This chapter contains the following topics:

Introduction to Finance Charges

Printing an Edit List of Finance Charges

The Finance charges selection enables you to calculate and post finance charges on overdue open items.

Finance charges will be calculated on overdue items for every customer for whom you have answered Y to the question Fin chg ? in Customers.

Calculation of Finance Charges

Finance charges for balance forward customers are calculated differently from open item customers.

Finance charges are calculated by considering every existing document for the customer.

In Control information you specified whether the aging date for each document is the document date or the due date.

Each debit document is aged in comparison to the cut-off date you will enter below. If the age of the debit is greater than the number of days past-due allowed, this debit is added to the total on which finance charges will be assessed.

Payments and credits are subtracted from this total if their aging date is on or before the entered cut-off date.

In addition, payments after the cut-off date will be deducted from the total if you specify below to include payments after the cut-off date.

The procedure is the same except that documents are considered as grouped by apply-to number (i.e., all documents with the same apply-to number are one apply-to group.

If the total debit for an apply-to group is greater than its credit, the net debit amount is added to the debit total for the customer.

If the total debit for an apply-to group is less than its credit (for example, the customer has overpaid an invoice), the net credit amount is subtracted from the debit total for the customer.

Open item customers can have payments that have not been applied. These open credit items are accumulated up to the cut-off date, then the total is subtracted from the total debit for the customer. If you specify below to include payments after the cut-off date, all open credit items for that customer are applied to the total debit before the finance charge is calculated.

This method segregates payments into their apply-to groups, instead of being generally applied to all debits for the customer.

Finance Charge Levels

In Control information you may have specified one or two percentages for finance charge. If you specified two, the overdue amount is considered to be divided into two levels. The first percent is applied to the portion of the overdue amount that is not greater than the Level-1 cut-off amt. The second percent is applied to any amount over the cut-off. The two results are then added.

If the result is less than your specified Minimum finance charge, it is replaced by the minimum charge.

Compounding Finance Charges

Finance charges are compounded (computed on previous A/R finance charges) only if you have answered Y to the question Calc fin chg on fin chgs ? in Control information.

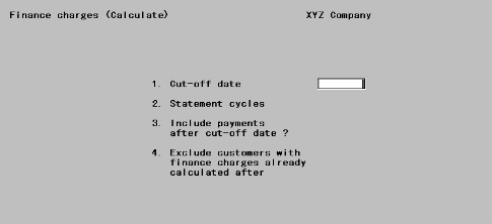

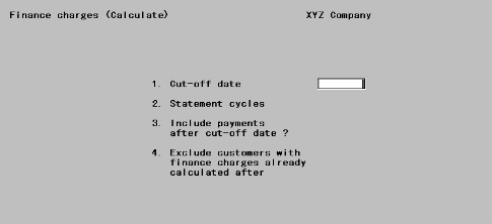

Select

Calculate from the Finance charges menu.

The following screen displays:

Enter the following information:

1. Cut-off date

Enter the cut-off date. Finance charges will be applied to items which are due on or before this date.

|

Format |

MMDDYY |

|

Example |

Type 33105 |

2. Statement cycles

Enter the statement cycle codes for the statement periods you are calculating finance charges for.

Statement cycle codes, defined in the Customers function, specify how often statements are printed.

You can enter multiple codes in up to five subfields, with the first blank terminating the entry. On the first subfield you may use the option.

Options

You may use the option:

|

<F5> |

For All statement cycles |

|

Format |

One letter in each of five subfields |

|

Example |

Press <F5> |

3. Include payments after cut-off date

Answer Y to include payments recorded after the cut-off date. This will reprieve customers who were overdue as of the cut-off date, but who have since paid up. (Charges and credit memos after the cut-off date are always automatically excluded.)

|

Format |

One letter, either Y or N. The default is N. |

|

Example |

Press <Enter> |

4. Exclude customers with finance charges already calculated after

If you want to exclude customers who have already had finance charges assessed against them after a particular date, supply a date here.

This prevents double assessment of finance charges during the designated period.

Enter a date here, or use the option.

Options

You may use the option:

|

<F2> |

To include all customers, whether or not finance charges have been calculated for them |

|

Format |

MMDDYY The default is a date calculated as being one month earlier than the cut-off date. |

|

Example |

Press <F2> |

Field Number To Change ?

Make any desired changes, then press <Enter>. There will be a period of processing as finance charges are calculated.

Once you have reviewed the Finance Charges Edit List, you may want to modify the charges for one or more customers. Finance charges can be modified up until the time they are posted.

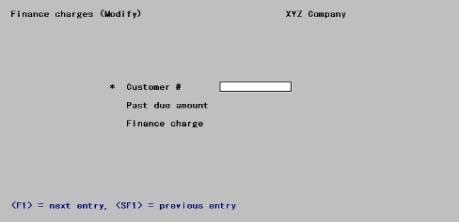

Select

Modify from the Finance charges menu.

The following screen appears:

From this screen you can work with existing finance charges, but you cannot create new ones.

Enter the following information:

Customer #

Enter the number of the customer whose finance charges you wish to modify, or use one of the options.

Options

You may use the option:

|

<F1> |

For the next customer for whom a finance charge has been calculated. |

|

<SF1> |

For the previous customer |

Upon entering or selecting a customer, his past-due amount and finance charge display.

|

Format |

12 characters |

|

Example |

Type 200 |

Any Change ?

Answer Y to modify this charge, or N to not do so.

Options

You may use one of the options:

|

<F1> |

For the next customer for whom a finance charge has been calculated. |

|

<SF1> |

For the previous customer |

|

<F3> |

To delete the finance charge |

|

Format |

One letter, either Y or N |

|

Example |

Answer N |

If you answer Y, the cursor moves to allow entry of a different finance charge:

Finance Charge

Enter the finance charge. You may not enter a zero amount, but you may enter an amount less than the Minimum finance charge in Control information. After you enter a valid amount, the cursor returns to Any change ?.

|

Format |

999,999,999,999.99 |

|

Example |

(Does not occur in this example as you answered N to the preceding) |

A sample Finance Charges Edit list is in the Sample Reports appendix.

Select

Edit list from the Finance charges menu.

No selection screen appears as all finance charges are printed unconditionally. There will be a period of processing while the Finance Charges Edit List prints.

Select

Post from the Finance charges menu.

No selection screen appears as all finance charges are posted unconditionally. There will be a period of processing while the finance charges are posted to A/R Open Items and to A/R Distributions, and the customer’s balance is updated in Customers.