This chapter contains the following topic:

Creating Statement Layouts and Specifications

This chapter describes two ways of automatically creating format layouts and format specifications for your financial statements, adapted to your requirements. You can fine-tune the resulting layouts and specifications as needed.

These features are optional. If the layouts and specifications provided in the demonstration data are adequate for your needs, you may never need to use these selections. Conversely, you can choose to build your own layouts and specifications from the ground up, without using these features.

| • | Make Proforma layouts lets you create a Balance Sheet and an Operating Statement layout from the Proforma Chart of Accounts. This is a schematic representation of your account structure. |

| • | Make SAF layouts lets you automatically create three different kinds of layouts from an existing balance sheet layout. This feature relies on the SAF type field of the Chart of Accounts. |

Many enterprises use similar patterns in presenting their financial statements. One option that is provided is called Make proforma layouts. In this function such a balance sheet layout and such an operating statement layout are prepared.

The layouts generated by this function can be used several ways. You can print financial statements from them as they are created. You can use them to better understand layouts, since they contain your account numbers. You may copy or modify them to suit your specific needs. They may also be used in the Make SAF layouts function.

Select

Make proforma layouts from the Financial statement layouts menu.

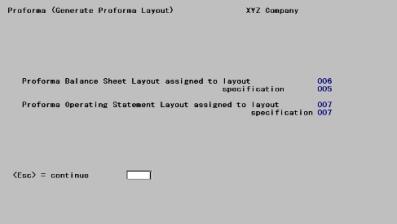

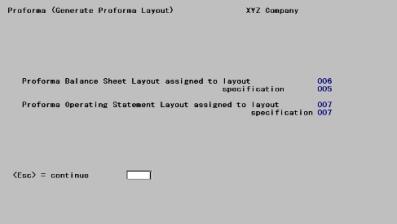

No data entry is required, and processing begins immediately. As the layout and specification are built, a running display appears as follows:

Upon termination, make a note of the numbers assigned to the two layouts and two specifications generated. Press <Esc> to return to the main module menu.

The layouts and specifications created will be assigned numbers just after the highest existing numbers.

| • | This will cause problems if the highest existing numbers are 998 or 999, so avoid this situation. |

| • | If you have adopted a standard numbering system for your layouts, you may use the Financial statement layouts (Copy) selection to renumber the layout as desired. |

The Make SAF layouts selection enables you to automatically make SAF (Source and Application of Funds) layouts from an existing balance sheet layout. In order to make accurate SAF layouts, the balance sheet layout you select must contain all balance sheet accounts.

The SAF layouts that can be made are:

| • | Statement of Changes in Financial Position |

| • | Analysis of Changes in Working Capital |

| • | Cash Flow Statements |

These statements contain standard predefined headings and subtotals.

All of these are optional; you may create any combination of these three.

The layout statement types C (for Cash Flow Statement), F (for Statement of Changes in Financial Position), and W (for Analysis of Changes in Working Capital) are for the three Source and Application of Funds Reports. They use special processing and require a fixed structure to produce the correct results.

You may also create them manually or change the automatically produced SAF layouts.

Do not violate the basic structural requirements for these statements, or the statements will produce incorrect results.

This code is used only in the layout for statement type F (Statement of Changes in Financial Position). It identifies the start of the accounts that are sources of funds.

This code is used only in the layout for statement type F. It identifies the start of the accounts that are uses of funds.

This code is valid for SAF statement types C and F. The calculated net income appears at this line of the financial statement.

You are requested to enter Prt/Accum ? (print/accumulate ?). Enter P or A, as appropriate. If P is entered, PRT COL will be requested. Enter 1, 2, or 3.

Except for type E statements, the parentheses control is always assumed to be D, since net income is typically credit.

For type E statements, you can reverse the balance of BSNI and override the parentheses control. This is useful when creating statements showing reconciliation of net income to cash flows from operations.

To understand these SAF statements, you must first be familiar with the SAF types. These are listed below.

The Cash Flow Statement shows the effect of all the balance sheet accounts and net income upon cash during the current period and year-to-date. It shows the beginning balance of cash at the start of the period and year, all the sources and uses of funds, and a final cash ending balance.

All five types of SAF accounts (entered in the Chart of Accounts) and the BSNI (balance sheet net income) should be included in the balance sheet layout, from which the SAF layouts are created.

All cash accounts must be coded with an SAF type of C (in the Chart of Accounts File) or cash will not be handled correctly. The cash accounts are summarized to produce a cash beginning balance, so individual cash accounts do not print on the report.

Cash accounts will accumulate, regardless of the PRT/ACCUM or PAT options you enter for them on the layout. Therefore, if you manually create this layout, you must code a subtotal (SUB#) following the last cash account.

Parentheses controls for accounts, subtotals, and PATs are ignored on this statement, as on all SAF statements.

There is a recommended format in which the detail of the report appears, but the order of accounts in the report is flexible. The Cash Flow Statement Layout is created automatically in this format:

| • | First, all the cash accounts are coded. These accounts are followed by a SUB2 for the total beginning balance of cash. |

| • | Then the BSNI (balance sheet net income) code, followed by non-cash charges against income (type N) accounts, and a SUB1 for the total from operations. <Operations> are BSNI minus non-cash charges against income. |

| • | After the total from operations come the current asset accounts, the current liability accounts, and then the funds flow accounts. |

| • | Next will follow a SUB1 for the total sources or uses of funds, followed by a SUB2 for net increase or decrease in cash, and finally a SUB3 for the cash ending balance. |

The Statement of Changes in Financial Position calculates the changes in working capital, using the non-current assets and liabilities, net income, and non-cash charges against income. This provides a picture of the effects of these accounts on the working capital.

The non-current assets and liabilities (also called funds flow accounts) are put into separate sections, depending on whether they are sources or uses of funds. (An increase in an asset is a use of funds, an increase in a liability is a source of funds. The opposite is true for decreases.)

The BSNI (balance sheet net income) code, non-cash charges against income (SAF type N), and funds flow accounts (SAF type F) are included in this statement. The funds flow accounts all appear twice in the layout: once following the SSRC function code (start sources of funds) and again following the SUSE function code (start uses of funds).

The sources and uses must appear at the end of the report, after the BSNI and non-cash charges against income. When the statement is printed, an account is printed as a source only if its amount is a credit, and as a use only if its amount is a debit. Consequently, each account appears only once on the statement, even though it appears twice in the layout.

The format which we recommend, and the format of the layout produced by Make SAF layouts, is as follows:

| • | First, the BSNI code, followed by the non-cash charges against income, and then a SUB1 for the total from operations. |

| • | Next, an SSRC code, followed by all the funds flow accounts, and a SUB1 for the total sources. |

| • | Then, an SUSE code, followed by all the funds flow accounts again (the exact same accounts as in the sources section), followed by a SUB1 for the total uses. |

| • | Finally, a SUB2 for the net increase or decrease in working capital. |

The Analysis of Changes in Working Capital shows changes in current assets, minus changes in current liabilities, giving changes in working capital. Its total should match the changes in working capital, which is the last line of the Statement of Changes in Financial Position.

Cash, current asset, and current liability accounts should be included in the layout. Parentheses control for accounts is ignored.

The format which we recommend, and the format of the layout produced by Make SAF layouts, is as follows:

| • | First all the cash accounts, second is all the current assets, followed by a SUB1 for assets, whether an increase or decrease. |

| • | Then all the current liabilities, followed by a SUB1 for liabilities, whether an increase or decrease. |

| • | Finally, a SUB2 grand total for the net increase or decrease in working capital. |

Select

Make SAF layouts from the Financial statement layouts menu.

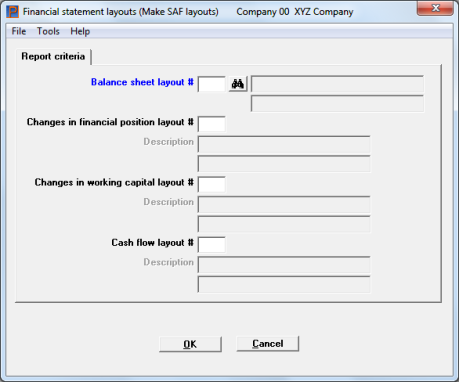

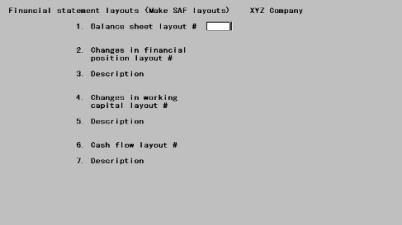

The following screen appears:

Graphical Mode

Character Mode

Enter the following information:

Enter the layout number of a Balance Sheet layout. This must previously have been defined in the Financial Statement Layouts (Enter) selection, with B for the Type of Statement field. The layout may be one you have entered directly, a layout from the Demonstration Data, or a layout created by the Make Proforma layouts selection described earlier in this chapter.

The description will be displayed to the right of the layout number. The Balance Sheet layout must contain all balance sheet accounts, in proper order, for the created SAF layouts to be accurate.

|

Format |

999 |

|

Example |

Type 003 |

Changes in financial position layout #

Leave this field blank if you do not want this layout.

Otherwise, enter the number of the new layout to be created for the Statement of Changes in Financial Position. This may not be the number of any existing layout.

|

Format |

999 |

|

Example |

Type 011 |

This field is skipped if you left the preceding field blank, and is optional even if you did not.

Enter the description of the layout for this statement.

|

Format |

Two lines of 25 characters each |

|

Example |

Type Balance Sheet |

Changes in working capital layout #

Leave this field blank if you do not want this layout.

Otherwise, enter the number of the new layout to be created for the Analysis of Changes in Working Capital. This may not be the number of any existing layout.

|

Format |

999 |

|

Example |

Type 012 |

This field is skipped if you left the preceding field blank, and is optional even if you did not.

Enter the description of the layout for this statement.

|

Format |

Two lines of 25 characters each |

|

Example |

Type Working Capital |

Leave this field blank if you do not want this layout.

Otherwise, enter the number of the new layout to be created for the Cash Flow Statement. This may not be the number of any existing layout.

|

Format |

999 |

|

Example |

Type 013 |

This field is skipped if you left the preceding field blank, and is optional even if you did not.

Enter the description of the layout for this statement.

|

Format |

Two lines of 25 characters each |

|

Example |

Type Cash Flow |

Select OK to continue or Cancel to return to the menu without.

Character Mode

Make any needed changes. Press <Enter>. If you have left Fields #2, 4, and 6 blank, you will be informed that at least one layout must be chosen for generation.

Upon completion, the first screen of this selection re-appears.

There are a number of ways in which the SAF report layouts might be designed incorrectly.

For example, vital accounts such as cash or current assets might be omitted from the Balance Sheet. This would make an incomplete and incorrect SAF statement.

Accounts might be in the balance sheet layout which are not actually balance sheet accounts (which do not have a B (Balance Sheet) for a financial statement type in Chart of Accounts). In this case, an error report prints and the SAF layout is not created.

One or more accounts might not have an SAF type designated in Chart of Accounts. An error report prints showing all accounts which do not contain an SAF type and the SAF layout is not made.

If an error occurs, the SAF Error List is printed (no report appears when there are no errors). Use this to make the necessary corrections, either to the Balance Sheet layout or to the Chart of Accounts; then make SAF layouts again.

If you want more levels of subtotaling or different headings and literals from the ones automatically made, you may change these, using the Enter option of Financial statement layouts.

An SAF report layout made from a Balance Sheet with more than 999 actual accounts and account totals (PAT’s) does not include accounts after the 999th.