This chapter contains the following topics:

Post Closing Entries Selection

The Close a year selection enables you to run this function at the end of your accounting year as part of the closing procedure. It consists of two functions:

| • | Print closing report - This function is used to print the Year End Closing Report, which shows the net profit (loss) entries that will be made by Post closing entries when it is run. This report may be printed to verify the net profit for the year prior to closing GL so that any final corrections can be made. |

| • | Post closing entries - This function is used to close the year. It performs the actions needed to close the fiscal year. These actions are described in detail later in this chapter. |

It often occurs that you must start your new fiscal year before the old fiscal year is closed. This occurs, for example, if your fiscal year ends on June 30th of the year, but the final adjusting entries are not made available to you until August. In this case, you must start your new fiscal year before closing the previous year.

If you are not ready to close your General Ledger at fiscal year end, you can take the following steps so that you can process information for the new year.

| • | This step is only needed if you plan to print balance sheets in the new year prior to closing the previous year. In this case, you need to make a temporary posting of retained earnings and modify your financial statements as described below. |

Determine the unadjusted net profit for the current year.

Assuming there is a net profit for the year, make the following entry, dated the last day of the old year:

|

DR |

Suspense account (an O/S account) |

|

|

CR |

Unadjusted retained earnings (a B/S account) |

Add Unadjusted retained earnings to the balance sheet. Note that since this account usually has a 0 balance, it can be placed permanently on the B/S layout, since it will only be printed when it has a non-zero balance (unless you requested that Financial Statements print zero dollar accounts).

Do not add the suspense account to the Operating statement layouts. This ensures that the closing year profit is not included in the balance sheet net income or on the income statement of the new year.

Post the entry in the old year.

| • | Using Accounting periods, make the following changes: |

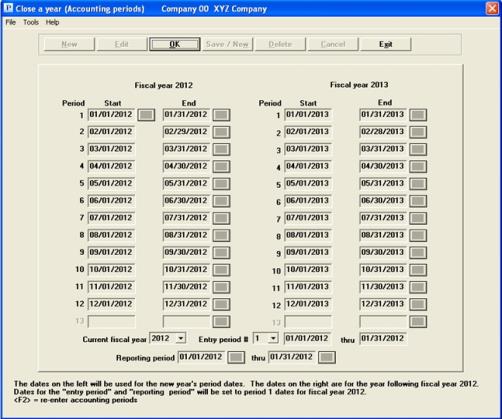

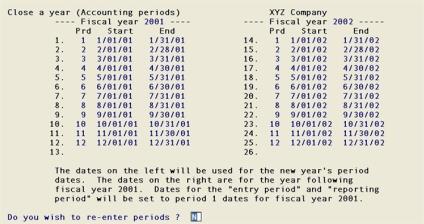

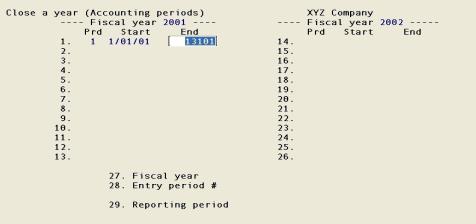

Set Current fiscal year (Field #27) to be the new fiscal year.

Set Entry period # (Field #28) to be the period in the new fiscal year for which you want to make general journal entries.

Set Reporting period (Field #29) to be the period for which you want to print reports such as the Trial Balance for the new fiscal year.

| • | Make entries as usual. The Trial Balance includes a beginning balance for your Operating Statement accounts from last year until you close. Operating Statements will be printed correctly. Balance sheets will print correctly, provided that you have performed the instructions outlined in step 1 above. |

| • | When you are ready to close, make the following changes using Accounting periods: |

Set Current fiscal year (Field #27) to be the closing fiscal year.

Set Entry period # (Field #28) to be the period in the closing fiscal year for which you want to make general journal entries. This will usually be the last period.

Set Reporting period (Field #29) to be the period for which you want to print reports in the closing fiscal year.

| • | Perform the End of Fiscal Year Checklist from the chapter titled Guide to Daily Operations. |

| • | Run Print closing report (if needed), followed by Post closing entries. |

| • | This step is only required if you made a temporary posting of retained earnings in step (1) above. In this case, you must reverse the entry that was made by making the following correcting entry, dated the last day of the old year. |

|

DR |

Unadjusted retained earnings (an B/S account) |

|

CR |

Suspense account (an O/S account) |

The following is a list of the actions performed by Post closing entries:

| • | The periods shown on the right-hand side of the screen in Accounting periods are moved to the left-hand side of the screen. Accounting periods are generated for the new following fiscal year and are shown on the right-hand side of the screen. The fiscal year is set to be the one shown on the left-hand side of the screen. The entry period and reporting period both are set to be the first period. |

| • | It sets the comparative amounts for each GL account. After Post closing entries is run, the comparatives for an account will contain the balances for that account for each period of the fiscal year just closed. When comparative financial statements are run in the new year, you will then be able to compare new year balances against comparatives from the fiscal year just closed. The comparative amounts stored by Post closing entries are called the new comparatives throughout this chapter. They are the new comparatives which are set up for use in the new fiscal year, although their amounts correspond to the account balances from the prior year. |

| • | It creates balance forward entries for all balance sheet accounts. The date for these entries is the last day of the fiscal year being closed. |

| • | It automatically posts the net profit (loss) to the retained earnings account entered in Control information. |

| • | It prints the Year End Closing Register. As mentioned at the beginning of this chapter, you may print the Year End Closing Report prior to running Post closing entries in order to see the information that will be printed on the Year End Closing Register when Post closing entries is actually run. |

| • | It updates the current fiscal year in Control information to the next year. |

| • | The full data for the closed year is retained and may be reported on, but you may no longer do any entries for that year. |

Before you select this function, you may want to print all closing financial statements, including a detailed year-end Trial Balance.

You will then have a permanent record of the activity for the fiscal year.

Select

Print closing report from the Close a fiscal year menu.

This selection prints the Year End Closing Report, which shows what net profit (loss) entries Post closing entries will make. Print closing report does not perform any other function except showing what will occur when Post closing entries is run.

You will not be able to continue if:

| • | Any entries exist in Distribution Transactions (which means they have not yet been posted to General Ledger Transactions), or |

| • | Someone else is using General journal. |

If today’s date is during the fiscal year being closed, you see a warning message.

The report is printed in two sections. The first section is titled Closing Entries and will show all Operating Statement accounts with the amount totals to be posted. The second section is titled Retained Earnings Entries and shows the profit (loss) amount to be posted.

Select

Post closing entries from the Close a fiscal year menu.

After a screen which describes the Close a fiscal year functions is displayed:

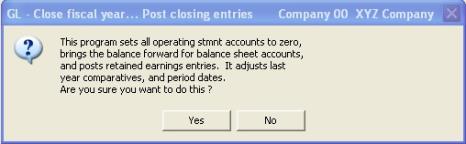

The following screen appears:

Graphical Mode

Character Mode

The accounting periods shown on the left-hand side of the screen are for the new fiscal year. The accounting periods shown on the right-hand side of the screen are for the year after the new fiscal year. If you want to change the accounting periods, use the same procedures as described in the Accounting Periods chapter.

The following screen appears:

The first step is to print the Year End Closing Register.

During processing, a screen appears showing the account number being processed.

The following are the results of running Post closing entries:

| • | The Accounting Periods has been updated for the new year. (You may need to update the current period and reporting period at this point, by using Accounting periods, if there were delays in closing your fiscal year.) |

| • | The comparative amounts for each account in the Chart of Accounts are updated to be the ending balances for the periods of the fiscal year just closed. |

| • | Balance forward entries for all balance sheet accounts have been created. The date for these entries is the last day of the fiscal year just closed. |

| • | A net profit (loss) entry has been made to the retained earnings account entered in Control information. If Varies by cost center was entered for the retained earnings account, individual entries have been made for each of the cost centers of the retained earnings account. |

The Working Trial Balance selection enables you to print the Working Trial Balance, which is used in closing procedures for an accounting period.

With the introduction of the multi-year detail each year's worth of data now has the fiscal year actually written as a separate field into each transaction. This is why you could have an actual real transaction for say a Balance Sheet account dated 12/31/09 in the fiscal year 2009 and a BBF transaction also dated 12/31/09 but in the (next) fiscal year 2010. Before the distribution date WAS the fiscal year; now they can be different. Each fiscal years is in essence a silo with the fiscal year value being the wall in between the next year.

For the fiscal years to properly distinguish the years for view/print/Financial Statement purposes, you must close the current year prior to the end of the next year. At closing time the fiscal years get rolled over.

There is currently no recommended way to reopen a year, enter new transactions for that year and then re-close it.