This chapter contains the following topic:

Setting Up G/L Control Information

You use the Control Information selection to set up the General Ledger module for your particular requirements. The information entered here will control various operations throughout this module.

Select

Control information from the Master information menu.

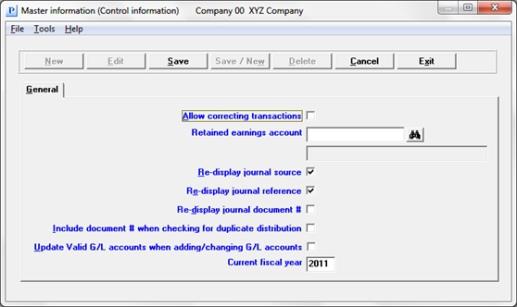

Graphical Mode

When entering the control file, you have the following button and keyboard equivalent options:

|

Button |

Keyboard |

Description |

|

Edit |

Alt+e |

To edit the control file |

|

Save |

Alt+s |

To save the changes to the control file |

|

Cancel |

Atl+c |

To cancel editing or adding the control record |

|

Exit |

Alt+x |

To exit the screen and return to the menu |

The New, Save/New and Delete buttons are not active on this screen.

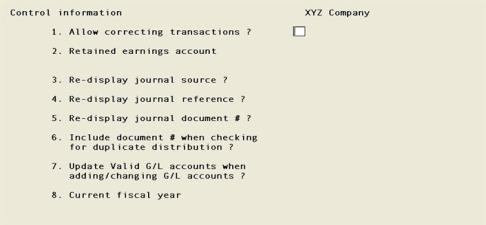

Character Mode

The following screen appears:

This software includes provisions for creating the Expanded Cash Flow Statement (FASB 95 Cash Flow Statement). FASB 95 means the 95th official statement of the Financial Accounting Standards Board.

In order to handle the requirements for this statement, correcting ledger entries must be labeled as such. A correcting entry is a ledger entry which has been made to correct an earlier, erroneous, entry.

For example, let us assume that the following debit and credit have been entered and posted:

|

DR Accounts Receivable |

$100 |

||

|

|

CR Sales |

|

$100 |

After posting, you discover that the amount should have been $50. In this case, you would enter and post the following:

|

DR Sales |

$50 |

||

|

|

CR Accounts Receivable |

|

$50 |

However, the above two ledger entries must be marked as correcting entries to indicate that they are not the result of a business transaction. If they are not so marked, your books can give the appearance of a greater volume of business (as reflected in the gross debits to your A/R account) than is in fact the case.

There are two methods by which entries can be labeled as correcting entries:

| • | When entering either a General Journal transaction, a transaction in another module (A/R, A/P, PR, I/C) or an order in O/E, you may specify that the transaction, order, or invoice is a correcting entry. If you wish to do this, answer Y to Allow correcting transactions. If you do, whenever correcting entry transactions are posted the debits and credits generated by the transactions will be marked as correcting entries and will appear as such in General Ledger Transactions data (which contains all of the debits and credits for your company.) |

If you check this box, you may also use the Correcting entries selection within G/L to mark entries as correcting entries, as described below.

| • | After debits and credits have been posted to the General Ledger Transaction data within G/L, you may mark individual debits and credits as correcting entries, using the selection Correcting entries. This selection is discussed in the Correcting Entries chapter. If you want to allow correcting entries to be made only through the Correcting entries selection, answer (unchecked) N to Allow correcting transactions. In this case, you will not be able to specify that individual transactions within G/L or other PBS modules are to generate correcting entries — you will only be able to mark debits and credits as correcting entries through the use of the Correcting entries selection. (Debits and credits generated by other modules must be transferred to G/L using the selection Get distributions before they can be marked as correcting entries using the Correcting entries selection. Refer to the Get Distributions section of the Distributions chapter. |

Consult with your accountant to determine which of the above methods is most appropriate for your business.

|

Format |

Graphical mode: Check box where checked is yes and unchecked is no. The default is unchecked Character mode: One letter, either Y or N |

|---|---|

|

Example |

Graphical: Check the box Character: Enter Y |

Options

Enter the account number for the retained earnings account.

|

<F5> |

To specify that each cost center has a separate retained earnings account. When net profit calculations are done in Close a year, the net profit for each cost center will be calculated separately. |

You may enter an account even though it has not yet been defined in Chart of Accounts (described in the next chapter), but if you do so you will be warned to define this account as soon as possible.

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 3100-000 |

Re-display journal source

Re-display journal reference and

Re-display journal document #

A checked box for the Re-display journal source field means that when you are making entries in the distribution journal, recurring journal, or standard journal, and you come to the Source field, whatever value you had entered as the source in the previous transaction will now appear as the default value. You can then accept that source by pressing <Enter>, or change it if desired.

An unchecked box means that no default will appear. The previously-entered value will still be available as an <F2> option.

The Re-display journal reference and Re-display journal document # fields similarly control the Reference and the Document number fields.

|

Format |

Graphical mode: Check box where checked is yes and unchecked is no. The default is checked for the first two fields and unchecked for Re-display journal document # Character mode: One letter, either Y or N |

|

Example |

Press <Enter> at each field |

Include document # when checking for duplicate distribution

Check the box for yes and leave it unchecked for no.

|

Format |

Graphical mode: Check box where checked is yes and unchecked is no. The default is unchecked Character mode: One letter, either Y or N |

|

Example |

Type N |

Update Valid G/L accounts when editing / changing G/L accounts

The Passport Business Solutions modules other than G/L need to have a list of valid account numbers available. Not everyone who uses those modules also uses G/L. Those who do not have no access to the Chart of Accounts. Instead, they use the Valid G/L Accounts data which has been defined for the purpose. This may be thought of as a stripped-down version of the Chart of Accounts.

Checking the box (entering Y) to this question ensures that your changes to the Chart of Accounts will automatically update the Valid G/L Accounts as well. This not only saves work but reduces the chance of error. If you check this box (answer Y) you should avoid using the System Manager module’s (CTL) Valid G/L accounts selection altogether.

If you leave it unchecked (enter N), remember to make corresponding changes to Valid G/L accounts whenever you add or delete an entry in Chart of accounts, or merely change its description.

If G/L is the only module that you use, it makes no difference what you answer here.

|

Format |

Graphical mode: Check box where checked is yes and unchecked is no. The default is unchecked Character mode: One letter, either Y or N |

|

Example |

Check this box or enter Y |

This field can only be entered when setting up a new company. It changes to the next year when you run Close fiscal year.

Enter the year for which you are entering and getting distributions.

|

Format |

CCYY |

|

Example |

2010 |

Make any needed changes, select Save to keep your changes or Cancel or Exit to return to the menu without any changes.

In character mode make any changes and select <Enter> from Field number to change.