This chapter contains the following topics:

Definition of Voiding and Purging Checks

Printing and Posting Voided Checks

Checks are said to be purged when old checks are removed from the file after the employee has cashed them. They are said to be voided when they are removed from the system because the employee has not cashed them at all (for instance, if a check was lost in the mail, or if the employee points out an error and requests a replacement).

Purging is a one-step process, and occurs as soon as you enter the transaction. Voiding is a two-stage process: transactions are first entered and then posted.

As many as 999,999 pay cycles can be accumulated at any one time, so the only reason to purge checks is to free up disk space or improve performance. You should not however purge a pay cycle until you are confident that all checks in that cycle have been cashed or otherwise accounted for.

If you have set the Summary post distribs field checked in Control information, skip this selection.

This feature lets you void individual checks or ranges of checks at will. A separate selection is provided for each method, and each can be executed as often as needed until you are satisfied that all the void checks, and only those checks, have been correctly flagged. You can void a range of checks and then use the individual selection method to unvoid any checks that you do not want to void. You can then post void checks. A Payroll Voided Check Register will print.

Void checks is intended for checks written in the recent past. A check cannot be voided if:

| • | Any of the following have been purged: |

The check’s Payroll distributions

The check itself

| • | The year has been closed since the check was written. |

Note that if the year has not been closed a check can be voided even though W-2s have already been printed.

When this happens it is your responsibility to rerun the W-2 process for that employee.

This only applies if Payroll is interfaced to Job Costs per the J/C Control information. If Job Cost distributions have been purged or there never where any distributions because the payment was not assigned to a job, it will still allow you to purge the payment. However it will put NO J/C DETAIL REC FOUND in the reference. In this case the reference cannot be changed.

Voiding Direct Deposits (ACH Checks)

In general, this applies to both electronic payment direct deposit and report-only direct deposits, unless otherwise indicated. For a description of both methods, see the Direct Deposit Settings section of the Control Information chapter.

Note that you cannot void individual payments in an electronic payment ACH file, you must void ALL the direct deposit payments made after a check (direct deposit) run. Then you should either mark the ACH file in some manner by renaming it as voided, or delete it if you don't retain copies, or any other method that will help prevent it from being mistakenly submitted to the bank.

Under normal conditions, DDP/ACH checks not only update the payroll accounting files but they also produce a transmittal file (the ACH file) which is sent to the bank for it to use in distributing the cash. This situation means that the bank may have acted on the ACH file and distributed the cash from the company’s checking account before any attempt at voiding a check. This is an important consideration.

Three situations can arise. The first is you find the necessity for voiding one of the checks before the ACH file is transmitted. This case is clear cut – the bank has not yet been involved and so in that case you can simply void the whole batch of ACH checks and then, after appropriate changes to the payroll (the things that made you want to void checks), do a new check run. You can delete the “bad” ACH file text produced in the first run. As a result, any void transactions for ACH checks are never used in the transmission to the bank of the ACH file.

The second is a case where the amount in error on the check is relatively small and the effect on quarterly totals and other reporting are relatively immaterial. Here you might consider allowing the check to go through and make a one-time adjustment in a subsequent payroll. (This is a judgment call in relation to the type of employee (salaried, part-time) and other considerations of their deductions and net pay.) Note: The adjustment in the following payroll must be made with a deduction /earnings code that matches the in-error amount being corrected – e.,g. taxable, non-taxable, etc., so that the net effect over the two payrolls exactly cancels out the error.)

In the third case, you have already transmitted the ACH file before you find the need for the void and you have to assume the check money has been distributed to the employee and it is not reasonable to apply any adjustment later.

In this case, when you proceed with the voiding transaction, the program will properly void the check internally within the PBS system and will produce a warning message indicating the ACH transaction will not be added to the ACH output file. This means you will have to make arrangements with the employee (or possibly the bank) to correct this problem with respect to the disposition of the incorrect cash amount.

You may also be able to have the employee write a refund check back to you. In this case since the void process will have already “returned” the cash to the cash account as far as the accounting system is concerned, you will need to avoid double dipping on cash by depositing the check outside of the accounting system and then making a note to include this money in that month’s cash reconciliation.

A final note: There is exception to the general rule that when you void an ACH payment you must void the whole batch: Depending on your bank's policies, you may be able to specify that they not make a direct deposit payment to one particular employee, even if it is in the submitted ACH file. In that case you may void that employee's payment. Note that as a result, your copy of the ACH file will be inaccurate but this is likely to have no consequences. It is not necessary to retain copies of submitted ACH files, but if you do, you may want to create a text file of the same name as the ACH file with a different extension with an explanation of what happened.

Having NOT paid that employee you are free to create a new paycheck and submit it as a separate ACH payment.

Select Individual checks from the Void checks menu.

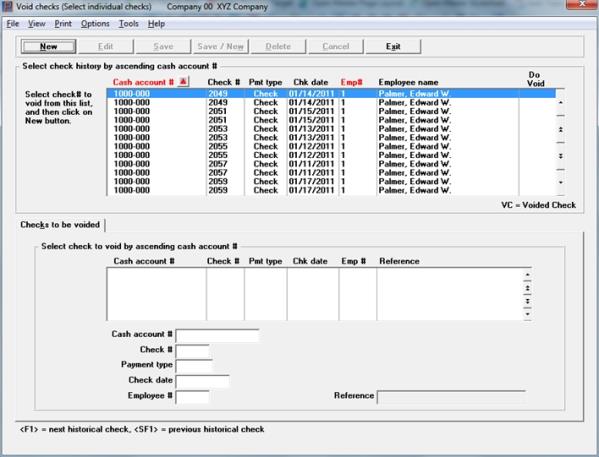

If you choose Select individual checks, this is the screen that displays:

Graphical mode

Select the check # or ACH payment to void from the upper list box. Then click on the New button or enter <Alt+N> to select and indicate that the check is to be voided.

This screen has 2 list boxes.

The upper list box displays up to 12 existing checks and ACH payments at a time. The records are from the Void Payroll Checks file/table (VDMTRX). You may sort the payments by cash account or employee number both in ascending or descending order. Only columns with red labels may be sorted. To select a field or change the sort order, click on the column name or the arrow to the right of the column name or use the View options.

To locate a payment, start typing a cash account or employee number, depending on which sort field is selected. The default sort is employee number. You may also use the up/down arrows, Page up, Page down, Home and End keys to locate an entry. The <F1> and <SF1> keys function the same as the up/down arrow keys.

Payments that display in the upper list box are available for voiding. After selecting a check in the upper list box, click on the New button or enter <Alt+N> to indicate that the check is to be voided. Then it will display in the lower list box and you may edit the Reference field.

If you are using Report only direct deposit, the Pmt type column will indicate a check type because a check number was used. If you are using Electronic payment "ACH file" direct deposit, the payment type will indicate ACH payment. In either case, a warning displays letting you know that the payment was made via direct deposit.

Payments marked to be voided will have a Yes in the Do void column. Payments already voided will have a VC in the column.

You may click on a button or enter the keyboard equivalent for adding, editing, deleting or canceling a payroll entry:

| Button | Keyboard | Description |

|---|---|---|

|

New |

Alt+n |

With the focus on the upper list box, use to select a payment for voiding. |

|

Delete |

Alt+d |

With the focus on the lower list box, use to remove a payment from voiding. You may also use the <F3> key. This button is not accessible by using the Tab key. |

|

Edit |

Alt+e |

With the focus on the lower list box, use to edit the void check selection. This button is not accessible by using the Tab key. |

|

Save |

Alt+s |

To save a new void check selection or changes to an void check. |

|

Save/New |

Alt+w |

This button is not active on this screen. |

|

Cancel |

Alt+c |

To cancel adding or editing a void payment. |

|

Exit |

Alt+x |

To exit the screen. You may also use the <Esc> key. |

Menu Selections

Many of the menu selections are the same for each screen. The sorting View selections are alternative ways to sort the data. The other selections that are unique to this screen include:

| Main | Sub menu | Link to more information |

|---|---|---|

| Edit list | Print Edit List | |

| Employee payroll history | Employee Payroll History Report | |

| Options | Post | Posting Voided Checks |

Check already cleared.

You will get this message if you are interfaced with Check Reconciliation and the check has been cleared via a bank statement reconciliation.

If you still feel this check must be voided, go to the Load checkbook utility in C/R and remove the cleared status first.

Enter whatever reference you want.

|

Format |

25 characters |

|

Example |

Press <Enter> |

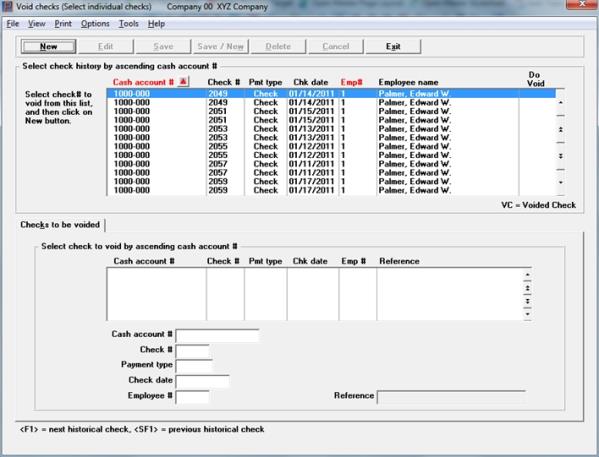

Character Mode

From this screen you can work with both new and existing void check entries, whether these originated by the Void individual payroll checks selection or the Void range of payroll checks selection.

1. Cash account #

Options

Enter the cash account number.

|

<F1> |

For the next void check entry |

|

<SF1> |

For the previous entry |

|

<F2> |

For the next cash account |

|

<SF2> |

For the previous cash account |

|

Format |

Your standard account number format, as defined in Control information |

|

Example |

Enter account 1000-000 |

2. Check number

Enter the number of the check you want to void.

|

Format |

999999 |

|

Example |

Type 8025 |

3. Check date

Enter the date of the check that was written.

|

Format |

MMDDYY |

|

Example |

Type 30224 |

4. Employee number

Enter the employee number

|

Format |

999999 |

|

Example |

Type 5 |

5. Reference

Enter whatever reference you want.

|

Format |

25 characters |

|

Example |

Press <Enter> |

Field number to change ?

Options

Make any needed changes and press <Enter>. You may also use one of the options:

|

<F1> |

For the next void check entry |

|

<SF1> |

For the previous entry |

|

<F3> |

To delete this entry (valid for existing entries only) |

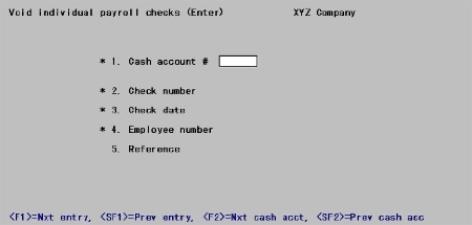

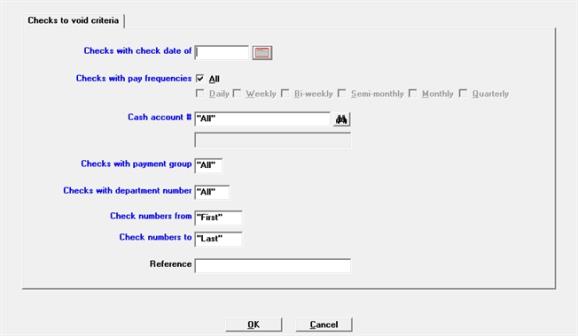

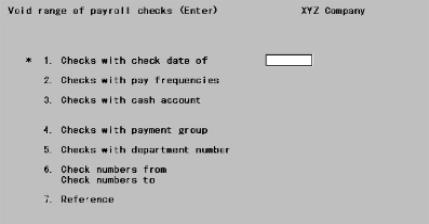

If you choose Select a range of checks, the following screen displays:

Graphical Mode

Character Mode

This selection lets you create new void check entries. Refer to the previous section for processing existing entries.

|

Note |

Only checks that meet the requirements of all the fields below, except Reference, will be voided. |

Enter the date the checks were written.

|

Format |

MMDDYY |

|

Example |

Type 30224 |

Options

Enter the pay frequency of the checks to be voided. You can specify:

| Character | Graphical |

|---|---|

|

D |

Daily |

|

W |

Weekly |

|

B |

Bi-weekly |

|

S |

Semi-weekly |

|

M |

Monthly |

|

Q |

Quarterly |

|

<F5> |

<F5> = "All" frequencies |

|

Format |

Graphical: Check box, where checked is selected and unchecked is not selected Character: One letter from the list above |

|

Example |

Press <F5> |

Options

Enter the cash account of the checks you are voiding. This must be a valid entry in Cash accounts. You may use one of the following options:

|

<F1> |

For the next cash account |

|

<SF1> |

For the previous cash account |

|

<F5> |

To void All checks regardless of cash account |

|

Format |

Your standard account number format, as defined in Company information |

|

Example |

Type 1000-000 |

Options

Enter the payment group code for checks you are voiding, or use the option:

|

<F5> |

To void "All" checks regardless of payment group |

|

Format |

Three characters |

|

Example |

Press <F5> |

Options

Enter the department number for checks you are voiding, or use the option:

|

<F5> |

To void "All" checks regardless of department number |

|

Format |

9999 |

|

Example |

Press <F5> |

Check numbers to

Options

Enter the range of check numbers you are voiding, or use the option:

|

<F5> |

To void All checks regardless of check number |

|

Format |

999999 |

|

Example |

Type 8025 at each field |

Enter whatever reference you want. Unlike the previous fields, this field is not used to select which checks to void. It will be used as the reference in the G/L transaction for each voided check.

|

Format |

25 alphanumeric |

|

Example |

Press <Enter> |

You will get the above reference if you are interfaced with Check Reconciliation and the check has been cleared via a bank statement reconciliation.

If you still feel this check must be voided, go to the Load checkbook utility in C/R and remove the cleared status first. Using Select individual checks remove it from the list of voided checks and re-select it.

Make any needed changes. Click OK to select the range of payments to be voided or click Cancel to return to the menu without selecting any payments.

This section explains how to print a void check edit list and post voided checks.

SelectEdit list from the Void checks menu.

The printer selection screen displays. Select a printer, Create HTML, Print to disk or Display on screen.

SelectPost from the Void checks menu.

The printer selection screen displays where you can select a printer or Print to disk.

Voided check information is posted to the Payroll Distribution file, the Employee file, the Payroll History file, the QTD History file, YTD History file, and the YTD state and city History file.

If Payroll is interfaced to the Job Cost package, distribution information is posted to the Job Detail file.

A Payroll Voided Checks Register is printed, and the entries on file in the Void individual checks selection are deleted.

Void Checks Interface to Check Reconciliation

Per the Check Reconciliation Control information you may be setup to either automatically post to C/R or manually pull the check void checks into C/R. The data is transferred to the C/R Check Book (CKBOOK).

When you are automatically posting to Check Reconciliation, the Voided Check Register will include this message:

*** Transferred to Check Reconciliation ***

If you are not setup to automatically post, you must run the Transfer checks\deposits function on the C/R menu to pull the data into Check Reconciliation.

Whether the system is auto-posting or you are transferring manually, the cash account used must be setup as a checking account in C/R in order to interface to C/R.

Use this selection to purge voided payroll transaction records.

When a check is written, information for that check is saved in case the check must be voided at a later date.

If you use ODBC or SQL for reporting, purged data is no longer accessible. However, once you are sure that the checks printed on a specific date will not have to be voided (that is, that they have cleared the bank) and you no longer need the data for reporting purposes, you may run Purge payroll transactions.

This function will purge records from the Void Payroll Checks (VDMTRX) file/table only. If you want to purge records from the Payroll history file/table (KHISFL), check the Purge file field when running the Employee Payroll History Report.

Select Purge payroll transactions from the Utility menu.

The following screen will appear:

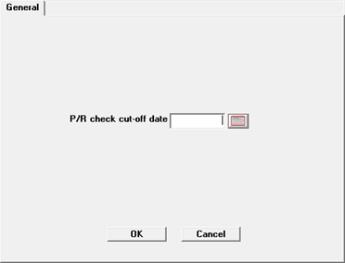

Graphical Mode

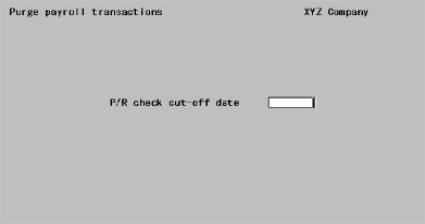

Character Mode

This is the latest check date for which to purge saved check information. Enter the date or use the calendar to locate and return a date to the field.

|

Format |

MMDDYY There is no default. |

|

Example |

Type 063024 |

Select OK to proceed with the purge. Select Cancel to return to the menu without purging.

Once information for a check is purged, you can no longer void that check using Void checks. Instead, you must key in a negative check and post it. If many checks need to be voided, this can be a greater task than processing payroll; therefore, beware not to purge the saved check information until you are sure you will not need to void those checks.