This chapter contains the following topics:

Features Common to All PBS Modules

Upgrading from Earlier Versions

Diagrams of Job Cost Information Flows

Cost Types, Categories, and Items

PBS Job Cost allows you to accurately track costs incurred for jobs. It provides reports to tabulate and examine these costs, compare them with budgeted or estimated costs, and track the progress of jobs. It also tracks job billings and payments, and tracks progress in terms of percentage completed and cost remaining to complete

J/C works with other accounting modules in these ways:

| • | Costs for materials, subcontractors, and supplies can be entered in Accounts Payable and automatically transferred to the right jobs in J/C. |

| • | Wage costs for laborers can be entered in Payroll and automatically transferred to the right jobs. |

| • | Materials stored in inventory and not yet allocated to any job can be transferred to the appropriate jobs from Inventory Control. |

| • | Billings to and payments from customers can be entered in Accounts Receivable and automatically transferred to the right jobs. |

| • | General journal entries from General Ledger can be transferred to the appropriate jobs. These include distribution of payroll taxes and workers’ compensation insurance premiums to jobs, posting of recognized profit to jobs, and adjustments because of previous entry errors. |

You can run J/C without having Accounts Payable, Inventory Control, Payroll, or Accounts Receivable. In this case, you enter costs and billings directly in J/C. You can then transfer these cost and billing amounts to the appropriate accounts in the General Ledger.

If you add J/C to a system that currently contains A/R, A/P, I/C, PR, or G/L, you should interface J/C to them. This is done through the Job Cost module.

When J/C is present in your system, these five modules expect you to enter certain information from within J/C.

You can also run Job Cost independent of any other module.

J/C is appropriate for a wide range of companies that are in the business of doing jobs for customers. Using options and choices selected in Control information when the module is initially set up, you can tailor J/C to your business.

The Job Cost system is suitable for a small to medium size construction company, a general contractor, or a subcontractor. It is also suitable for job shops such as print shops, light manufacturing, advertising agencies, scientific laboratories, interior decorators, etc. It is not particularly suitable for large-scale manufacturing companies with crews working at fixed work stations or assembly lines, but it can be tailored for use in small-scale manufacturing companies.

The PBS Job Cost module includes these features:

| • | New or in-progress jobs can be easily entered and edited. |

| • | Labor costs, material costs, subcontract costs, profit, and up to five user-defined cost types are tracked for management. |

| • | Cost categories are user-defined. |

| • | Budgets for all detailed costs can be entered. Jobs cannot be activated unless estimates are equal to the job price. |

| • | Budgets are tracked against actual costs incurred. |

| • | Completion estimates can be entered for individual parts of jobs. A fast enter function is available which will generate completion estimate entries for all cost items for a job, as well as an entry for the entire job. |

| • | Detailed on-line inquiry is provided. |

| • | Completed jobs can be saved for viewing or later restoration to an active status. |

| • | Information for a new job can be quickly created by copying all or part of another job. |

| • | Numerous reports such as Job Status Report, Job Performance Report, Job Profitability Report, and Cost Category Analysis Report can be printed. |

| • | Job Cost can be used independently or interfaced with Accounts Receivable, Accounts Payable, General Ledger, Payroll, Inventory Control, Purchase Order, and ODBC (Open Database Connectivity). The product that access via ODBC is called XDBC. |

| • | Includes password protection and backup/restore facilities. |

This section briefly describes the different menu selections in the module. Each topic is more fully explained in a separate chapter.

Easily maintainable, Control information allows you to define various parameters, which control many of the characteristics of the module. See Control Information

You can maintain your master list of cost categories (cost items for jobs). You do not have to have such a master list of cost categories, but if you do, then as you enter cost items for jobs, the program checks to see that the category number you enter is in master categories. See Categories

Use this selection to set up jobs and enter them into the system so that the other selections can track and report on them.

You can enter the basic information about a job, which includes such things as the job title, the price of the job, the customer for the job, etc.

You can also enter the cost items that give the detailed breakdown of the job.

You can print a list of jobs.

Finally, you must use this selection to activate a job after you have entered it. You will not be able to enter any costs or billings for a job until it has been activated.

Activating a job means making it into an active job. (Refer to the Job Descriptions chapter.) This checks to see that the estimated costs, plus overhead and profit, add up to the price of the job. This ensures that you have entered a job completely and correctly before you can start entering costs and billings for the job.

Use the Control information selection to set up J/C so that costs are transferred to jobs from Accounts Payable, Payroll, and Inventory Control.

If one or more of these other modules are not used, you can enter these costs directly from within J/C through the Costing selection. This selection prints an edit list showing all costs entered. Use this list to check the accuracy of the costs before they are posted and become part of the permanent Job Cost files/tables. See the Costing chapter.

|

Note |

If you are interfacing Accounts Payable, Payroll, and General Ledger, you cannot enter costs from within J/C. |

You can set up J/C so that billings and payments for jobs automatically transfer to jobs from Accounts Receivable. The J/C Billing and payment selection lets you enter billings and payments directly from within the J/C system. You can also print an edit list, which shows all the billings and payments you have made, before they are posted and made a permanent part of the Job Cost data. See Billing and Payment

|

Note |

If you are interfacing the Accounts Receivable and General Ledger systems, you cannot enter billings and payments using this selection. |

Use this selection to enter your estimates of completion percentages or completion costs for jobs. It also prints a Job Inspection Worksheet, which lists the cost items in jobs and has spaces to write the new completion percentages or costs to complete. After you enter these estimates you can print an edit list of the estimates entered before they are posted to jobs. See the Completion Estimates chapter.

This selection gives you a fast way of looking into the status of jobs on file. It includes five methods of inquiry:

Jobs

| • | You can display a list of jobs on file, pick one, and look at the cost items that make up the job. You can also look at sub-jobs and change orders on file for the job, any additional description entered for the job, and a summary of the costs, billings, and payments posted to the job. |

Costs by job

| • | You can look at all costs, billings, and payments entered for a particular job. You can limit this view to a particular time period by entering starting and ending dates. |

Costs by vendor/employee/customer

| • | You can see what costs have been entered for a particular vendor, employee, or customer for all jobs. You can select the particular vendor, employee, or customer you wish to view. You can limit this view to a particular time period by entering starting and ending dates. |

Cost categories

| • | You can display a list of the cost categories in your Cost Categories. |

G/L accounts

| • | You can display a list of the G/L accounts you have on file. |

You can print the Job Status Report, which shows actual costs incurred for a job compared to budgeted costs. It shows how well you are doing on the job compared to your original estimates, based on the current cost to complete. It also shows your projected costs at the end of the job.

With the Reports selection, you can print the reports described below.

Job Performance shows in a simple format how the actual costs and quantities (of material, labor, etc.) compare to the estimated costs and quantities for your jobs.

Job Labor Analysis highlights the labor cost and hours for your jobs. It compares actual labor expended to the estimated labor for the job, shows the difference, and projects the difference to the completion of the job.

Job Profitability, also known as the Bonding report, is used by construction companies. It shows the estimated and actual costs, the expected profit at the completion of the job, the profit previously recognized and to be recognized for the job, the revenue earned, and the amount billed.

Job Entry reports show:

| • | Lists of detailed entries (transactions) sorted in several ways: |

| • | All costs for a job in date order. |

| • | Costs transferred automatically from Accounts Payable, either in job number order or in vendor number order. |

| • | Costs transferred automatically from Payroll, either in job number order or in employee number order. |

| • | Costs transferred automatically from Inventory Control. |

| • | All billings and payments coming from both Job Cost and Accounts Receivable, in either job number order or customer number order. |

| • | Job Summary helps you to prepare bills for your customers. For each job or sub-job it shows, by major cost category grouping: total budgeted price, costs incurred this period and job-to-date, the percent complete, and the balance to complete. It provides a space to enter the current amount to be billed. |

| • | A/P Items for Payment shows the balance owing on all A/P open items connected with a job, up to a specified cut-off date. When you receive a payment from your customer on a job, you can print this report to list all suppliers and subcontractors who you can now pay, based on the payment you have just received. |

| • | Cost Category Analysis is based on cost categories, not on jobs. It shows the costs incurred for your various cost categories across all jobs. It also shows quantities and labor hours (if these are appropriate for a cost category) and the ratios of costs to quantity, hours to quantity, and quantity to hours. It shows all these figures for the last period, the current period, and the prior year. |

| • | Job Closing Report is useful for a company that does many short jobs of a couple of days duration. This closing option greatly simplifies the job closing process for such a company. |

You can show the debits and credits posted to the Job Distributions to G/L as a result of entering costs, billings, and payments in J/C. These debits and credits will be transferred to G/L when the Get distributions selection is run from G/L. This report does not show general ledger activity for entries that have been automatically transferred to J/C from other modules. If you enter all costs and billings through other modules, you would not use this report.

This selection takes the costs entered for jobs in other modules and updates the accumulated job costs. Costs are transferred based on a cut-off date you enter, so you can keep your general ledger in balance with your job costs.

Job Cost accumulates costs for the current period. This is done automatically as costs are posted to jobs. After you have printed all reports you need at the end of the period (usually a period is a month), you must use this selection to close the period in preparation for posting for the new period. This selection moves the accumulated costs for the current period to the last period costs, then sets the current period costs to zero.

Job Cost accumulates costs for the current year in the same way it does for the current period. After you have printed all reports you need at the end of the year, you must use this selection to close the year in preparation for the new year. The accumulated costs for the year are all set to zero. Year-to-date accumulated costs are found only in Cost Categories. See the Close a Year chapter.

This function has four separate selections not used in the regular routine of entering information for jobs or reporting on jobs:

You can mark a job as closed (when you are done with it and all costs have been entered for it), or re-open a job (return it to active status) if it had been closed previously.

As you enter and post costs and billings to jobs from day to day, week to week, and month to month, the size of the data file that holds these continues to grow and can get very large. In addition to taking up a lot of disk space, a very large data file can slow down your computer.

With this selection, you can remove entries (transactions) from this data file and store them in another file temporarily, thereby reducing its size. This is the save option of this selection. Or you can purge these entries from the main file, which removes them completely without saving them anywhere. Also, at any time after you have saved some entries from the main file (but not purged them), you can restore them from the saved file back to the main file. You have many options to choose which entries you want to purge, save, or restore.

From time to time, you may want to look at the entry detail that you have removed from the main file and saved. As long as the file holding the saved detail is accessible on hard disk, you can use this selection to display the saved detail on the screen. Please note that the file holding the saved detail is not the same as the inactive job files described below.

This selection deals only with inactive jobs, which are jobs that have been completed and marked as closed. After a job has been closed, you can either save it, with or without its detailed entries, in the inactive job files (where it can be accessed at a later time), or you can purge it (remove it completely) from the active files without saving it. If you save it, then you can restore it later to the active files. Refer to the J/C Control Information Options section in the Getting Started chapter for more information about inactive files.

This section describes some features which are present not only in Job Cost but also in all PBS modules.

Passwords are required to access PBS. A password is a unique code you assign to each individual using your software. Each potential user must first enter a valid password before he or she will be allowed to use a protected function.

This function provides the capacity to recover corrupted data. You can also use it to convert important data files to a format, which can be easily interfaced to common data base and word processing modules. See the PBS Administration documentation for more information.

You can easily select any of the more popular printers. Refer also to the Starting PBS, Menus and Printing chapter in the System User documentation.

We have included the necessary functions and instructions to allow you to upgrade from an earlier RealWorld Classic version 8 or 9. Refer to the PBS Administration documentation for more information.

If you are on RW32 or an early version of PBS, there is a means to upgrade to the latest version. Contact your PBS provider for more information.

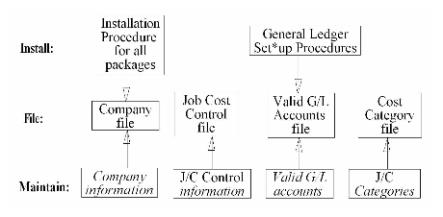

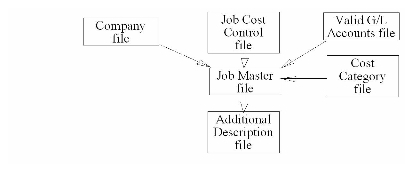

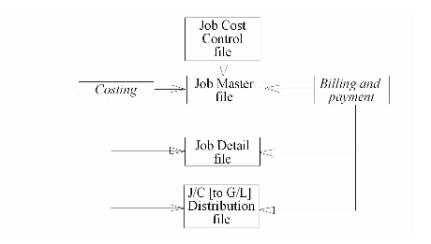

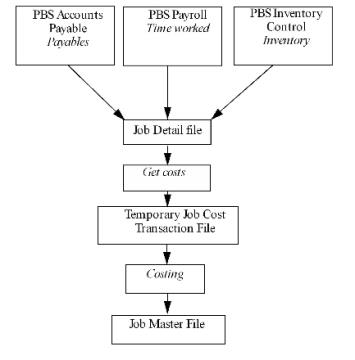

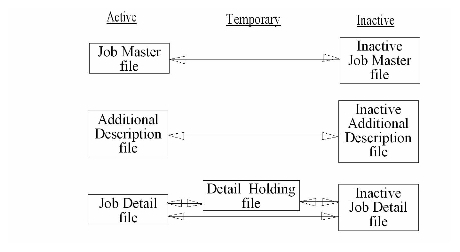

The following diagrams show the major information flows within Job Cost, as well as flows between J/C and other Passport Business Solutions modules.

These diagrams show how the major pieces of J/C work together.

These are the files that must be set up before any jobs can be entered in the system:

These files are set up and maintained using the following selections:

These are the files that are used to set up your jobs:

The Job Master contains both the job descriptions as well as the cost items for jobs.

This diagram shows the selections used and the files/tables updated when transactions are processed within Job Cost:

When costs are processed from PBS Accounts Payable, Payroll, and Inventory Control:

When transactions are processed in PBS General Ledger and Accounts Receivable:

Active and inactive files:

This example demonstrates how these three terms are used in Job Cost.

|

Cost Types |

Cost Categories |

|

Labor |

Concrete-setting up forms (Labor) |

|

Material |

Concrete-Portland cement (Material) |

|

Subcontract work |

Concrete-mixing truck (Equipment rental) |

|

Equipment rental |

Electrical wiring (Subcontract work) |

|

Overhead |

Plumbing (Subcontract work) |

|

Profit |

Excavation-bulldozer (Equipment rental) |

|

|

Excavation-bulldozer operator (Labor) |

|

|

Rough carpentry (Labor) |

|

|

2” x 4” lumber (Material) |

|

|

Nails and other hardware (Material) |

|

|

Sheet plywood (Material) |

There are always a very limited number of cost types—at most 9 in the PBS Job Cost system. There can be many cost categories—tens or hundreds—but each cost category has just one cost type.)

Before you have a cost item, you must have a job.

As an example, your job is the City Hall Addition. The price is $1,500,000. The cost items for the job are listed below:

|

Cost Category |

Budget |

|

Excavation-bulldozer (Equipment rental) |

$1,500 |

|

Excavation-bulldozer operator (Labor) |

$300 |

|

Concrete-setting up forms (Labor) |

$2,500 |

To get a cost item, take a cost category, put it in a job, and give it a price. It then becomes a cost item for that job.

To understand how to use Passport Business Solutions (PBS) Job Cost, you should understand some key concepts and words that are used in this module. Major concepts in Job Cost are identified in alphabetical sequence below.

Accounting is the methodical collection, categorization, and organized presentation of financial records.

When the documentation refers to alphanumeric, it means letters of the alphabet, numerals (numbers), special symbols (*, &, $, etc.) or any combination of all three kinds. In contrast, numeric (or digits), means only numbers.

Expense incurred for a job beyond the cost of wages and materials. There are two kinds, labor burden and overhead burden.

See the Cost Category below.

Company information is a collective term for the choices you make about how you will customize PBS software to your business applications. These decisions relate to all your PBS modules, and control such matters as the format of your screen display. They are made when the system is installed and seldom changed thereafter.

To customize PBS J/C to the needs of your business you must make choices, which are collectively called Control information. These decisions relate to all applications in the module, such as whether or not you access inactive files. They are made when the system is installed and seldom changed thereafter.

Control Information differs from Company Information. The former controls matters specific to the J/C module. The latter controls matters common to all modules.

A cost category is an aspect of a job or group of jobs for which money might be spent. Cost categories define in a fairly detailed way the types of work or costs that can go into one or more of your jobs. Examples of cost categories are: rough carpentry, plumbing, heating, air conditioning, etc. Cost categories are more detailed than cost types, and can be broken down into even more detailed categories if desired, until a very fine level of detail is reached.

A cost item is a cost category assigned to a specific job. The difference between a cost item and a cost category is that a cost item has been connected to a specific job and assigned a dollar amount. A full list of the cost items in a job is equivalent to a complete description of the work and costs that make up the job. For example, the cost category Finish carpentry-labor is budgeted at $3,500 for the Smiths’ house. Therefore, Finish carpentry-labor = $3,500 is listed as a cost item under the job for the Smiths’ house.

A cost type is the broad classification of types of costs that go into all of your jobs. Cost types are not very specific and do not describe the costs in any detail. Examples are: labor, materials, subcontract fees, overhead, administrative expenses, etc. A more detailed breakdown of types of costs is provided by the cost categories.

Most of the information you enter into your computer is stored on disk. In order for computer programs to locate specific pieces of data (within large masses of data), data must be organized in some predictable way. PBS accounting software organizes your data for you automatically as it stores it on your disk.

The following terms are associated with the structure of data.

| • | Alphanumeric |

Alphanumeric characters are letters of the alphabet, numerals (numbers), special symbols (*, &, $, etc.) or any combination of all three. In contrast, numeric characters (or digits) are only numbers.

| • | Character |

A character is any letter, number or other symbol you can type on your keyboard.

| • | Data file |

A data file is a group of one or more related records. A data file is often referred to simply as a file. When on an SQL system a set of data is referred to as a table.

The Cost Category file in Job Cost is an example of a data file. Such a file is made up of several records, each of which contains the category number, description, etc. for one cost category.

Each file is kept separate from other files on the disk.

| • | There are other types of files in addition to data files. Programs are stored on the disk as program files. However, references to files in this user documentation mean data files unless specifically stated otherwise. |

| • | Entry |

A record in a data file is often referred to as an entry.

| • | Field |

A field is one or more characters representing a single piece of data. For example, a name, a date and a dollar amount are all fields. When on an SQL system this is referred to as a column.

| • | Record |

A record is a group of one or more related fields. For example, the fields representing a customer’s name, address and account balance might be grouped together into a record called the customer record.

| • | Table |

Similar to a data file. but called Table when on an SQL system.

In addition to handling a particular area of accounting, as described above (such as accounts receivable or accounts payable), each module also keeps track of the effect of those transactions on G/L. For example, when you bill customers for jobs or receive payment from your customers, this activity affects not only J/C, but also G/L.

These transactions must be recorded both in the job and in G/L under the proper G/L account numbers.

The terms debit and credit refer to the types of transactions which must be recorded in G/L accounts to accurately reflect the activity occurring in all accounting areas. (Refer to the Glossary in the System User documentation for exact definitions of these terms.)

In J/C, a debit memo issued by you to a customer increases what that customer owes you, and a credit memo decreases what is owed. Unfortunately, debit doesn’t always mean an increase in an account and credit doesn’t always mean a decrease in an account. In some accounting areas, a debit increases a G/L account and a credit decreases a G/L account. In other areas, a debit decreases, and a credit increases, a G/L account.

This occurs because of the system called double entry accounting (also called double entry bookkeeping) which is the standard method of accounting used today.

The concept behind double entry accounting is that every entry (transaction) results in balancing debit and credit entries into the General Ledger.

Let’s look at the debits and credits involved when a typical independent business pays for goods or services bought earlier on credit:

| • | The debit: The disbursement (payment you make) results in a debit transaction which decreases your money owed others account (usually called the accounts payable account). This is a debit to accounts payable. |

| • | The credit: The payment also causes a credit transaction, which decreases one of your cash on hand accounts. This is a credit to cash. |

So two entries are made into G/L, which balance each other. These balancing entries form the basis of double entry accounting. If you or your accountant ever find your G/L accounts out of balance, it means that the proper balancing entries were not made.

No attempt is going to be made in this documentation to teach you all about accounting, especially about what types of transactions cause what accounts to be debited or credited. Unless you’re an accountant or fully responsible for maintaining your company’s general ledger, don’t worry if you don’t remember whether a debit increases or decreases a particular type of G/L account.

When using PBS accounting software, you will occasionally be asked to enter the G/L account to be debited or credited. Refer to the appropriate chapter in this User documentation, where you’ll find exact instructions about what to enter.

Within General Ledger, Accounts Receivable, Accounts Payable, Payroll, Order Entry/Billing, Job Cost, Inventory Control, Purchase Order, Check Reconciliation, and Point of Sale the software automatically takes care of all double entry accounting as you enter the required information on the screen.

As used here, function means one or more programs that accomplish a specific task.

Each selection on a menu of a PBS module is a function. When you select a function from a menu, one or more programs automatically execute, thereby allowing you to accomplish the task you selected. In fact, selection is often used interchangeably for function.

General ledger is the area of accounting where all accounting records are brought together to be classified and summarized. Financial statements are printed based on this data.

As used here, general means pertaining to many areas. General ledger is often abbreviated G/L or GL.

Ledger refers to a book where accounting records are kept. This term evolved from pre-computer times when accounting records were kept exclusively by hand in large books called ledgers.

A general ledger account is a specific category under which all financial activity of a certain kind is classified. For example, you might have a general ledger account called telephone expenses for telephone bills.

Accountants are experts at defining the various G/L accounts (financial activity categories) needed by a business. Part of this definition process involves assigning an account number to each G/L account.

Independent businesses usually use a 3- or 4-digit account number. For example, you can have a G/L account called 100—Cash in the Bank, and one called 400—Sales of Product A, and one called 410—Sales of Product Line B.

Typically, an independent business will have a hundred or more G/L accounts. In PBS accounting modules, each time any financial activity occurs in any area of accounting, the dollar amount of the activity is recorded under the appropriate G/L account numbers.

You may wish to divide your account number into a main account and a subaccount. You may also wish to incorporate a cost center into your account number structure. A cost center is a part of your company (for instance, a department or a regional office) for which sales and/or expenses (and sometimes profits) can be calculated separately from the total sales and expenses of the whole company.

The Company Information chapter provides detailed information on the format of the account number. To alter an existing format, refer to the Reformat Account Number chapter of the PBS Administration documentation.

Help refers to descriptions of functions which appear on the screen by pressing a designated key.The Help text gives you a quick reference to the highlights of functions while you are running the application. In graphical mode you can access the entire chapter. From there you can access the entire documentation for the module.

To access help in graphical mode, select <Ctrl+F1>. In character mode select <F8>.

Look-ups refer to a list of available entries for a particular field. There are two kinds of lookups: Data Lookup and Date Lookup.

Data Lookup

Many fields allow you to press a designated key <F8> to show all available data on file. For instance, when entering an invoice you may press this key at the Account number field to bring up a list of all G/L accounts on file. Selecting an entry from this list is often easier and faster than remembering the account number or stepping through all possible entries until the right one is reached.

Date Lookup

The date lookup provides a point and click window for finding and entering date fields.

In Graphical mode the date lookup is available via the <F4> key. In Character mode (Windows only) you may access the date lookup via the <F7> key.

|

Note |

In Character mode, depending on where you press <F8>, this function will return a Look-up window or context sensitive Help. If a Look-up window is returned, pressing <F8> a second time will display Help for the field if available. |

When a set of computer modules is integrated, any information generated in one module, which is needed in another module is automatically supplied to that other module. You don’t have to enter it twice.

PBS accounting software is fully integrated. When J/C is used with other modules, any data recorded in those other modules, which J/C should know about, is automatically made available to J/C.

Job Cost is the area of accounting dealing with costs and revenues accumulated and accounted for on an individual job basis. It is often abbreviated as J/C.

As used here, job means an overall, complete piece of work a business agrees to do for a customer. A job generally lasts for weeks or months and is individually customized to the client’s specification. Jobs are also often referred to as contracts.

Jobs can be run using the Completed Job method of accounting in which profit is recognized only when a job is completed (or when it is substantially completed). Alternatively, jobs can be run using the Percentage-of-completion method of accounting in which profit is recognized each period as the job progresses.

Multi-company refers to the capability to do accounting functions for multiple companies with the same set of modules. A user wanting to do accounting functions for more than one company on can select the multi-company option.

A period is a regular interval of time, which you use for evaluating your operation and comparing current information to historical data. At the expiration of a period, standardized reports are usually printed and running totals are reset to zero. This is called closing the period.

You define the length of your periods, which can (but need not) correspond to the accounting periods you use in your General Ledger system. Regardless of your choice, each period remains open until you explicitly close it. For illustrative purposes this documentation assumes that you use monthly periods.

To post means to take transactions from a temporary file and move them to a permanent file (where other transactions probably already exist). Often, during transaction posting, information in other data files is also updated. For example, in J/C, costs are initially entered into a temporary transaction file. After costs have been entered and verified as correct, they are posted to the permanent files.

As used here, purge means to remove unnecessary items. Job Details are occasionally purged of transactions when the information is no longer useful to you.

That portion of the overall profit of a job which you currently recognize as having been earned, whether or not you have yet been paid for it. This is a concept, which applies only if you use the Percentage-of-completion method of accounting.

This is a percentage of a contracted job price retained from a contractor as assurance that subcontractors will be paid and that the job will be completed.

It is an amount of money retained (held back) from a payment pending the completion of a job or part of a job. The term retainage is most commonly used for construction jobs. When a general contractor is doing work for a property owner, the owner usually makes progress payments, based on the amount of work completed as of certain dates. Usually, the owner customer will retain hold back a percentage of each expected payment until the entire job is finished and inspected. This retainage is a receivable for the general contractor.

In the same way, a general contractor employing a subcontractor will retain a percentage of the payment due to the subcontractor until the subcontractor’s work is completed and inspected. This retainage is a payable for the general contractor.

A screen is the image you see on your computer monitor. Each screen in the system has a standard format, and each is discussed and (with trivial exceptions) illustrated in this documentation.

The two main types of screens are:

| • | Menus. These allow you to choose which application you wish to execute. |

| • | Data-entry screens. These allow you to enter new data into the system, or to change existing data. |

PBS screens are interactive. In other words, they respond to each item of data as you enter it, without waiting for you to enter the entire screen.

Selection is the name given to the choice, which you make from the options available on a menu. Making this selection will either lead you directly into the desired application, or it will bring up a submenu requiring you to narrow your selection further. In this documentation, all references to selections are spelled exactly as they appear on the screen, but are printed in italics.

SPOOL is an acronym meaning Save Printer Output Off-Line. Spooling is a technique that allows a report to be printed at a later time. Instead of reports going directly to a printer, they are saved as a disk file (which is usually a lot faster). When a printer is available, all or some saved reports can be printed in one long run (for example, overnight).

As used in accounting, transaction means a business event involving money and goods or services. For example, a transaction, occurs each time you gas up your car: you pay money in exchange for gasoline (goods).

Because computer software deals primarily with business events, which have already taken place, in PBS software, transaction means the record of a completed business event involving money and goods or services.

The records of sales made and payments received are examples of transactions from the area of accounting called accounts receivable. The records of your purchases and the payments you make for such purchases are transactions from the accounting area called accounts payable. The records of quantities of goods received or sold are transactions from the area of accounting called inventory control.

To view information is to examine it on a screen. This is a rapid alternative to obtaining a printed report. View screens are designed to display information more compactly than data-entry screens, but without permitting the information to be modified.