This chapter contains the following topics:

An inventory account is a current asset account in General Ledger summarizing the value of items in inventory.

PBS Inventory Control provides for multiple inventory accounts. You may enter as many as your company needs.

You may set up multiple inventory accounts in this selection. You will then assign each inventory item to one of those accounts. All postings (inventory sales, usage, and receivings) debit or credit the inventory account associated with that item.

Select

Inventory accounts from the Master Information menu.

This selection lets you enter, modify, or delete inventory accounts.

When you use this selection to add a new inventory account, you are given the option of adding it to the list of valid G/L accounts as well.

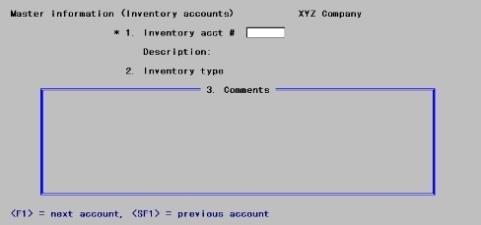

Enter the following information:

*1. Inventory acct #

Options

Enter the inventory account number, or use one of the following options:

|

<F1> |

For the next Inventory Account |

|

<SF1> |

For the previous inventory account |

|

Format |

Your standard format for account numbers, as defined in Company Information. |

|

Example |

Enter account 1200-000 |

If the account you enter does not already exist in Valid G/L Accounts, you may add it here.

Description

When adding a new account, a message displays informing you that the new account is not a valid G/L account and asks whether you would like to add it.

You must enter Y to add the account. Although I/C maintains its own account numbers, they must also appear in the Valid G/L accounts. If you enter N, the number is cleared from the first field and the cursor is positioned to enter another number without having recorded the new account. After entering Y, you will be prompted to enter an account description of up to 30 characters.

|

Format |

Up to 30 characters |

|

Example |

In this example the description appears automatically. |

If this account already exists in Valid G/L Accounts, its description displays. If not, enter the description, and the account is automatically added to the Valid G/L Accounts.

2. Inventory type

This designates the type of inventory represented by this inventory account.

Enter one of the following codes:

|

Code |

Type |

Description |

|

M |

Merchandise |

Items purchased for resale |

|

R |

Raw Materials |

For raw materials. This account type is for items that are components of kits. |

|

F |

Finished Goods |

Items (defined as kits in the Kits selection) constructed from raw materials, and possibly from other kits. |

|

C |

Miscellaneous costs applied |

Used for inventory accounts which are assigned to miscellaneous items in inventory. For example, if a miscellaneous item is set up to represent labor costs associated with constructing a kit, then this account will be credited when the components for the kit are taken from inventory. In addition, if miscellaneous items are sold using O/E, A/R or P/S, this account is credited at the time of the sale. Refer to the Billing chapter in the O/E User documentation, the Post Invoiceschapter in the A/R User documentation or the Post Transactions chapter in the P/S User documentation for additional information regarding the handling and posting of miscellaneous items. |

|

W |

Work in progress |

Used directly for inventory items, but is used on a work order to designate the G/L account to which component items should be posted while the work order is in progress. |

|

Format |

A single-letter code from the above table. |

|

Example |

Type: M |

|

Note |

The Distributions to G/L report contains a separate section for each of the above inventory types. Refer to the Distributions to G/L Report chapter. |

While the Inventory acct # field (inventory asset account) for a Miscellaneous item must be entered, its use is not that of a true balance sheet asset account since no inventory is kept for this item. Rather it is used basically for generating the contra-account to cost-of-sales and therefore is really being used as a suspense account against the expense side distribution that happened when the item was received. In this sense the accounting transactions for Miscellaneous items are similar to what happens when an item is drop-shipped, except that a drop ship clearing account is used instead of the inventory account.

The accounting T bars associated with these transactions are:

|

|

Accounts Payable |

Expense account used in AP = * Item |

Cost of sales account from selling this item |

|

|

Debit |

Credit |

Debit |

Credit |

Debit |

Credit |

|

Miscellaneous item receiving |

- |

1000 |

1000 |

- |

- |

- |

|

Miscellaneous item selling |

- |

- |

- |

1000 |

1000 |

- |

3. Comments

Enter any comments about the cash account.

This field uses Passport’s text editing function. Enter the text in much the same way as most word processing programs, using the <Enter> key, the character keys, and the <Delete> key. When you are finished entering text, press <Esc> and follow the screen instructions.

When you have finished entering commands, press <Esc> and the following options display:

|

File |

Save what was entered / changed, clear the screen, and get ready for another comment. Like pressing <Enter> at “Field number to change?” in other selections.) |

|

Save & |

Save what was entered / changed, but leave the information on the screen for further work. |

|

Abandon changes |

Do not save what has been entered / changed and get ready for a new comment. Like pressing <Enter> at “Field number to change?” in other selections.) |

|

Delete |

Delete this entire comment and clear the screen to get ready for another comment. Like Delete in other selections. The software will ask you to confirm the deletion with an “OK to delete ?” message. |

|

Format |

Ten lines of 65 characters each |

|

Example |

Type: Primary inventory account for sales |

The completed screen

This completes the screen to enter inventory accounts. Make any needed changes or press <F3> to delete this inventory account.

|

Note |

An inventory account cannot be deleted if it is currently in use in the I/C Control information as a default inventory account, or if it has been entered as the inventory account for an item. If you are not allowed to delete an inventory account, a message will display giving the reason. |

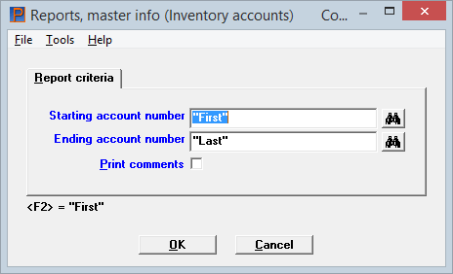

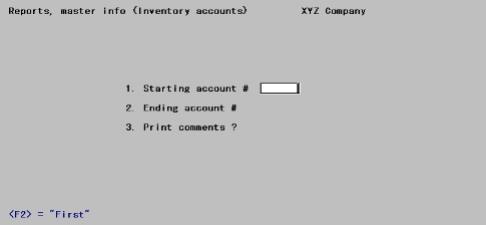

Select

Inventory accounts from the Reports, master info menu.

The following screen displays:

Character Mode

Enter the following information:

Ending account number

Enter the range of inventory accounts to be included. Follow the screen instructions.

|

Format |

Your standard format for account numbers, as defined in Company information. |

|

Example |

Press <F2> at each field for "First" and "Last". |

Your answer here determines whether comments will be printed.

|

Format |

One character, either Y or N. There is no default. |

|

Example |

Type Y |

This completes the screen. Make any needed changes.

Select OK for a list of printers to print or view the report. Select Cancel to return to the menu without printing.