This chapter contains the following topics:

Introduction to Master Information

Master information includes functions that allow you to further define your Inventory Management system. Each selection is explained fully in this chapter. Here is a brief description of each:

Item Types

Item Types are used as an optional sorting code in almost every report involving inventory. Proper use of these can help you review your database in much smaller, more logical segments.

These codes can be used as a Commodity Code classification for purchased items. For manufactured items, you may wish to use the Item Type Codes to categorize final assemblies, subassemblies, and fabricated piece parts, or to establish other manufactured item groupings that are logical for engineering, production , and inventory management purposes. See Item Types

Inventory Cost Categories

Inventory Cost Categories are intended to identify broad classes of items for inventory valuation purposes. Categories like Finished Goods, Raw Materials, and Fabricated Components may each be separately costed and reported in your system. See Inventory Cost Categories

Product Categories

Product Category Codes are intended to provide meaningful groupings of saleable items for sales analysis reporting, price discounts, and salesman's commissions in the PBS Manufacturing Customer Order Processing module. See Product Categories

I/M Accounts by Warehouse

This is only necessary if you are using the Interface to General Ledger option in I/M. It allows you to establish general ledger accounts for each independent warehouse maintained in PBS Manufacturing. If you choose to use the same accounts for all warehouses, you won't be required to enter these fields. See I/M Accounts by Warehouse

Warehouses

If you wish to store materials in more than one warehouse in PBS Manufacturing, you must establish a warehouse code for each warehouse other than the main warehouse. If you use only one warehouse, you may optionally use this program to describe the single locations (address...). See Warehouses

Item Type is a user defined classification code used for selecting or sorting Item Master records for output to various Inventory Management lists created by other programs. It is often desirable to group, or sequence items on a code other than Item Number or Item Description for reporting and analysis purposes.

Before defining the codes with this function, you should think about how you will want to extract output information by various Item groups to be identified by Item Type. For example, you may wish to use the Item Type Code as a Commodity Code classification for Purchased items. For Manufactured items, you may wish to use Item Type Code to categorize final assemblies, subassemblies, and fabricated piece parts, or to establish other Manufactured item groupings that are logical for engineering, production, and inventory management purposes. You don't have to enter an Item Type Code to every Item Master record, but you will probably find it desirable to do so for reporting purposes.

In defining your Item Type codes, you should also be aware of some other codes entered to Item Masters and their use in the system:

Inventory Cost Category codes are intended to identify broader categories of items for inventory valuation purposes. The on hand inventory values for major Inventory Cost categories such as Finished Goods, Raw Materials, Fabricated Components, etc. may be separately reported and costed by the Inventory Management module.

Product Category codes are intended to provide meaningful groupings of saleable items for the purpose of sales analysis and for defining price discount and salesman commission rates in the Customer Order Processing package.

Planner/Buyer codes allow sorting report information by responsible individual when using the Master Scheduling & MRP or Purchasing modules.

Use this function to identify all Item Types that can be referred to in the Item Masters entry program. Any time an Item Type code is used in an Item Master record, the code entered is validated against Item Types. Thus, an Item Type code must first be put into this file before it can be applied to an Item Master.

Select

Item types from the Master information menu.

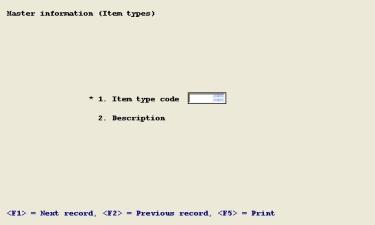

A screen like the following displays:

The fields you enter are:

1. Item type code

Entry Format: Up to 4 alphanumeric characters.

If the code matches a record on file, the description will display.

2. Description

Entry Format: Up to 25 alphanumeric characters.

Press

<F5> from Field number to change? to print a report of all Item types on file.

If you store or manufacture inventory items at multiple warehouse (or plant) sites, you must identify each of those locations with a Warehouse Code. This enables Inventory Management to track and report inventory balances and dollar values by warehouse location.

In all PBS Manufacturing modules, enter spaces in the Warehouse entry field to default to "Main".

If you have only one warehouse location, you may optionally use this function to describe that single location. For a single warehouse operation, always use the default Primary Warehouse of Main (enter space in Warehouse Code) in I/M Control Information and Item Masters entry. You may also use the Main default for one warehouse if you use multiple warehouses.

Use this function to identify all Warehouse Codes that can be referred to in other I/M files including Item Masters, Branch Warehouse Items, Purchase Order Items, Shop Orders, and Shop Order Materials. Any time a Warehouse is entered to one of those files, the code is validated to the Warehouses File. A Warehouse Code must first be put into this file before it can be entered to another file. One exception is the code for Main (spaces), which may be used even if it is not in Warehouses.

The fields you enter are:

1. Warehouse code

Entry Format: Up to 2 alphanumeric characters, or Blank = Main.

If the code matches a record on file, the description will display.

2. Description

Entry Format: Up to 15 alphanumeric characters.

3. - 6. Addresses

Entry Format: Up to 30 alphanumeric characters.

Press

<F5> from Field number to change? to print a report of all Warehouses on file.

Inventory Cost Category Codes are intended to identify broad classes of items for inventory valuation purposes. Such major Inventory Cost Categories as Finished Goods, Raw Materials, Fabricated Components, etc. may each be separately costed and reported in your system. You don't have to enter an Inventory Cost Category Code to every Item Master record, but you will probably find it desirable to do so for reporting purposes.

Use this function to identify all Inventory Cost Categories that can be referred to in the Item Masters entry program. Any time an Inventory Cost Category is used in the Item Master File, the code entered is validated against the Inventory Cost Category File. Thus, an Inventory Cost Category must first be put into this file before it can be entered to an Item Master record.

Select

Inventory cost categories from the Master information menu.

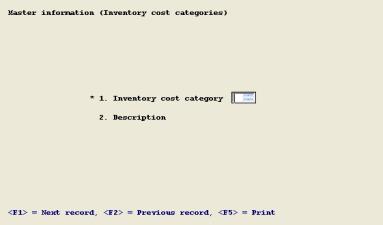

A screen like the following displays:

The fields you enter are:

1. Inventory cost category

Entry Format: One alphanumeric character.

If this entry matches a record on file, the description will display.

2. Description

Entry Format: Up to 25 alphanumeric characters.

Press

<F5> from Field number to change? to print a report of all Inventory cost categories on file.

Product Category Codes are intended to provide meaningful groupings of saleable items for sales analysis reports, price discounts, and salesman's commissions in the PBS Manufacturing Customer Order Processing module. Price discount percents and commission percents may be defined by Customer Type and Product Category in Customer Order Processing. You don't have to enter a Product Category Code to a saleable product's Item Master record, but you will may find it useful for these purposes.

Use this function to identify all Product Categories that can be referred to in the Item Masters entry program. Any time a Product Category is entered to an Item Master record, the code entered is validated to the Product Category File. Thus, a Product Category must first be put into this file before it can be entered to an Item Master.

Select

Product Categories from the Master information menu.

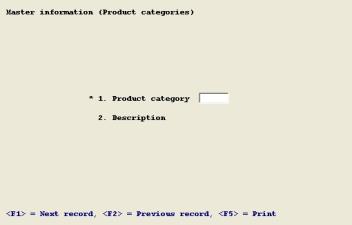

A screen like the following displays:

The fields you enter are:

1. Product category

Entry Format: Up to 5 alphanumeric characters.

If this entry matches a code on file, the description will display.

2. Description

Entry Format: Up to 25 alphanumeric characters.

Press

<F5> from Field number to change? to print a report of all Product categories on file.

If the answer is Y to "Interface I/M with G/L ?" in I/M Control Information and you use multiple Warehouse or Plant locations, you may optionally use this function to define Inventory Asset and Expense Accounts for each location.

When you use the Distributions To G/L function, the default accounts in the I/M Control information are used if Warehouse Accounts are not found in I/M Accounts By Warehouses.

The Maintain Sales Accounts function of the PBS Manufacturing Customer Order Processing package provides another option to define Cost of Sales Accounts by item Product Code within Warehouse. If a Warehouse Cost Of Sales Account is not found in C/O Sales Accounts By Warehouses, the Distributions To G/L function will try to find it in I/M Accounts By Warehouses, and if not found there, it will default to the Cost of Sales Account in I/M Control Information.

Select

Product Categories from the Master information menu.

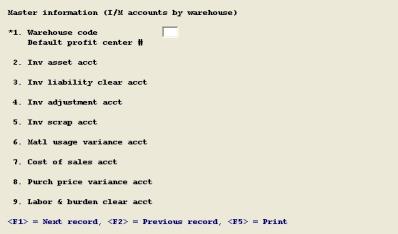

A screen like the following displays:

The fields you enter are:

1. Warehouse

Entry Format: Up to 2 alphanumeric characters, or Blank = Main.

Validation: When adding a record, any code other than "Main" must match a record on the Warehouse Codes File and the warehouse description is displayed.

If this entry matches a Warehouse Accounts record already on file, the remaining fields are displayed.

Entry Format: Up to the number of digits (numeric) that are specified in the Sub-account Size field in System Information.

Comments: If you enter a Profit Center (i.e. Sub-account) here, the subsequent Account Number entries will conveniently default to the corresponding Main Account Numbers that you put in I/M Control Information, appended by this suffix.

If the Company information entry for Sub-account Size is zero this field will be bypassed and you will not be allowed to change it.

For the Warehouse Account Numbers requested you may enter a Main Account Number and an optional Sub-account Number, up to the number of digits specified in Company information for Main Account Size and Sub-account Size. When adding a record, you may press <F1> if you wish to override the displayed default Account Numbers or press ENTER to accept the default.

As you enter each account number, the account description will display from Valid G/L Accounts. However, if the account number is not on file the program asks if you wish to add it as a valid G/L account. If your response is Y, you will be prompted to enter the account description, after which that account number and description are added to your Valid G/L Accounts.

The accounts requested are:

2. Inv asset acct #

This is the default balance sheet asset account for inventory.

3. Inv liability clear acct #

This is the account to which the estimated cost value of purchase receipt transactions will be posted, as an offset to the Inventory Asset Account charge amount. This must be the same clearing account to which the expense distribution of invoices for inventory items will be posted in Accounts Payable. Use of the clearing account allows Inventory Management to keep track of inventory and Accounts Payable to keep track of liabilities.

4. Inv adjustment acct #

This is the expense account to which the cost value of inventory quantity adjustment transactions will be posted. Both negative (shrinkage) and positive (pickup) adjustments will be posted to this account.

5. Inv scrap acct #

The cost value of reported stock scrap and work-in-process scrap transactions will be posted to this expense account.

6. Matl usage variance acct #

Inventory Management allows you to track the quantity and cost value of component materials issued to a parent Shop Order. When the Shop Order is closed, the difference between the reported total cost of components used and the Standard cost of material for the parent item can be calculated and reported. These material usage cost variances can optionally be posted to this expense account.

7. Cost of sales acct #

The cost value of sales transactions less the cost of credit memo returns is posted to this account.

If you use PBS Manufacturing Customer Order Processing, the Sales Accounts function of that package provides an additional option to define Cost of Sales accounts by item Product Code within Warehouse.

8. Default purch price variance acct #

The PBS Manufacturing Purchase Order Processing package allows you to post the actual invoice costs of inventory purchases and to calculate purchase price variance amounts to be posted to this account. If you specify the Standard Cost method of material inventory valuation in this control file, the P/O package will determine price variances (from standard cost) of both material and outside processing purchases. If you use the Average Cost method of material inventory valuation, the P/O package will only calculate price variances of outside processing purchases.

9. Default labor & burd clearing acct #

When you interface I/M transactions to the G/L, you have the option of including Labor & Burden costs.

This is the account to which the standard labor and burden cost value of manufactured item receipt transactions will be posted, as an offset to the Inventory Asset Account charge amount. You should also clear (debit) any actual direct labor and burden costs to this account. The balance of this account at the end of an accounting period will then be the total labor and burden variance for the period.

Press

<F5> from Field number to change? to print a report of all I/M Accounts by Warehouse on file.

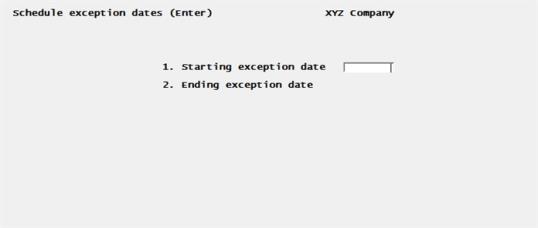

Use this menu to schedule the exception dates.

Select

Schedule exception dates from the Master information menu.

The fields you enter are:

1. Starting exception date

Enter the starting exception date.

2. Ending exception date

Enter the ending exception date.

Any dates between this range of dates are included as an exception date.