This chapter contains the following topics:

Introduction to Close a Period

Use this selection to clear the period-to-date fields in Statuses. Specifically, the quantities or amounts in the following fields will be set to zero:

| • | Quantity sold PTD |

| • | Quantity used PTD |

| • | Quantity returned PTD |

| • | Sales PTD |

| • | Costs PTD |

Additionally, if prior period information is being retained in Statuses, then the oldest period is deleted and the period being closed becomes the most recent prior period.

You may also clear the year-to-date fields as explained below.

You must close at the end of the designated period, as defined by you. There is no grace period.

Prior to running this selection, you should ensure that you have posted all inventory transactions for the current period. Then you should print all needed inventory reports and any sales analysis reports (if you are using Sales Analysis) in order to obtain a permanent record of the final period-to-date figures (and corresponding year-to-date figures) for your inventory items.

The term period as used here, may either be your accounting period, or you may choose a longer or shorter time. For example, you could run this selection and close I/C each week. In this case, the period-to-date figures on the inventory and sales analysis reports would be weekly figures. Alternatively, you could close I/C once a quarter, in which case the period-to-date figures would be quarterly figures. If you are using S/A comparatives, then in I/C you must use the last day of the month as your closing date as S/A can only pull in data for one month at a time.

You may define your period in I/C as your accounting period or some other time period. Closing a period in I/C has no effect on General Ledger. The interface between I/C and G/L is through the G/L Get distributions selection, described in the G/L User documentation. Also refer to the chapter Distributions to G/L Report chapter.

The current period in I/C is determined by the Current period end date in Control information. If you post inventory transactions that are dated after this date, they will not appear in the period-to-date totals.

When you run this selection, the following occurs:

| 1. | The period being closed becomes the most recent prior period. If necessary, the oldest prior period information is removed. |

| 2. | The current period ending date in the I/C Control is information set to the ending date of the new period. |

| 3. | Average quantity on hand is calculated for each item at each warehouse at which it is stocked. Refer to Control Information chapter for more information on the calculation. |

Ensure that all necessary accounting operations, including printing all reports are completed, before proceeding.

If you are using the Passport Sales Analysis application, the sales analysis reports must be run before running Close a period. This is because information needed for these reports will be completely cleared by this function.

If this is the end of the year, this current period and date will become the default Prior fiscal year-end date for the new period in Control information.

If you are using this User documentation as an instructional tool, skip this function and follow the examples in the Sales Analysis documentation, if Sales Analysis is being used. Then return to the I/C User documentation to run Close a period.

Select

Close a period from the I/C menu.

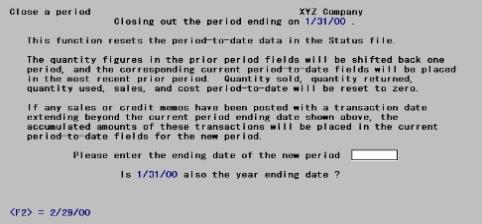

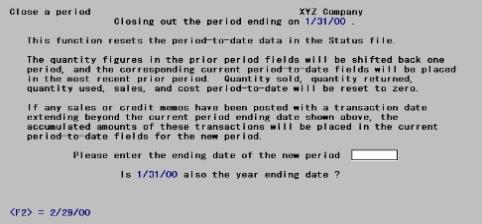

The following screen displays:

Enter the ending date of the new period.

If the period is the last period in your accounting year, answer Y to the question: Is (date) also the year ending date ?. Otherwise, answer N.

If you are using Sales Analysis, the sales analysis reports should be run before running Close a period. This is because information needed for these reports is cleared by running this selection.

After you answer Y to Are your sure ?, the period-to-date fields, average quantity on hand, and prior period fields are updated as described at the beginning of this chapter.