This chapter contains the following topics:

Making Standard Journal Entries

Posting Standard Journal Entries

The standard journal contains debits and credits which are to be posted to G/L Transactions (the permanent G/L file/table).

The entries are posted once per accounting period.

All of the debits and credits in the standard journal are posted. You cannot individually select entries to post.

Standard journal entries are left on file in Standard Journal Transactions for use in the next accounting period.

Each period, these entries can have either a fixed amount (such as a rent or a loan payment) or a variable amount (such as a utility bill).

The GL module also has a recurring journal which handles recurring entries, although its purpose is different from the standard journal. Refer to the Recurring Payables and Receivables section of the Recurring Journal chapter for a comparison of the recurring and standard journals.

Select

Enter from the Standard journal menu.

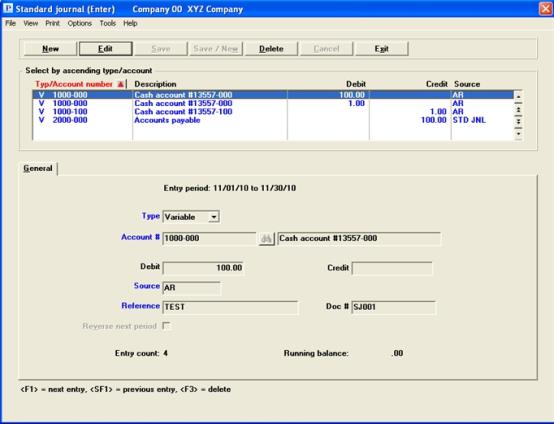

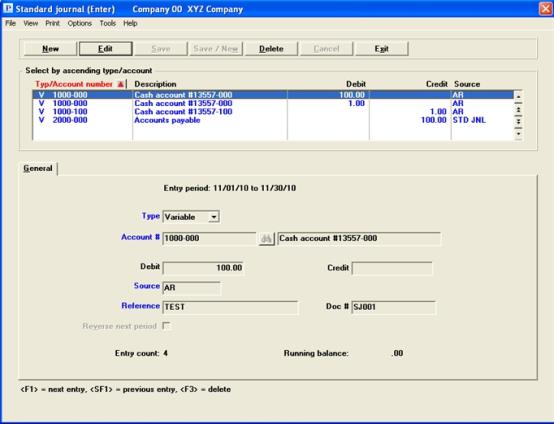

Graphical Mode:

A screen similar to the following appears:

The list box displays up to 6 standard journal records at a time. You may sort the standard journal entries by type/account number in ascending or descending order. To select a field or change the sort order, click on the column name or the arrow to the right of the column name or use the View options. Only column names in red may be sorted.

To locate a standard journal record, start typing a account number or entry sequence depending on which sort field is selected. You may also use the up/down arrows, Page up, Page down, Home and End keys to locate a standard journal.

Standard journal records that display in the list box are available for changes or deletion. The fields for the selected standard journal record display in the lower part of the screen.

When a standard journal record is found, you may select the <Enter> key or Edit button to start editing.

When you are adding or editing existing standard journals, you have the following button options:

|

Button |

Keyboard |

Description |

|

New |

Alt+n |

To enter a new standard journal record |

|

Edit |

Alt+e |

To edit an existing standard journal record |

|

Delete |

Alt+d |

To delete an existing standard journal record. You may also use <F3> to delete. |

|

Save |

Alt+s |

To save a new or edited standard journal record |

|

Save/New |

Alt+w |

To save a new or edited standard journal entry with the program ready to enter another new standard journal record |

|

Cancel |

Alt+c |

To cancel the entry of a new standard journal record or cancel the editing of an existing standard journal record |

|

Exit |

Alt+x |

To exit the screen. The <Esc> key may also be used |

Print and Options Menu Selections

From the Print menu you may print an Edit list. From the Options menu you may select to Post the standard journal records.

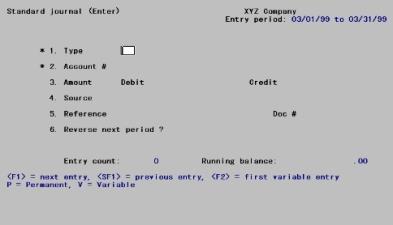

Character Mode:

The following screen appears:

From this screen you can work with both new and existing entries.

The dates displayed in the upper right-hand corner show your current accounting period.

A variable journal entry is any entry that is made to the same account each period, but for different amounts. Before posting, you can quickly locate and change the variable amounts to be posted by using <F2> as described below.

Options

For the 1. Type field, enter either P for permanent or V for variable; or use one of the options:

|

<F1> |

For the next entry |

|

<SF1> |

For the previous entry |

|

<F2> |

For the next variable entry on file |

Format | 25 characters. If you chose in Control information to re-display references, the previous reference entered appears as the default. |

Example | Type Standard depreciation |

Because the entries are in order by type (and then by account number), you can quickly locate variable entries by pressing <F2> and then using <F1> to scan through them.

Balancing Entries

For both character and graphical, note also that an Entry count (number of entries made) and a Running balance are kept as you make standard journal entries. When the running balance is equal to zero, all entries that have been made are in balance (debits equal credits).

The type determines whether the recurring amount is permanent (fixed) or variable.

A permanent journal entry is any entry that is made to an account for the same amount each period. These entries are kept on file and posted each period for the same amount.

A variable journal entry is any entry that is made to the same account each period, but for different amounts. Before posting, you can quickly locate and change the variable amounts to be posted as the type field is the first column in the list box and the list box is sorted by type.

Options

Enter the type, either Permanent or Variable; or use one of the options:

|

Format |

Drop down list with the choices above |

|

Example |

Select Variable |

Options

This is the GL account for this entry. It must be in the Chart of Accounts File. Enter the account number, or use one of the options:

|

<F1> |

For the next account in the Chart of Accounts, in account number sequence |

|

<SF1> |

For the previous account |

|

<F2> |

For the same account number as the previous transaction (not available if this is the first entry of the session) |

|

<Enter> |

To find the account by the account description instead of the number |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Enter account 6200-000 |

You can not create an entry with an inactive account number. If you enter an account number for an inactive account, the message Inactive accounts not allowed will display.

Options

If you choose <Enter> the cursor moves to the account description field. Enter the account description, or its leading characters.

Options

Your options at this point are:

|

<F1> |

For the next account in the Chart of Accounts, in account name sequence |

|

<SF1> |

For the previous account |

|

<Enter> |

To return to finding the account by its number |

|

Format |

30 characters |

|

Example |

(Not used in this example because you entered the account by number) |

or

This is the amount of the entry, which is always positive (no minus sign allowed). The cursor is positioned for entry in either the debit or credit field, depending on the parentheses control which you defined in the Paren control code field in Chart of accounts.

If you enter zeros for both debit and credit amounts, you are asked if this is correct. If you answer Y, you may proceed with the entry.

Options

Enter the amount, or press <Enter> to move to the opposite column and enter the amount there; or use one of the options:

|

<F1> |

For the next entry matching the type and account number |

|

<SF1> |

For the prior entry matching the type and account number |

|

<F2> |

To enter an amount that will off-set (counter-balance) the running balance (if non-zero) |

For example, if the Running balance is a debit of $700.00 and <F2> is pressed, a credit of $700.00 is entered as the counter-balancing amount.

|

Format |

999,999,999,999.99 |

|

Example |

Type 15 |

Options

The source is a code used to sort entries when the Source Cross Reference Report is prepared (see the Source Cross Reference chapter). Enter a source. If you chose in Control information not to re-display sources, you may use the option:

|

<F2> |

For the previous source entered |

|

Format |

Ten characters. If you chose in Control information to re-display sources, the previous source entered appears as the default. |

|

Example |

Type DEPR |

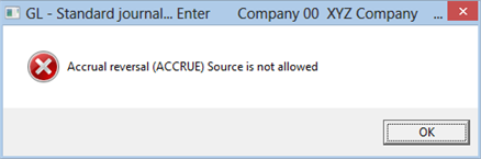

If the source entered is ACCRUE, accrual reversal is allowed. Refer to the explanation of Accrual Reversal in the Distributions chapter. If ACCRUE is entered as the source, you must also enter the counter-balancing entry with ACCRUE as the source, so that the accounts remain in balance.

If entry period is in the last period of accounting periods second fiscal year and you enter ACCRUE, the following message displays and you are not allowed to continue until you change the source to something else:

Options

Enter a reference. If you chose in Control information not to re-display references, you may use the option:

|

<F2> |

For the previous reference entered |

Entering a document number is optional. This is an additional reference.

Options

Enter the document number. If you chose in Control information not to re-display document numbers, you may use the option:

|

<F2> |

For the previous document number entered |

|

Format |

15 characters. If you chose in Control information to re-display document numbers, the previous document number entered appears as the default. |

|

Example |

Type 94t392 |

If ACCRUE was entered in the Source field (#4), you can allow automatic reversal of an accrual upon posting. If ACCRUE was not entered, this field is skipped.

|

Format |

Graphical mode: Check box where checked is yes and unchecked is no. The default is unchecked Character mode: One letter, either Y or N |

|

Example |

This field is skipped |

Select the Save button to save the entry and terminate this transaction. See Standard Journal Buttons for the other options.

The running balance is automatically updated to include the amount of the entry just made, the entry count is incremented by one, and the screen is cleared for the next entry.

To provide data for use in subsequent chapters of this documentation, you could make two entries as follows :

|

Entry Type |

Account # |

Account |

|

V |

6200-000 |

10.00 |

|

V |

1310-000 |

25.00CR |

Character Mode

Field number to change?

Options

Make any needed changes. For an existing entry you may use one of the options:

|

<F1> |

For the next entry |

|

<SF1> |

For the previous entry |

|

<F3> |

To delete this entry |

See a sample Standard Journal Entry Edit List in the Sample Reports appendix.

Select

Edit list from the Standard journal menu.

Only a printer selection screen displays as all transactions are printed unconditionally.

The Standard Journal Entry Edit List is used to verify the accuracy of the entries made, before you post them to the General Ledger Transaction File.

Select

Post from the Standard journal menu.

This selection posts the standard journal entries to the General Ledger Transaction File, and also performs verification checks while printing the Standard Journal Entry Register. All entries to be posted appear on this register, arranged in order by account number.

|

Example |

Post the three entries entered as examples above. |

The report number and journal name are used to form a unique journal number. Later, when you want to refer to a Standard Journal Entry Register, you can do so by using SJ (Standard Journal) plus this report number. For example, Standard Journal Entry Register number 0007 could be referred to as SJ0007.

The Standard Journal Entry Register verifies that the entries being posted are in balance by period (debits equal credits).

All entries fall in one of two periods, current period or next period (for accrual reversals). If either of the two possible periods do not balance, a message is given showing the balances for the non-zero periods, and posting is not allowed. To correct, you must either add additional entries or change the entries on file to balance the period.

The Standard Journal Entry Register will also verify that all accounts used by the entries are in the Chart of Accounts File.

If an entry uses an account that is not in the Chart of Accounts File, a message is given and posting is not allowed. To correct, you can either delete the entry and re-enter one for the correct account, or enter the account in your Chart of Accounts.

If you attempt to post standard journal entries that someone has already posted for the current period, a warning is given, but you can still continue and post the entries.

Once these entries are posted, they are not deleted from the Standard Journal Transaction File. They remain on file for posting next period.

The current period ending date for each posted entry is stored in the Standard Journal Transaction File to detect any attempt to re-post the same entry for the same period.