This chapter contains the following topic:

Introduction to Close a Period

The Close a period selection enables you to clear the period-to-date fields in Customers, Sales Reps and Tax Codes. If this is the last period of the year, it also resets the year-to-date fields.

Prior to running this selection you should ensure that you have posted all sales transactions, cash receipt transactions, and finance charge transactions for the current period. Then, you should print out a customer list, tax code list, and sales rep list, in order to obtain a permanent record of the final period-to-date figures (and corresponding year-to-date figures).

If you are running Sales Analysis, and are using the customer comparative feature within that module, you will not be allowed to perform the period-close until you have successfully transferred the current period sales and cost data. Once you have performed this transfer then you will be allowed to perform the period-close.

The term period as used here may either be your accounting period or it may be a longer or shorter period of time, as you choose. For example, you could follow the procedure above and close A/R each week. In this case the period-to-date figures on the reports listed above would be weekly figures. Alternatively, you could close A/R once a quarter, in which case the period-to-date figures would be quarterly figures. If you are using S/A comparatives, then you must use the last day of the month as your closing date as S/A can only pull in data for one month at a time.

The reason that your A/R period need not correspond to your accounting period is that closing a period in A/R has no effect on the PBS General Ledger. The interface between A/R and G/L is through the selection Get distributions described in the G/L User documentation. Refer also to the Distributions to G/L chapter in this G/L User documentation.

The current period in A/R is determined by the Current period end date in Control information. If you post transactions which are dated after this date, they will not appear in the period-to-date totals. Instead, they are added to a next period holding field which are only accessible to you directly in graphical mode.

When this selection is run, the following happens:

| • | The amounts stored in the next period fields are transferred into the period-to-date fields and added to the year-to-date fields, so that the period-to-date fields are now accurate for the new period. |

| • | The current period end date in A/R Control information is set to the ending date of the new period. |

| • | If this is not the end of the year, the amounts in the holding fields are added to the year-to-date amounts. |

| • | If this is the end of the year, the last-year amounts are set equal to the year-to-date amounts and the year-to-date amounts are set equal to the amounts in the holding fields. |

| • | The holding fields are all set to zero. |

|

Note |

Your period-to-date and year-to-date figures will be accurate as long as your invoice and miscellaneous charges transactions and cash receipts never span more than two periods; the current period and the next. |

If you delay running this Close a period selection until you have transactions dated in the period after the next period, you should not process these transactions. Do not process them until after you have run this selection.

You may also use the close to modify the date entry periods, if you are using this feature as defined in Control information. The entry of key date fields for Miscellaneous charges, AR invoice date, Cash receipts, O/E Invoice print, POS invoice print and Returned checks are prone to misinterpretation and inaccuracy. This feature provides a mechanism to restrict users to entering dates, which ultimately result in G/L transactions, to a specified a date range. The use of this feature would substantially increase the security against accidental incorrect entry of dates. See the A/R Control Information chapter for more information.

Select

Close a period from the A/R menu.

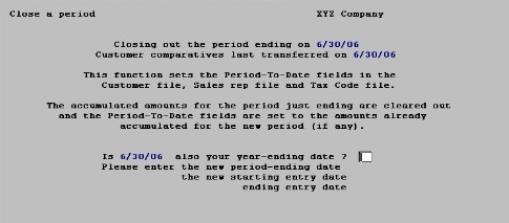

The following screen appears:

Is [date] also your year-ending date ?

[date] represents the current period-end date.

If the period you are about to close is the last period in your accounting year, answer Y; otherwise, answer N.

|

Format |

One letter, either Y or N |

|

Example |

Type N |

Please enter the new period-ending date

You can enter the new period ending date, or use the option:

Options

|

<F2> |

For the same calendar date in the month following the current period ending date. The last day of the month remains the last day, even when the months have different lengths. |

|

Format |

MMDDYY |

|

Example |

(If you are using this documentation as a tutorial, escape from the screen at this point to retain your demo data) |

Please enter the new starting entry date

This field will not display if you are not using the date entry controls. See the Control Information chapter for more information.

Enter the new starting entry date, or use the option:

Options

|

<F2> |

For the first day of the month following the month of current period ending date. |

|

Format |

MMDDYY |

|

Example |

(If you are using this documentation as a tutorial, escape from the screen at this point to retain your demo data) |

Please enter the new ending entry date

This field will not display if you are not using the date entry controls.

Enter the new ending entry date, or use the option:

Options

|

<F2> |

For the same calendar date in the month following the current period ending date. The last day of the month remains the last day, even when the months have different lengths. |

|

Format |

MMDDYY |

|

Example |

(If you are using this documentation as a tutorial, escape from the screen at this point to retain your demo data) |

If you entered a starting and ending date range that is not correct or if you want to change the range mid-period, you can manually change these dates at any time in A/R Control information. Do not close the period again to change the date range, unless it is the right time to do so.

Any change ?

Make sure that all necessary accounting operations, including the printing of all reports, have been carried out before you proceed.

No report is produced by this selection.

If you are running the Passport Business Solutions Sales Analysis module, and are using the customer comparative feature within that module, some of the sales analysis reports should be run before running Close a period. This is because some of the information needed for these reports will be cleared by this process.

Answer Y to re-enter the screen, or N to reset the period-to-date fields, and if applicable the year-to-date fields, in Customers, Sales Reps, and Tax Codess.