unit will be displayed automatically and cannot be changed.

Options

If this service is not in the file, enter the unit for this service, or use the option:

|

<F2> |

For HOUR |

Leave the field blank for a service which either is not charged separately or is charged at a flat rate. This will display as None.

|

Format |

4 characters |

|

Example |

(The unit displays automatically in this example.) |

If this service is on file, its description displays automatically. You can change this or press <Enter> to accept it as is.

If the service is not on file, enter the description of the service.

|

Format |

The service text length specified in Control information |

|

Example |

Press <Enter> |

In graphical mode a window displays where you may enter up to 10 lines of description. If more than 1 line of description has been entered, then the word (more) displays. If the word is black, you may click on it to view more lines of description, even when you are not in edit mode. When the word is grayed out then there is only 1 line of description for the service line.

In character mode, the following message displays:

Do you wish to enter any additional description ?

Answer Y to enter up to nine additional lines of description.

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> |

If you had answered Y, a window would have opened to allow the additional description. This description is not added to the file but appears on this document only. If there is more information than can be viewed on the first description line, then the word (more) displays to the right of the description line.

Options

If you have fewer than nine lines, use the option:

|

<F2> |

To terminate the description. Press this at the next line after the one you want to save. |

The window closes as soon as the additional description is entered, and only the first line remains visible.

|

Format |

Up to nine lines, each of the service text length specified in Control information |

|

Example |

(Does not occur in this example) |

If there is no unit for this service, this field displays as Not applicable and may not be entered.

Otherwise, enter the number of units. If you leave this field blank, a quantity of 1 is assumed.

For an invoice (but not a credit memo), you may enter a negative quantity. This means you are giving a credit for this line item.

|

Format |

99,999,999.99999 |

|

Example |

Type 5 |

If there is a unit for this service, enter the price per unit. If there is no unit, enter the total price of the service.

Options

If the service is on file, you may use the option:

|

<F2> |

For the price on file for this service in the Goods and |

If this is a unit price, the quantity is automatically multiplied by this price and the extended price displays.

If this is a total price, the price as entered is rounded to the nearest penny for computing the extension.

|

Format |

9,999,999,999.99999 |

|

Example |

Press <F2> |

This field is the same for services as for goods.

Customer Credit Check

As soon as the discounted amount of the line item is known, the customer credit is checked.

Options

Enter the cost per unit for this service, if a unit has been specified; otherwise the total cost. You may use the option:

|

<F2> |

For the cost on file in Goods and services |

Although not seen by the customer, the unit cost is important because it is used to calculate the profit margin on this line item. This is required if you pay commissions based on margin. It is also transferred into the A/R Miscellaneous Charges file and is included in the cost of the sale on the Sales Journal.

|

Format |

999,999,999.99999 |

|

|

999,999,999.99 (For total cost) |

|

Example |

Press <F2> |

Taxability for services is entered in the same way as for goods.

This field is skipped if Control information specifies that you do not use commissions.

Otherwise, check this box (yes) if a sales representative is entitled to commission on this line item, or leave it unchecked if not.

|

Format |

Check box. Checked is yes and unchecked is no. The default is no |

|

Example |

Select the <Enter> key for the default |

Job and sub-job numbers are entered the same way for services as they are for goods. See the item Invoices and Invoices fields.

Credit acct

This field appears on the screen only if Control information specifies that sales are distributed. If not, the sale amount is automatically distributed to the default account.

Enter the sales account to which the revenue from this service is to be distributed.

If This Service Is Not For a Job

One of the default sales account (main and sub-account only) from Control information is combined with the cost center or sub account from the invoice header.

Options

You may use the option:

|

<F1> |

For the next sales account specified in Control information |

|

<SF1> |

For the previous sales account |

These options are not available if no default sales accounts are defined in Control information.

If This Service Is For a Job

The billing account for the job is used. As this includes any cost center or sub account, the cost center or sub account from the invoice header is not used.

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Press <F1> |

Options

Change any field as desired, then press <Enter> to process another line item. For an existing line item, you may also use the option:

|

<F3> |

To delete this line item |

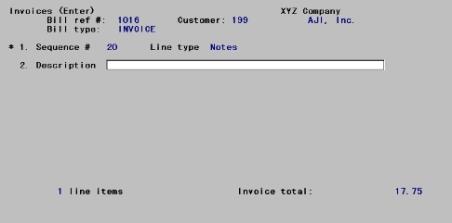

Graphical Mode

After selecting a Line type of Notes, the following tab displays:

Enter whatever notes or comments you want to appear on the invoice at this point. You can press <Enter> at the beginning of any line to leave a blank line. You may copy and paste information to and from this field.

|

Format |

10 lines with word wrap, each up to the maximum service text length specified in the Service text length field in Control information. A maximum length of 50 is displayed above. When less than fifty the field becomes narrower. |

|

Example |

Type Please contact our sales office if have any questions. |

Character Mode

After pressing <F2> for the Sequence # and typing N for the Line type, the screen appears thus:

Enter the following information:

Description

Enter whatever notes or comments you want to appear on the invoice at this point. You can press <Enter> at the beginning of any line to leave a blank line. To exit from entering the note, press <F2>.

|

Format |

10 lines, each up to the maximum service text length specified in Control information |

|

Example |

Type Please contact our sales office if have any questions. |

Options

Change any field as desired, then press <Enter> to process another line item. For an existing line item, you may also use the option:

|

<F3> |

To delete this line item |

|

Note |

When printing invoices with Notes line items, be sure to use an invoice format that allows Notes. Refer to the Invoice Formats chapter. |

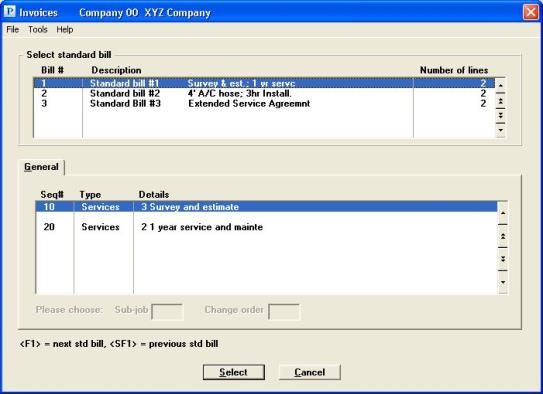

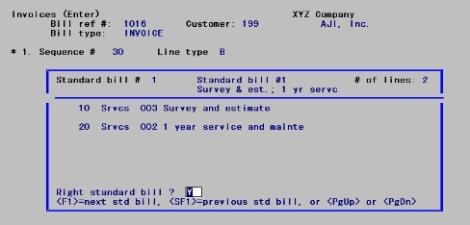

Standard bills may consist of many lines. See the Standard Bills chapter. When transferred to an invoice, these are renumbered in increments of ten.

To avoid conflict with the sequence numbers of existing line items, a standard bill may only be added to the end of an invoice. You will only be able to enter a Standard bill Line Type (B type in character mode) if the Invoices is exactly 10 higher than the number of the last existing line item.

Once transferred, a standard bill is not required to remain at the end. You can continue adding more line items (including more standard bills).

After being transferred, a standard bill is no longer treated as a unit. You can change or delete individual line items after their transfer.

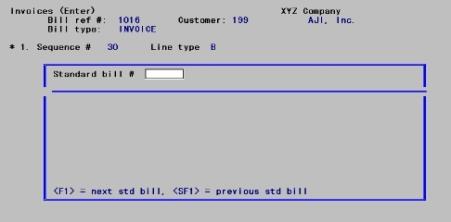

After selecting a Standard bill Line type, the following screen displays:

The two list boxes consist of the header on top and the lines on the bottom. Up to six standard bills will display in the header list box. To locate other standard bills you have the following options:

|

Down arrow or <F1> |

For the next standard bill on file |

|

Up arrow or <SF1> |

For the previous standard bill |

|

Page Down |

For the next group of six standard bills |

|

Page Up |

For the previous group of six standard bills |

|

End |

For the last standard bill |

|

Home |

For the first standard bill |

Once you have found the standard bill to insert into the invoice, highlight the line and click the Select button. If you do not want to insert a standard bills, click on the cancel button.

Please Choose: Sub-job

This field appears only if this invoice is for a job and the job uses but does not bill for sub-jobs.

Enter a sub-job number to be used in assigning a cost item to each Goods line item in the standard bill that contains a category number.

|

Format |

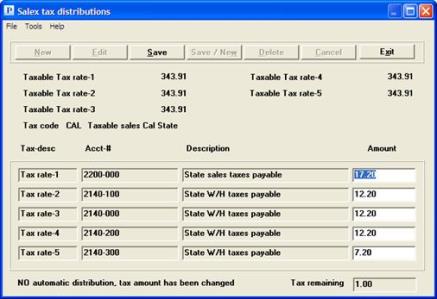

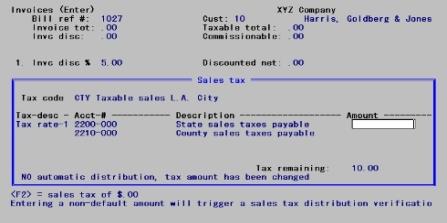

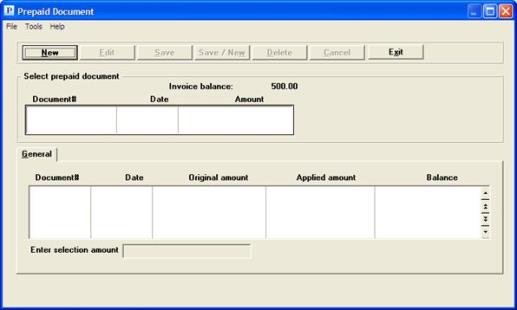

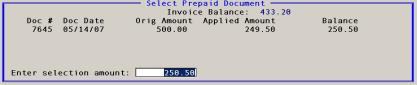

999 |