This chapter contains the following topics:

Introduction to G/L Distributions

Selecting Distributions to G/L

This report shows you all the G/L activity (called G/L distributions) that has resulted from posting I/C transactions. In addition, you can purge (delete records from) I/C Distributions.

G/L activity resulting from transactions entered in other modules, such as Accounts Payable or Payroll, is not shown on this report. Those entries can be printed using the Distributions to G/L Report in the appropriate module.

The report contains eight sections:

| 1. | Cost of Goods Sold |

| 2. | Liabilities |

| 3. | Inventory Value (Merchandise) |

| 4. | Inventory Value (Finished Goods) |

| 5. | Inventory Value (Raw Materials) |

| 6. | Inventory Value (Variance) |

| 7. | Inventory Value (Work in Process) |

| 8. | Miscellaneous Costs Applied |

A total is printed for each account, and for each section.

If there is no G/L activity for a particular section, then that section will not be printed.

Within each section, distributions are summarized for each day in which transactions are entered. The date of the accounting transaction is used, not the date of posting.

Sections of the Distribution to G/L Report for which inventory accounts have not been defined are not printed:

For example, you only use merchandise inventory in your business. The sections for finished goods, raw materials, and work in progress will not be shown.

The Variance report section appears only if you use the Standard Cost valuation method, and only when postings have occurred to the two variance accounts specified in Control information.

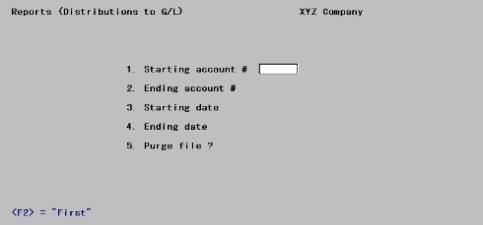

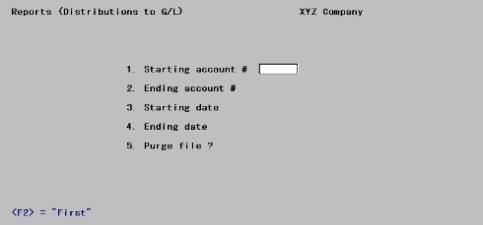

Select

Distributions to G/L from the Reports menu.

The following screen displays:

Enter the information as follows:

1. Starting account # and

2. Ending account #

Enter the range of account numbers for this report.

|

Example |

Press <F2> at each field. |

3. Starting date and

4. Ending date

Enter the range of transaction dates for this report. Follow the screen instructions.

|

Format |

MMDDYY |

|

Example |

Press <F2> for the Earliest and Latest dates for both fields. |

5. Purge file ?

Answer Y to purge the data after printing the report, or answer N if you do not wish the data to be purged.

Entry here is allowed only if you entered First to Last for the range of account numbers (in field #’s 1 and 2 above). Otherwise, Purge file ? displays (Not applicable). The reason for this is that purging only some accounts would put I/C Distributions to G/L out of balance. This is true, whether General Ledger is interfaced or not.

In a multi-user environment, do not purge distributions while another user is posting sales transactions or cash receipts, or is posting invoices from Order Entry.

If G/L is not installed and you answer Y to Purge file?, all distributions within the date range will be purged after the report is printed.

|

Format |

One character, either Y or N. |

|

Example |

Type N. |

If G/L is installed and you answer Y to Purge file?, field # 6 appears:

6. Dists to purge

This field appears only if G/L is interfaced and you have answered Y to the previous field.

Enter 1 to purge all distributions within the date range entered above, regardless of whether they have already been interfaced to G/L.

Enter 2 to purge only those distributions that are within the date range and that have already been interfaced to G/L.

If you selected to purge, there is a period of processing while the data is being purged.

Two situations arise: If you are using or not using General Ledger. These are described below.

General Ledger not used

The I/C Distributions to G/L Report lists the debits and credits that must be entered into your manual ledger.

You should print out this report at the end of each accounting period after all I/C transactions for the period have been entered and posted.

Backup your data and then print this report for all accounts. Specify a date range from Earliest to the date that is the end of your accounting period. Specify that the data should be purged. By purging the distributions that are printed on the report, the only distributions remaining (if any) will be those that apply to the future accounting periods.

You may wish to print the report to disk and then obtain a printed copy using Print reports from disk.

If a system failure occurs while printing the report and purging the data, restore the backup and repeat the procedure.

General Ledger Used

The I/C Distributions to G/L contains debits and credits (created by I/C transactions) that must be transferred to General Ledger.

The distributions are actually transferred using the Get distributions selection from the G/L menu, and then specifying that you want to get distributions from the I/C module. Refer to the Get Distributions chapter in the G/L User Manual.

Printing Considerations

Prior to running Get distributions, you should print the I/C Distributions to G/L Report for all accounts. Specify a date range from Earliest to the date that is the end of your accounting period.

Do not specify to purge the file.

If you purge distributions before transferring them to G/L, you must enter the distributions manually in G/L (using General journal).

The purpose of printing this report prior to transferring the distributions to G/L is to obtain an accurate list of the debits and credits that are to be transferred to G/L.

You may wish to print the report to disk and then obtain a printed copy using the Print reports from disk selection.

After printing the report, you should then back up your data and run Get distributions. When running this selection, you should specify that the distributions are to be purged as they are copied to General Journal Transactions. If a power failure (and computer crash) should occur while running Get distributions, restore your backup and repeat the procedure.

After Get distributions has been run, you may then print a General Journal Entry Edit List and compare this report with the I/C Distributions to G/L Report to verify that all debits and credits have been transferred. (The debits and credits will only be comparable if you have purged the distributions each period. If you have not purged I/C Distributions to G/L in a previous period, then the reports will not be comparable.)

Alternative procedure

An alternative procedure is listed below:

|

Step |

Description |

|

1 |

Back up your data. |

|

2 |

Run Get distributions, specifying that distributions are not to be purged. |

|

3 |

Run Distributions to G/L Report, specifying to purge the data and only interfaced distributions are to be purged. |

|

4 |

Print the General Journal Entry Edit List. The debits and credits printed on the edit list should be comparable to the debits and credits on the I/C Distributions to G/L Report, provided that you have followed this procedure each period. If you have not purged I/C Distributions to G/L in a previous period, then the reports will not be comparable. |

If you specify that distributions are not to be purged by Get distributions, and you run Get distributions again, you will still never transfer the same distribution from I/C to G/L more than once, because Get distributions prevents this.

Therefore, if after step 2 in the alternate procedure, you discover additional I/C distributions for the accounting period that have not yet been entered into Inventory Control, simply enter and post these transactions in I/C, and repeat the alternate procedure starting with step 1.

Account not on file

When printing this report, it is possible to get an **Account not on file** message with an accompanying account number and distribution amount. This occurs when an amount has been distributed to a valid General Ledger account that is not in Valid G/L Accounts.

If you get this message, you should trace the missing account name and re-enter it in Valid G/L Accounts, using the Valid G/L accounts selection. If you are using General Ledger, ensure the account number also exists in Chart of Accounts in that module.

If distributions have been made to an invalid account, one that you do not intend to set up, print and purge the Distribution to G/L Report as usual. If you are using General Ledger, allow the invalid account to interface and then correct the invalid account and distribution using the General journal selection in General Ledger.

In any event, determine the source of the invalid account number, make the entry to the proper account number, and take steps to ensure that the invalid number cannot be used again.

If you encounter any problems in tracing the erroneous entry (amount, where it came from, where it should go, etc.), you may wish to use the printout from the previous accounting period as a guide. This will show you the accounts you usually post to, the amounts, etc.

Comparing the current report to the previous report line by line should isolate the error.

If the above procedure fails, calculate and reconstruct the postings manually and then compare these figures to the figures on the printout.